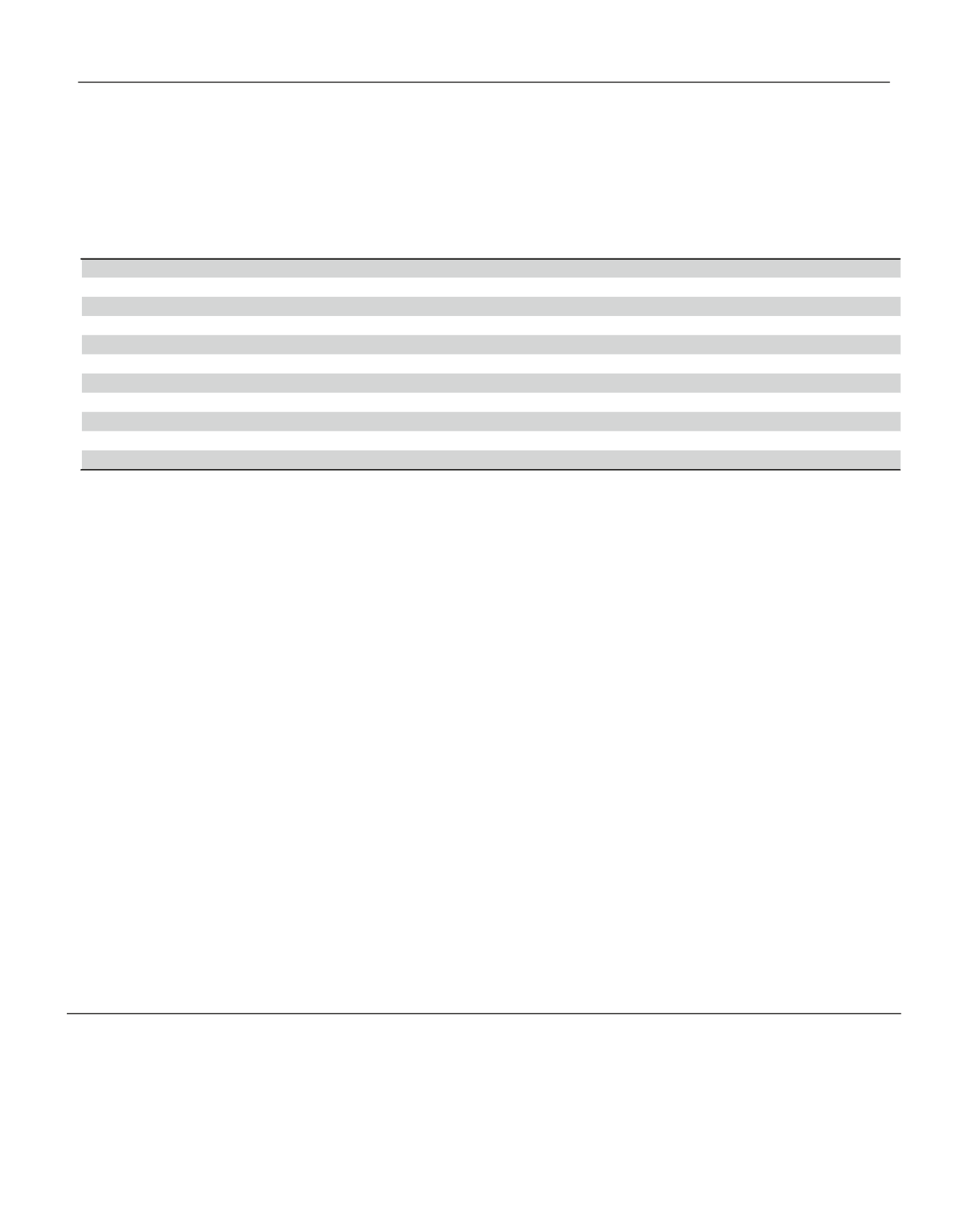

Name

(1)

Stock

Awards

(2)

Option

Awards

(3)

Total

($)

($)

($)

($)

($)

($)

John Shelby Amos II*

86,250

—

— 42,117

4,055,346

4,183,713

W. Paul Bow ers

121,667

125,008

—

—

— 246,675

Elizabeth J. Hudson

130,000

125,008

— 36,047

— 291,055

Douglas W. Johnson

150,000

— 143,157

—

— 293,157

Robert B. Johnson

135,000

125,008

—

—

— 260,008

Charles B. Knapp

145,000

— 143,157

40,852

— 329,009

E. Stephen Purdom, MD*

38,333

—

—

—

— 38,333

Barbara K. Rimer, DrPH

130,000

— 143,157

18,996

— 292,153

Melvin T. Stith

125,000

125,008

—

—

16,360

266,368

David Gary Thompson

115,000

125,008

—

—

— 240,008

Takuro Yoshida

115,000

— 143,157

—

— 258,157

Change

in Pension

Value and

Nonqualified

Deferred

Compensation

Earnings

(4)

Fees Earned

or Paid in

Cash

The following table identifies each item of compensation paid to Non-employee Directors for 2014.

All Other

Compensation

(5)

*

E. Stephen Purdom and John Shelby Amos II retired from the Board of Directors on May 4, 2014 and October 1, 2014, respectively. John Shelby

Amos II presently serves as an employee of Aflac.

(1)

Daniel P. Amos, Chairman and CEO; Paul S. Amos II, President, Aflac; and Kriss Cloninger III, President, CFO, and Treasurer, are not included

in the table, as they are employees and thus do not receive compensation for their services as Directors. The compensation received by Messrs.

Daniel P. Amos, Paul S. Amos II, and Cloninger as employees is shown in the Summary Compensation Table below.

(2)

This column represents the dollar amount recognized in accordance with Financial Accounting Standards Board Accounting Standards

Codification Topic 718 (“ASC 718”) for financial statement purposes with respect to the 2014 fiscal year for the fair value of restricted stock

granted in 2014. The fair values of the awards granted in 2014 were calculated using the closing per-share stock price on the date of grant of

$59.33 for W. Paul Bowers, Elizabeth J. Hudson, Robert B. Johnson, Melvin T. Stith and David Gary Thompson. Each Non-employee Director

may elect, in the year prior to the grant, to convert all or a portion of any annual stock option grant to restricted stock based upon a conversion

formula approved by the Board of Directors. As of December 31, 2014, each Non-employee Director held the following number of restricted

stock awards: W. Paul Bowers, 4,787; Elizabeth J. Hudson, 6,336; Douglas W. Johnson, 2,211; Robert B. Johnson, 8,861; Melvin T. Stith, 7,674;

and David Gary Thompson, 8,861.

(3)

In accordance with the SEC’s reporting requirements, this column represents the dollar amount recognized in accordance with ASC 718 for

financial statement purposes with respect to the 2014 stock option grants. The Company's valuation assumptions are described in Note 12

“Share-Based Compensation” in the Notes to the Consolidated Financial Statements in the Company’s Annual Form 10-K filed with the SEC for

the year ended December 31, 2014.

To determine the number of options granted to a Non-employee Director, $125,000 was divided by $13.73,

a Black-Scholes-Merton stock option value as determined by the Consultant for the three-year period 2013-2015 (rounding to the nearest share).

Stock options granted to Non-employee Directors vest 25% per year over a four-year vesting period. As of December 31, 2014, each non-

employee Director held stock options covering the following number of shares of Common Stock: Elizabeth J. Hudson, 33,026; Douglas W.

Johnson, 51,236; Robert B. Johnson, 12,513; Charles B. Knapp, 56,749; Barbara K. Rimer, 56,749; David Gary Thompson, 19,513; and Takuro

Yoshida, 44,749.

(4)

Represents change in pension value. W. Paul Bowers, Douglas W. Johnson, Robert B. Johnson, Melvin T. Stith, David Gary Thompson and

Takuro Yoshida do not participate in the Director retirement plan since they first became Directors after the plan was closed to new participants in

2002. The aggregate change in the actuarial present value of the accumulated benefit obligation for E. Stephen Purdom was a decrease of

$24,885.

(5)

Amounts disclosed if in excess of $10,000. Included in All Other Compensation for John Shelby Amos II, who served as the State Sales

Coordinator Alabama/West Florida from January 1, 2014 through September 29, 2014, is $3,811,546 in renewal and first-year sales commissions

before expenses. The compensation arrangement with John Shelby Amos II was no more favorable when contracted than those of other State

Sales Coordinators. John Shelby Amos II was hired by the Company on September 30, 2014 as a Market Director. The compensation earned

as an employee during 2014 for salary, bonus, and employer deferred compensation contributions totaled $82,943, $75,000, and $78,750,

respectively (and is included in All Other Compensation). Amounts included in All Other Compensation for Melvin T. Stith are event tickets and

the cost of spousal travel to attend Aflac’s annual sales convention.

16