SECURITY OWNERSHIP OF MANAGEMENT

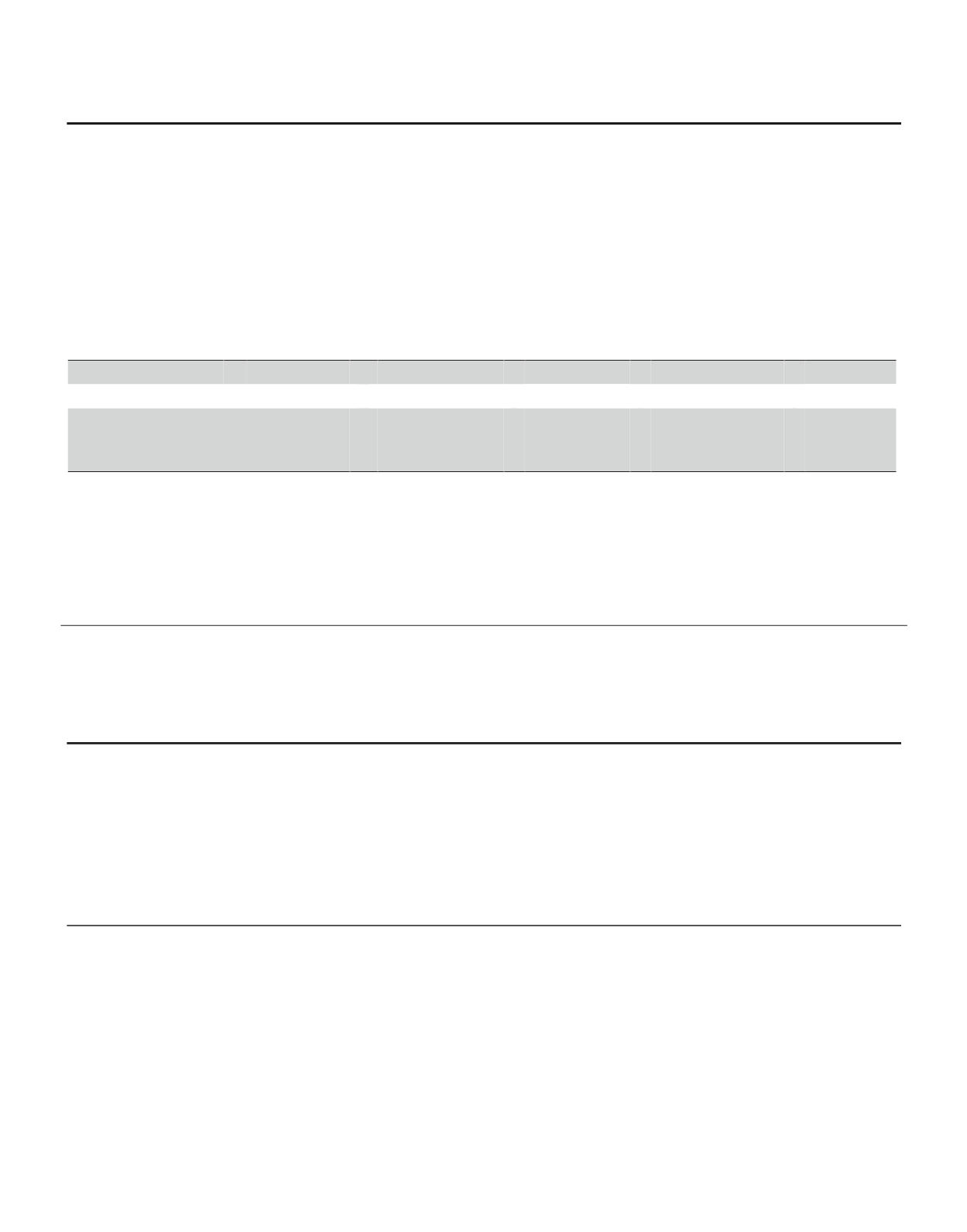

The following table sets forth, as of February 25, 2015,

the number of shares and percentage of outstanding

shares of Common Stock beneficially owned by: (i) our

named executive officers, comprising our CEO,

President/CFO, President of Aflac, and the two other

most highly compensated executive officers as listed in

the 2014 Summary Compensation Table (collectively,

the “NEOs”) whose information was not provided under

the heading “Election of Directors,” and (ii) all Directors

and executive officers as a group.

Common Stock Beneficially Owned and Approximate Percentage of Class as of February 25, 2015

Name

Shares

(1)

Percent of

Shares

Votes

Percent of

Votes

Eric M. Kirsch

126,028

*

126,028

*

Tohru Tonoike

292,703

.1

1,794,452

.2

All Directors, nominees, and executive

officers as a group

(25 persons)

15,038,129

3.4

130,287,230

16.4

* Percentage not listed if less than .1%.

(1)

Includes options to purchase shares, which are exercisable within 60 days for Eric M. Kirsch of 65,627; for Tohru Tonoike of 147,150 and all

Directors and executive officers as a group, 4,105,084. Also includes shares of restricted stock awarded under the 2004 Long-Term Incentive

Plan; in 2013, 2014 and 2015 for Eric Kirsch of 58,526; in 2013, and 2014 for Tohru Tonoike of 42,946; and all Directors and executive

officers as a group 884,950 which they have the right to vote, but they may not transfer until the shares have vested three years from the date

of grant if certain Company performance goals have been met. Includes 446,901 shares pledged for all Director nominees and executive

officers as a group. For information on the Company’s pledging policy, please see “Stock Ownership Guidelines; Hedging and Pledging

Restrictions” on page 41.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Pursuant to Section 16 of the Securities Exchange Act

of 1934, as amended (the “Exchange Act”), executive

officers, Directors, and holders of more than 10% of the

Common Stock are required to file reports of their

trading in Company equity securities with the SEC.

Based solely on its review of the copies of such reports

received by the Company, or written representations

from certain reporting persons, the Company believes

that its reporting persons complied with all applicable

Section 16 filing requirements during the last fiscal year.

17