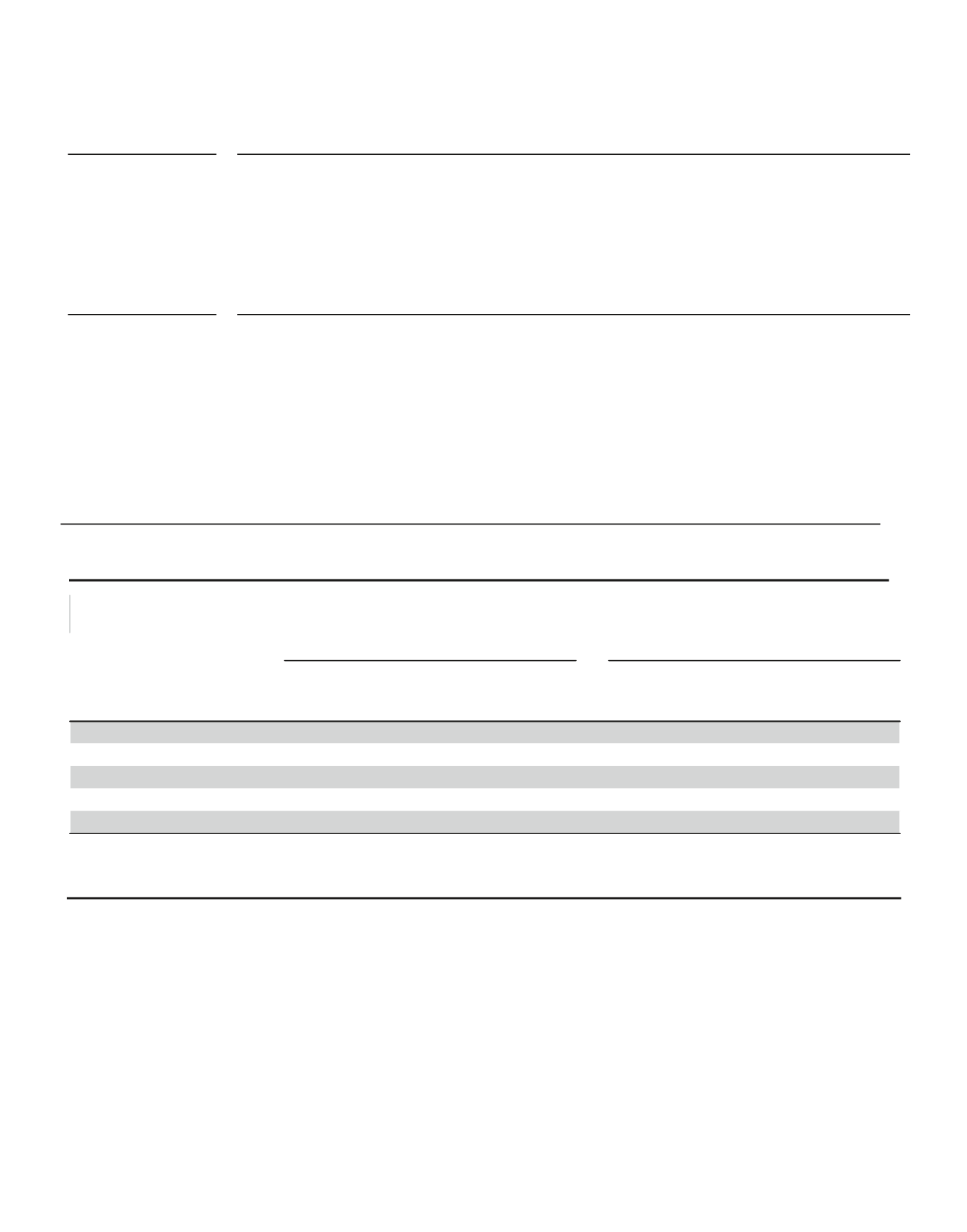

Grant Date

Option Vesting Schedule

02/14/12

02/12/13

09/30/13

02/11/14

100% vesting on the third anniversary of the option for Messrs. Paul S. Amos II and Tonoike

100% vesting on the third anniversary of the option for Messrs. Paul S. Amos II, Kirsch, and Tonoike

100% vesting on the third anniversary of the option for Mr. Paul S. Amos II

100% vesting on the

first

anniversary of the option for Mr. Cloninger

100% vesting on the third anniversary of the option for Messrs. Paul S. Amos II, Kirsch and Tonoike

Stock Award

Grant Date

Stock Award Vesting Schedule

02/14/12, 02/12/13,

and

08/13/13

Graded vesting on the third anniversary of the award based on the attainment of the cumulative target

performance goals for risk-based capital ratios of Aflac for three consecutive calendar years beginning

with the year of grant. Each year a credit can be earned with a minimum threshold of 50% and a

maximum of 150% as measured at each year-end. The final award will be the arithmetic average of the

credit earned each year, but with a maximum payout of 100%.

02/11/14

Graded vesting on the third anniversary of the award based on the attainment of the cumulative target

performance goals for risk-based capital ratios SMR, and ROE of Aflac for three consecutive calendar

years beginning with the year of grant. Each year a credit can be earned with a minimum threshold of

50% and a maximum of 150% as measured at each year-end. The final award will be the arithmetic

average of the credit earned each year, but with a maximum payout of 100%.

2014 OPTION EXERCISES AND STOCK VESTED

Name

Value Realized

on Exercise

($)

Value Realized

on Vesting

($)

Daniel P. Amos

143,169

3,088,155

70,323

4,388,841

Kriss Cloninger III

80,000

1,126,300

35,019

2,185,557

Paul S. Amos II

44,518

982,867

13,823

862,720

Eric M. Kirsch

—

—

—

—

Tohru Tonoike

—

—

13,823

862,720

Option Awards

Stock Awards

Number of Shares

Acquired on Exercise

(#)

Number of Shares

Acquired on Vesting

(#)

The following table provides information with respect to options exercised and stock awards vested during 2014 for

each of the NEOs.

PENSION BENEFITS

The Company maintains tax-qualified, noncontributory

defined benefit pension plans that cover the NEOs

other than Mr. Tonoike, and it also maintains

nonqualified supplemental retirement plans covering the

NEOs other than Mr. Kirsch, as described below. Mr.

Tonoike participates in a deferred compensation plan

maintained in Japan specific to the terms of his

employment agreement. The Company does not credit

extra years of service under any of its retirement plans,

unless required by employment agreements upon

certain termination events, such as termination

following a change in control or termination without

cause. Messrs. Daniel P. Amos and Cloninger are

eligible to receive immediate retirement benefits. For

Mr. Daniel P. Amos, retirement benefits fall under the

provisions of the U.S. tax-qualified plan and the

Retirement Plan for Senior Officers, and for Messrs.

Cloninger and Paul S. Amos II retirement benefits fall

under the U.S. tax-qualified plan and the Supplemental

Executive Retirement Plan. For Mr. Kirsch, retirement

benefits fall under the U.S. tax-qualified plan.

50