On the plus side flotation was a way of obtaining access to

capital for growth, and gave Vibroplant an opportunity to

enhance its profile. On the down side the increased publicity

resulted in some unwanted attention. As a reserved, privately-

owned company, Vibroplant had made a niche for itself as a

highly successful non-operator plant hire specialist. By

becoming a public company, with consequential information

disclosure, it caught the attention of businesses in the same

sector. Suddenly non-operator plant hire was seen as a

lucrative proposition and, inevitably, the resulting competition

subsequently affected the company’s fortunes.

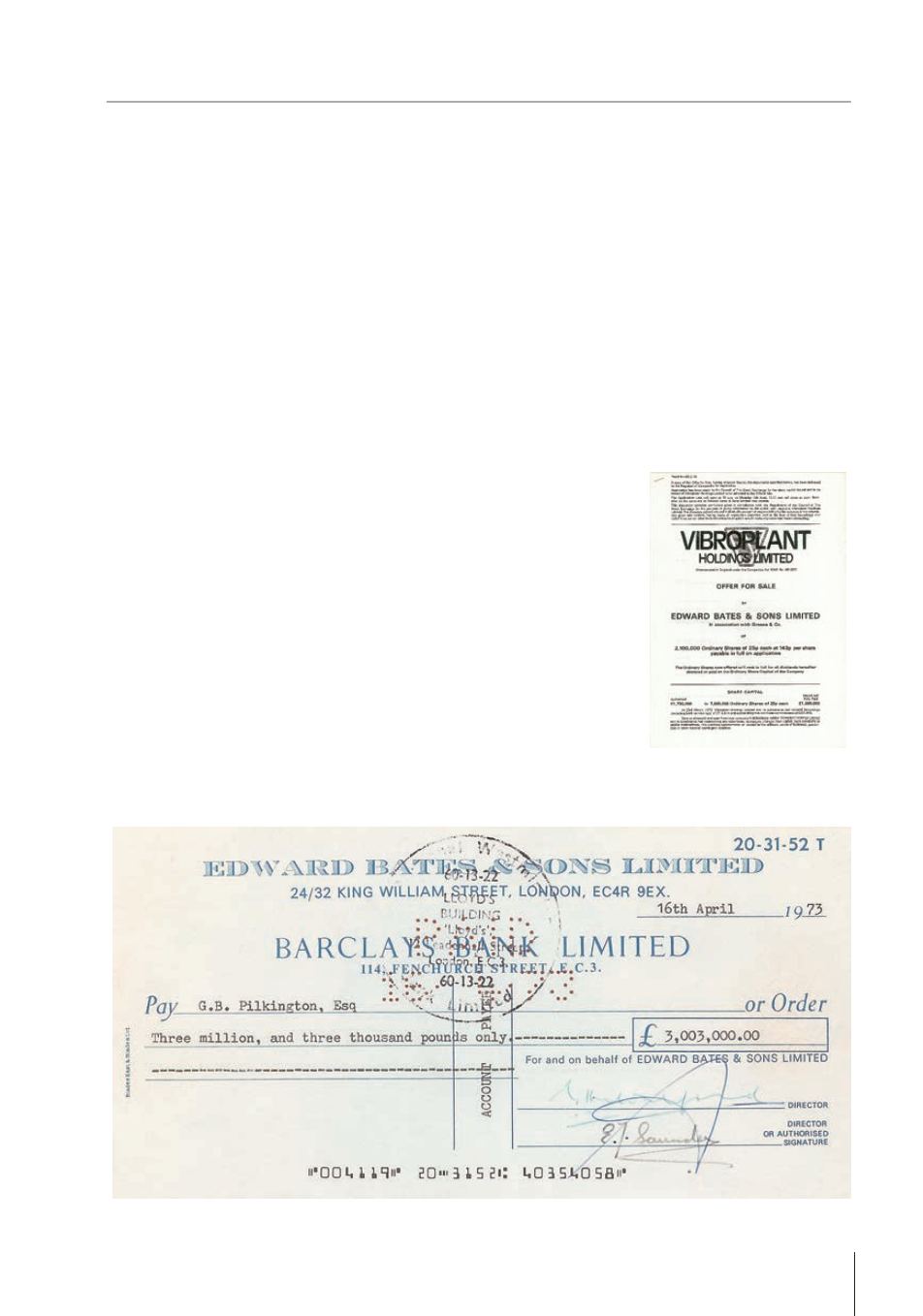

At the time of the stock market launch in 1973,

Vibroplant plc was valued at an impressive £8.6m and

Geoffrey negotiated a price of 143 pence per share with its

brokers. However, they reneged on the deal blaming weaker

market sentiment. Not to be deterred or browbeaten into a

lower price share, Geoffrey appointed new brokers Edward

Bates and Sons Limited in association with Greene and

Company who agreed to broker the flotation at the original

price. Unfortunately 83% of the shares were left with the

underwriters. Despite an initial negative reaction from the

financial press, Vibroplant’s flotation was a success. Growth and

profits continued and Vibroplant secured pole position as the

market leader in non-operator plant hire.

25

(above & below)

Stock market flotation

CHAPTER THREE