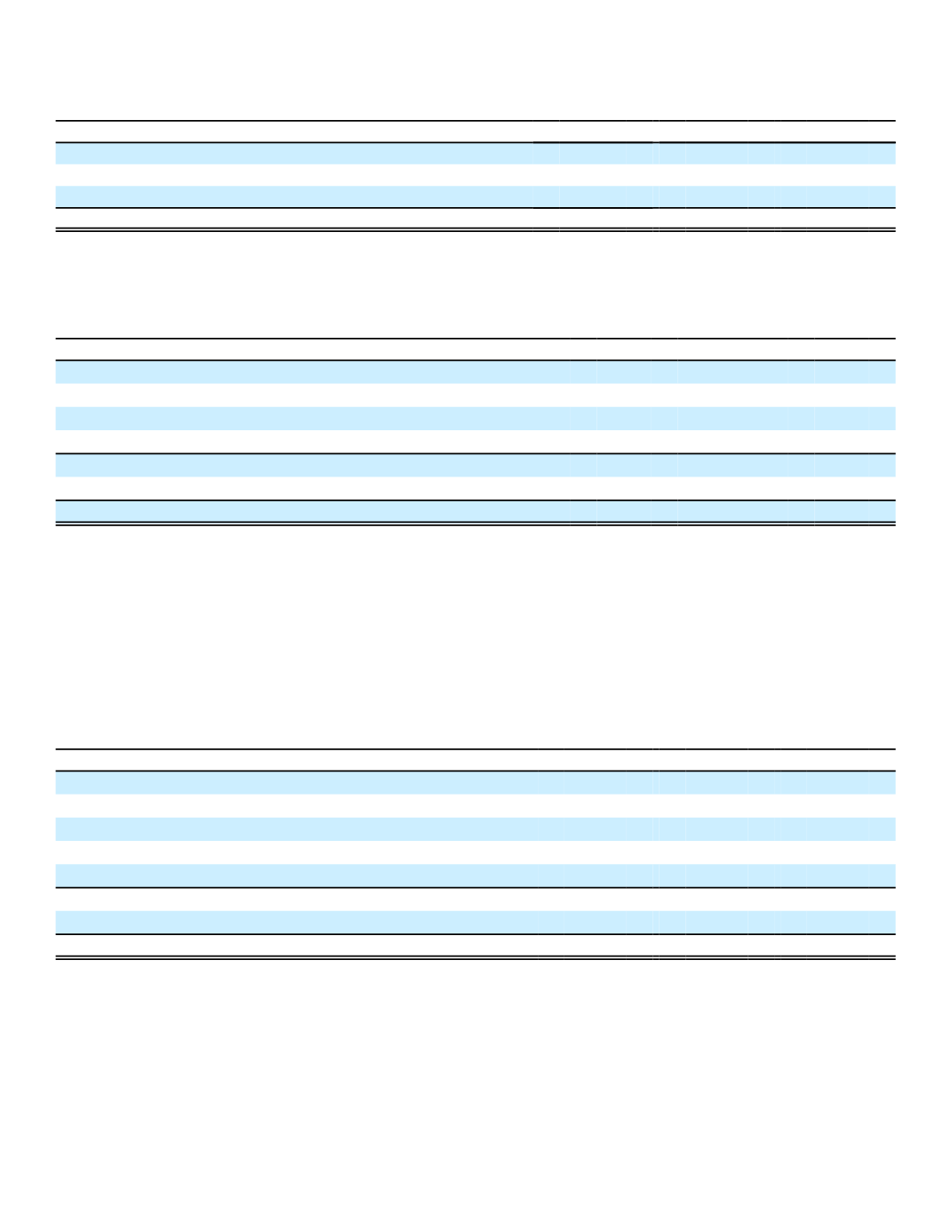

Transfers of funds from Aflac Japan:

Aflac Japan makes payments to the Parent Company for management fees

and to Aflac U.S. for allocated expenses and profit repatriations. Information on transfers for each of the years ended

December 31 is shown below. See Note 13 for information concerning restrictions on transfers from Aflac Japan.

(In millions)

2016

2015

2014

Management fees

$ 79

$ 53

$ 39

Allocated expenses

106

101

71

Profit repatriation

1,286

2,139

1,704

Total transfers from Aflac Japan

$ 1,471

$ 2,293

$ 1,814

Property and Equipment:

The costs of buildings, furniture and equipment are depreciated principally on a straight-

line basis over their estimated useful lives (maximum of 50 years for buildings and 20 years for furniture and equipment).

Expenditures for maintenance and repairs are expensed as incurred; expenditures for betterments are capitalized and

depreciated. Classes of property and equipment as of December 31 were as follows:

(In millions)

2016

2015

Property and equipment:

Land

$ 166

$ 166

Buildings

421

400

Equipment and furniture

355

329

Total property and equipment

942

895

Less accumulated depreciation

509

468

Net property and equipment

$ 433

$ 427

Receivables:

Receivables consist primarily of monthly insurance premiums due from individual policyholders or their

employers for payroll deduction of premiums, net of an allowance for doubtful accounts. At December 31, 2016, $207

million, or 30.9% of total receivables, were related to Aflac Japan's operations, compared with $257 million, or 36.4%, at

December 31, 2015.

101

3. INVESTMENTS

Net Investment Income

The components of net investment income for the years ended December 31 were as follows:

(In millions)

2016

2015

2014

Fixed-maturity securities

$ 3,214

$ 3,094

$ 3,249

Perpetual securities

94

114

141

Equity securities

35

3

1

Other investments

31

15

6

Short-term investments and cash equivalents

11

4

2

Gross investment income

3,385

3,230

3,399

Less investment expenses

107

95

80

Net investment income

$ 3,278

$ 3,135

$ 3,319