Expected maturities may differ from contractual maturities because some issuers have the right to call or prepay

obligations with or without call or prepayment penalties.

The majority of our perpetual securities are subordinated to other debt obligations of the issuer, but rank higher than

the issuer's equity securities. Perpetual securities have characteristics of both debt and equity investments, along with

unique features that create economic maturity dates for the securities. Although perpetual securities have no contractual

maturity date, they have stated interest coupons that were fixed at their issuance and subsequently change to a floating

short-term interest rate after some period of time. The instruments are generally callable by the issuer at the time of

changing from a fixed coupon rate to a new variable rate of interest, which is determined by the combination of some

market index plus a fixed amount of basis points. The net effect is to create an expected maturity date for the instrument.

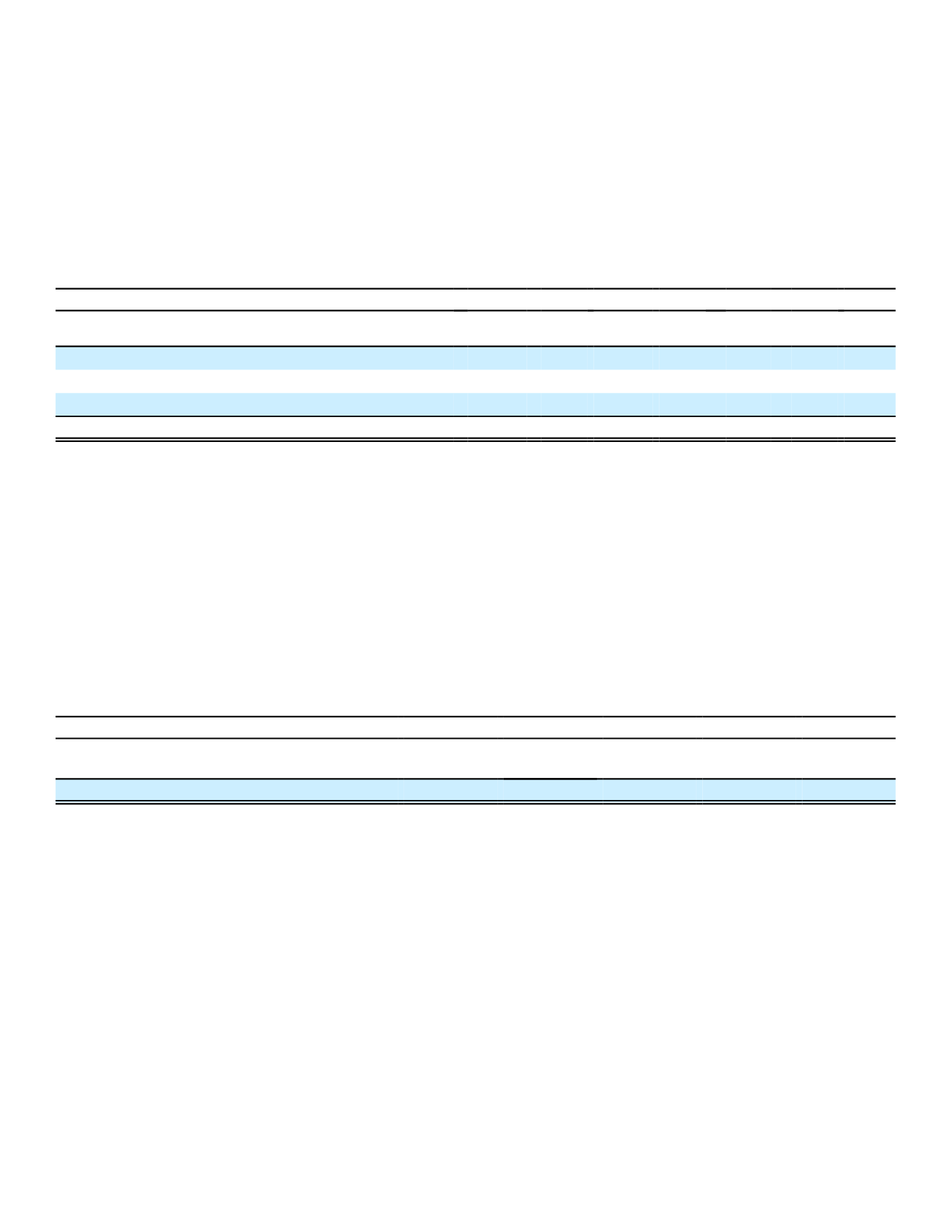

The economic maturities of our investments in perpetual securities, which were all reported as available for sale at

December 31, 2016, were as follows:

Aflac Japan

Aflac U.S.

(In millions)

Amortized

Cost

Fair

Value

Amortized

Cost

Fair

Value

Due in one year or less

$ 87

$ 82

$ 0

$ 0

Due after one year through five years

189

213

0

0

Due after 10 years

1,191

1,282

39

56

Total perpetual securities available for sale

$1,467

$1,577

$ 39

$ 56

106

Investment Concentrations

Our process for investing in credit-related investments begins with an independent approach to underwriting each

issuer's fundamental credit quality. We evaluate independently those factors which we believe could influence an issuer's

ability to make payments under the contractual terms of our instruments. This includes a thorough analysis of a variety of

items including the issuer's country of domicile (including political, legal, and financial considerations); the industry in

which the issuer competes (with an analysis of industry structure, end-market dynamics, and regulation); company

specific issues (such as management, assets, earnings, cash generation, and capital needs); and contractual provisions

of the instrument (such as financial covenants and position in the capital structure). We further evaluate the investment

considering broad business and portfolio management objectives, including asset/liability needs, portfolio diversification,

and expected income.

Investment exposures that individually exceeded 10% of shareholders' equity as of December 31 were as follows:

2016

2015

(In millions)

Credit

Rating

Amortized

Cost

Fair

Value

Credit

Rating

Amortized

Cost

Fair

Value

Japan National Government

(1)

A

$42,931

$51,345

A

$36,859

$42,025

(1)

Japan Government Bonds (JGBs) or JGB-backed securities

Realized Investment Gains and Losses

Information regarding pretax realized gains and losses from investments for the years ended December 31 follows: