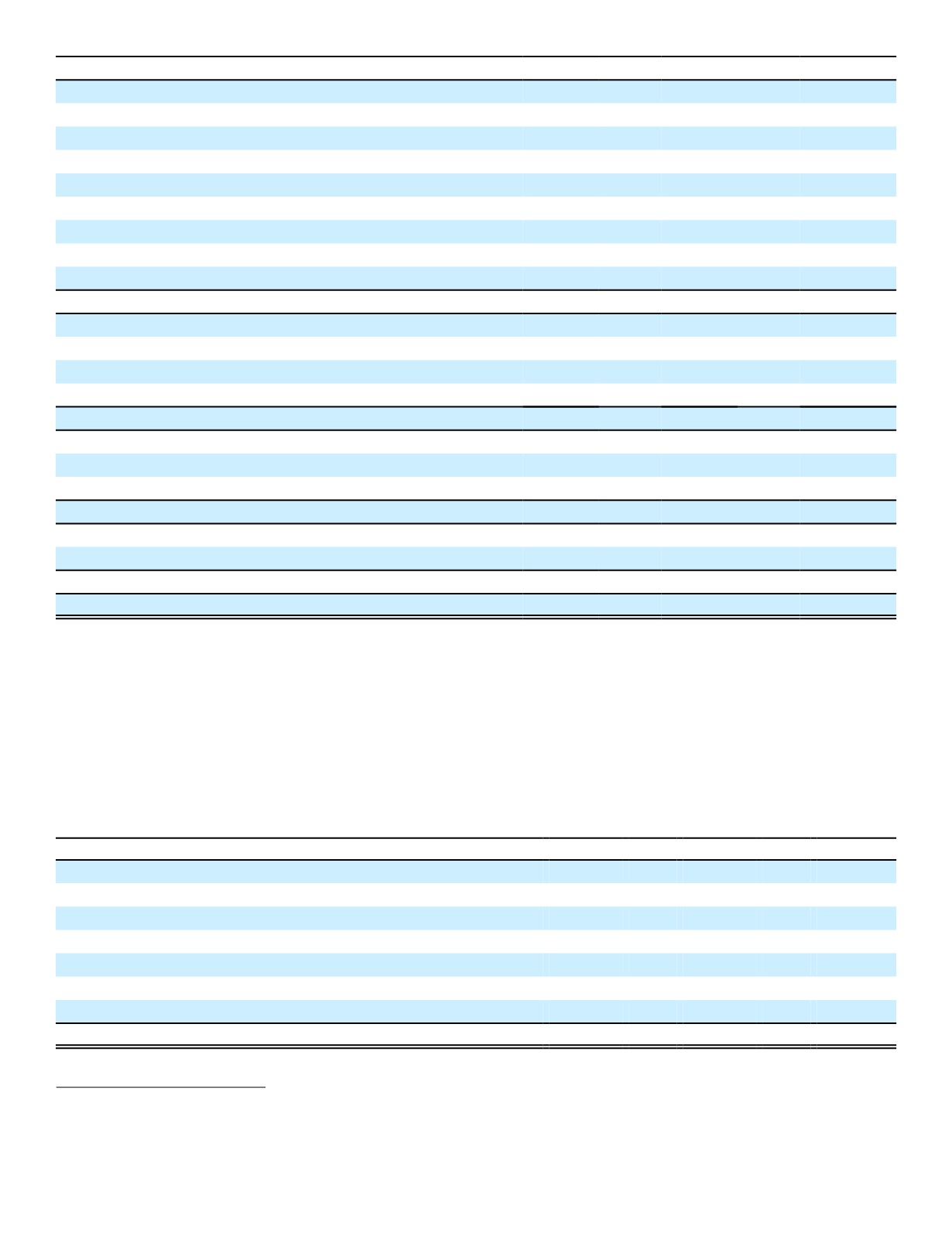

(In millions)

2016

2015

2014

Realized investment gains (losses):

Fixed maturities:

Available for sale:

Gross gains from sales

$ 77

$ 224

$ 192

Gross losses from sales

(134)

(1)

(8)

(12)

Net gains (losses) from redemptions

(1)

186

52

34

Other-than-temporary impairment losses

(24)

(1)

(152)

(31)

Held to maturity:

Net gains (losses) from redemptions

0

0

1

Total fixed maturities

105

116

184

Perpetual securities:

Available for sale:

Net gains (losses) from redemptions

64

35

0

Other-than-temporary impairment losses

(2)

0

0

Total perpetual securities

62

35

0

Equity securities:

Net gains (losses) from redemptions

22

0

0

Other-than-temporary impairment losses

(57)

(1)

0

Total equity securities

(35)

(1)

0

Derivatives and other:

Derivative gains (losses)

(255)

(10)

31

Total derivatives and other

(255)

(10)

31

Total realized investment gains (losses)

$ (123)

$ 140

$ 215

(1)

Primarily driven by foreign exchange

In 2016, the impairments we recorded related to fixed maturity securities were due to a change in intent to sell

securities. In 2016, the impairments we recorded related to equity securities were a result of significant and/or prolonged

declines in fair value, as well as expected portfolio rebalancing where we were not able to assert our ability and intent to

hold certain securities until recovery.

107

Unrealized Investment Gains and Losses

Information regarding changes in unrealized gains and losses from investments for the years ended December 31

follows:

(In millions)

2016

2015

2014

Changes in unrealized gains (losses):

Fixed maturities:

Available for sale

$ 2,690

$ (2,481)

$ 5,629

Transferred to held to maturity

0

0

(10)

Perpetual securities:

Available for sale

21

(123)

269

Equity securities

88

9

5

Total change in unrealized gains (losses)

$ 2,799

$ (2,595)

$ 5,893

Effect on Shareholders' Equity

The net effect on shareholders' equity of unrealized gains and losses from investment securities at December 31 was

as follows: