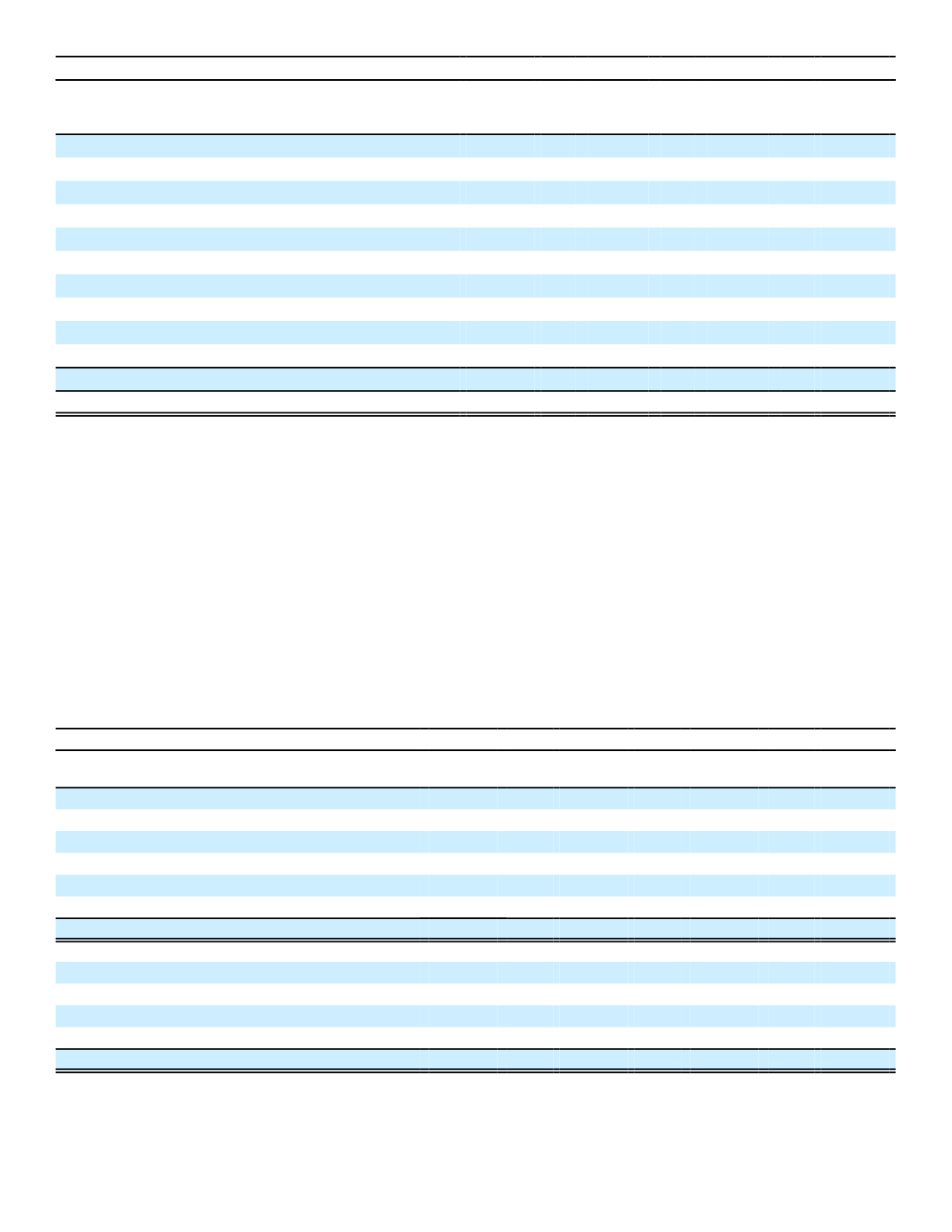

2015

(In millions)

Cost or

Amortized

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Fair

Value

Securities held to maturity, carried at amortized cost:

Fixed maturities:

Yen-denominated:

Japan government and agencies

$ 20,004

$ 3,387

$ 0

$ 23,391

Municipalities

341

74

0

415

Mortgage- and asset-backed securities

36

2

0

38

Public utilities

3,092

205

94

3,203

Sovereign and supranational

2,555

182

26

2,711

Banks/financial institutions

4,431

168

53

4,546

Other corporate

3,000

260

44

3,216

Total yen-denominated

33,459

4,278

217

37,520

Total securities held to maturity

$ 33,459

$ 4,278

$ 217

$ 37,520

The methods of determining the fair values of our investments in fixed-maturity securities, perpetual securities and

equity securities are described in Note 5.

Beginning in 2015 and continuing into 2016, we increased our investment in yen-denominated publicly traded equity

securities. In 2016, we also increased our investment in U.S. dollar-denominated publicly traded equity securities. These

securities are classified as available for sale and carried on our balance sheet at fair value.

During 2016 and 2015, we did not reclassify any investments from the held-to-maturity category to the available-for-

sale category. During 2014, we reclassified three investments from the held-to-maturity category to the available-for-sale

category as a result of the issuers being downgraded to below investment grade. At the time of the transfer, the securities

had an aggregate amortized cost of $424 million and an aggregate unrealized loss of $54 million.

105

Contractual and Economic Maturities

The contractual maturities of our investments in fixed maturities at December 31, 2016, were as follows:

Aflac Japan

Aflac U.S.

(In millions)

Amortized

Cost

Fair

Value

Amortized

Cost

Fair

Value

Available for sale:

Due in one year or less

$ 180

$ 204

$ 103

$ 105

Due after one year through five years

3,441

3,696

617

668

Due after five years through 10 years

9,374

9,694

2,860

3,018

Due after 10 years

39,461

45,125

8,545

9,411

Mortgage- and asset-backed securities

1,144

1,184

43

48

Total fixed maturities available for sale

$ 53,600

$ 59,903

$ 12,168

$ 13,250

Held to maturity:

Due after one year through five years

2,009

2,112

0

0

Due after five years through 10 years

1,584

1,737

0

0

Due after 10 years

29,727

36,140

0

0

Mortgage- and asset-backed securities

30

32

0

0

Total fixed maturities held to maturity

$ 33,350

$ 40,021

$ 0

$ 0

At December 31, 2016, the Parent Company and other business segments had portfolios of available-for-sale fixed-

maturity securities totaling $595 million at amortized cost and $607 million at fair value, which are not included in the table

above.