These reinsurance transactions are indemnity reinsurance that do not relieve us from our obligations to policyholders.

In the event that the reinsurer is unable to meet their obligations, we remain liable for the reinsured claims.

As a part of our capital contingency plan, we entered into a committed reinsurance facility agreement on December 1,

2015 in the amount of approximately 110 billion yen. This reinsurance facility agreement was renewed in 2016 and is

effective until December 31, 2017. There are also additional commitment periods of a one-year duration each which are

automatically extended unless notification is received from the reinsurer within 60 days prior to the expiration. The

reinsurer can withdraw from the committed facility if Aflac‘s Standard and Poor's (S&P) rating drops below BBB-. As of

December 31, 2016, we have not executed a reinsurance treaty under this committed reinsurance facility.

143

9. NOTES PAYABLE

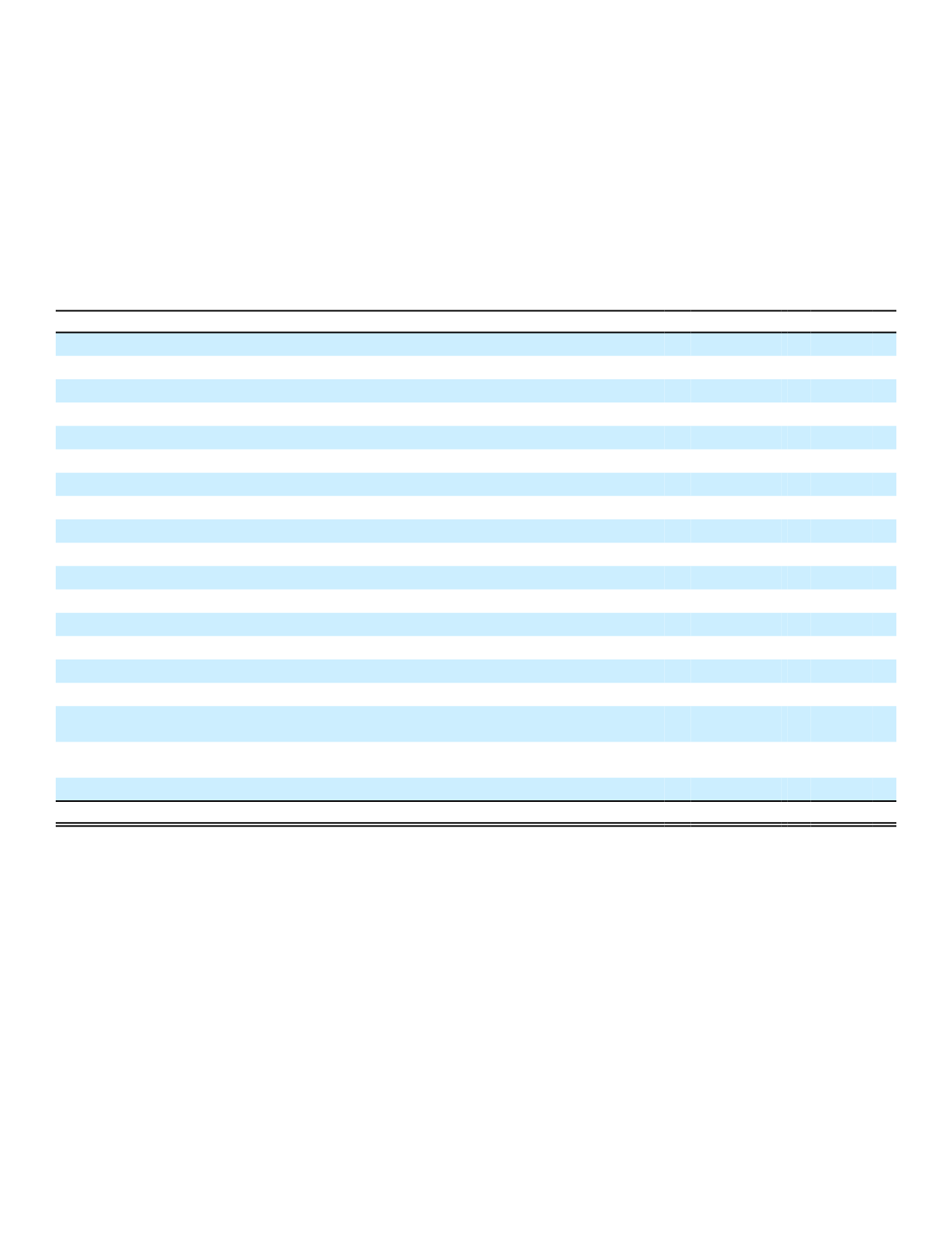

A summary of notes payable as of December 31 follows:

(In millions)

2016

2015

2.65% senior notes due February 2017

$ 649

$ 651

2.40% senior notes due March 2020

547

546

4.00% senior notes due February 2022

348

348

3.625% senior notes due June 2023

696

696

3.625% senior notes due November 2024

745

744

3.25% senior notes due March 2025

445

445

2.875% senior notes due October 2026

298

0

6.90% senior notes due December 2039

220

393

6.45% senior notes due August 2040

254

445

4.00% senior notes due October 2046

394

0

5.50% subordinated debentures due September 2052

486

486

Yen-denominated Uridashi notes:

2.26% notes paid September 2016 (principal amount 8 billion yen)

0

66

Yen-denominated Samurai notes:

1.84% notes paid July 2016 (principal amount 15.8 billion yen)

0

131

Yen-denominated loans:

Variable interest rate loan due September 2021 (.31% in 2016, principal amount 5.0

billion yen)

43

0

Variable interest rate loan due September 2023 (.46% in 2016, principal amount 25.0

billion yen)

214

0

Capitalized lease obligations payable through 2023

21

20

Total notes payable

$ 5,360

$ 4,971

Prior-year amounts have been adjusted for the adoption of accounting guidance on January 1, 2016 related to debt issuance costs.

Amounts in the table above are reported net of debt issuance costs and issuance premiums or discounts, if applicable, that are being

amortized over the life of the notes.

In September 2016, the Parent Company issued two series of senior notes totaling $700 million through a U.S. public

debt offering. The first series, which totaled $300 million, bears interest at a fixed rate of 2.875% per annum, payable

semi-annually and has a 10-year maturity. The second series, which totaled $400 million, bears interest at a fixed rate of

4.00% per annum, payable semi-annually, and has a 30-year maturity.

In September 2016, the Parent Company entered into two series of senior unsecured term loan facilities totaling 30.0

billion yen. The first series, which totaled 5.0 billion yen, bears an interest rate per annum equal to the Tokyo interbank

market rate (TIBOR), or alternate TIBOR, if applicable, plus the applicable TIBOR margin and has a five-year maturity.

The applicable margin ranges between .20% and .60%, depending on the Parent Company's debt ratings as of the date

of determination. The second series, which totaled 25.0 billion yen, bears an interest rate per annum equal to TIBOR, or

alternate TIBOR, if applicable, plus the applicable TIBOR margin and has a seven-year maturity. The applicable margin

ranges between .35% and .75%, depending on the Parent Company's debt ratings as of the date of determination.

In March 2015, the Parent Company issued two series of senior notes totaling $1.0 billion through a U.S. public debt

offering. The first series, which totaled $550 million, bears interest at a fixed rate of 2.40% per annum, payable semi-