The Parent Company and Aflac have a five-year senior unsecured revolving credit facility agreement with a syndicate

of financial institutions that provides for borrowings of up to 55.0 billion yen or the equivalent of yen in U.S. dollars on a

revolving basis. This credit agreement provides for borrowings in Japanese yen or the equivalent of Japanese yen in U.S.

dollars on a revolving basis. Borrowings bear interest at a rate per annum equal to, at our option, either (a) a eurocurrency

rate determined by reference to the LIBOR for the interest period relevant to such borrowing adjusted for certain additional

costs or (b) a base rate determined by reference to the highest of (1) the federal funds effective rate plus ½ of 1%, (2) the

rate of interest for such day announced by Mizuho Bank, Ltd. as its prime rate and (3) the eurocurrency rate for an interest

period of one month plus 1.00%, in each case plus an applicable margin. The applicable margin ranges between .79%

and 1.275% for eurocurrency rate borrowings and 0.0% and .275% for base rate borrowings, depending on the Parent

Company’s debt ratings as of the date of determination. In addition, the Parent Company and Aflac are required to pay a

facility fee on the commitments ranging between .085% and .225%, also based on the Parent Company’s debt ratings as

of the date of determination. Borrowings under the amended and restated credit facility may be used for general corporate

purposes, including a capital contingency plan for the operations of the Parent Company and Aflac. The amended and

restated credit facility requires compliance with certain financial covenants on a quarterly basis and will expire on the

earlier of (a) September 18, 2020, or (b) the date the commitments are terminated pursuant to an event of default, as such

term is defined in the credit agreement. As of December 31, 2016, we did not have any borrowings outstanding under our

55.0 billion yen revolving credit agreement.

The Parent Company and Aflac have an uncommitted bilateral line of credit with a third party that provides for

borrowings in the amount of $50 million. Borrowings will bear interest at the rate quoted by the bank and agreed upon at

the time of making such loan and will have up to a three-month maturity period. There are no related facility fees, upfront

expenses or financial covenant requirements. Borrowings under this credit agreement may be used for general corporate

purposes. As of December 31, 2016, we did not have any borrowings outstanding under our $50 million credit agreement.

We were in compliance with all of the covenants of our notes payable and lines of credit at December 31, 2016. No

events of default or defaults occurred during 2016 and 2015.

146

10. INCOME TAXES

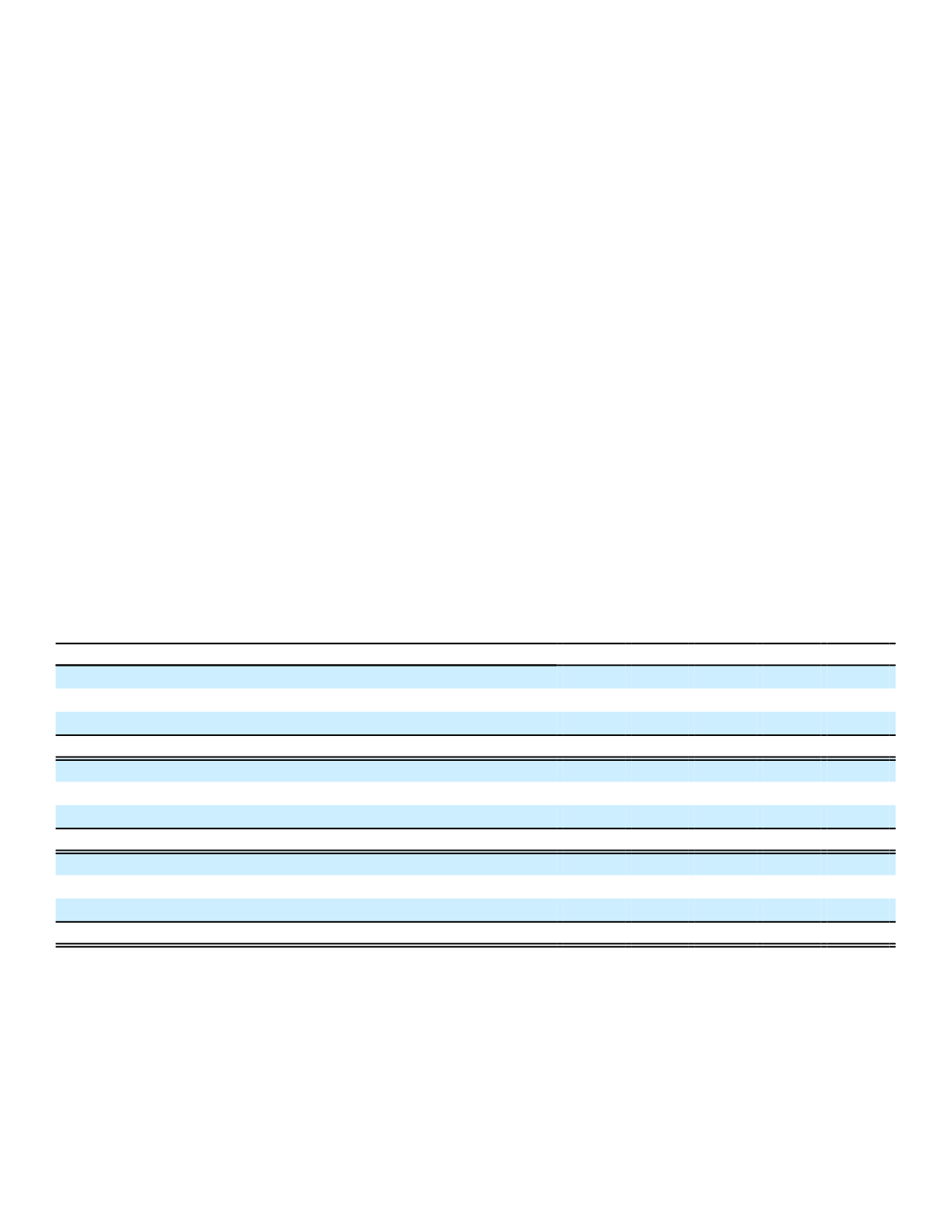

The components of income tax expense (benefit) applicable to pretax earnings for the years ended December 31

were as follows:

(In millions)

Foreign

U.S.

Total

2016:

Current

$ 650

$ 234

$ 884

Deferred

136

388

524

Total income tax expense

$ 786

$ 622

$ 1,408

2015:

Current

$ 1,063

$ 225

$ 1,288

Deferred

42

(1)

41

Total income tax expense

$ 1,105

$ 224

$ 1,329

2014:

Current

$ 995

$ 84

$ 1,079

Deferred

125

336

461

Total income tax expense

$ 1,120

$ 420

$ 1,540

The Japan income tax rate for the fiscal year 2014 was 33.3%. The rate was reduced to 30.8% for the fiscal year

2015 and reduced to 28.8% for the fiscal year 2016.

Income tax expense in the accompanying statements of earnings varies from the amount computed by applying the

expected U.S. tax rate of 35% to pretax earnings. The principal reasons for the differences and the related tax effects for