these derivatives and the related hedged items in current earnings within derivative and other gains (losses). The change

in the fair value of the interest rate swaptions related to the time value of the option is excluded from the assessment of

hedge effectiveness.

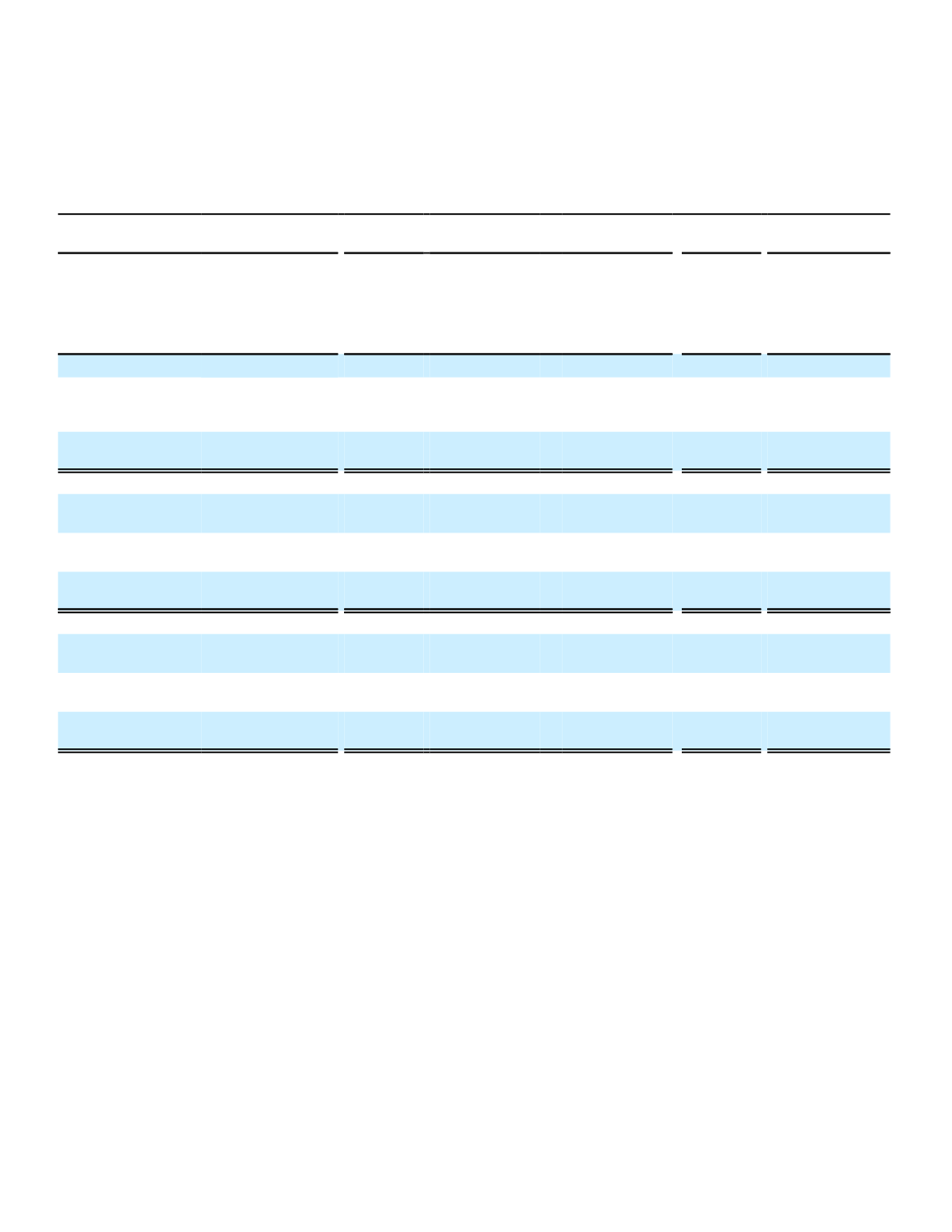

The following table presents the gains and losses on derivatives and the related hedged items in fair value hedges for

the years ended December 31.

Fair Value Hedging Relationships

(In millions)

Hedging Derivatives

Hedged

Items

Hedging

Derivatives

Hedged Items

Total

Gains

(Losses)

Gains

(Losses)

Excluded

from

Effectiveness

Testing

Gains

(Losses)

Included in

Effectiveness

Testing

Gains

(Losses)

Ineffectiveness

Recognized for

Fair Value

Hedge

2016:

Foreign currency

forwards

Fixed-maturity

securities and

equity securities

$ 207 $

(338)

$

545 $ (566) $

(21)

Foreign currency

options

Fixed-maturity

securities

(95)

(18)

(77)

70

(7)

2015:

Foreign currency

forwards

Fixed-maturity

securities

$ (133) $

(136)

$

3 $

(5) $

(2)

Foreign currency

options

Fixed-maturity

securities

(4)

3

(7)

7

0

Interest rate

swaptions

Fixed-maturity

securities

(95)

19

(114)

99

(15)

2014:

Foreign currency

forwards

Fixed-maturity

securities

$ (1,835) $

(38)

$

(1,797) $ 1,819 $

22

Foreign currency

options

Fixed-maturity

securities

(41)

(4)

(37)

38

1

Interest rate

swaptions

Fixed-maturity

securities

(318)

(36)

(282)

316

34

Net Investment Hedge

Our primary exposure to be hedged is our net investment in Aflac Japan, which is affected by changes in the yen/

dollar exchange rate. To mitigate this exposure, we have designated the Parent Company's yen-denominated liabilities

(see Note 9) as non-derivative hedges and designated foreign currency forwards and options as derivative hedges of the

foreign currency exposure of our net investment in Aflac Japan.

We used foreign exchange forwards and options to hedge foreign exchange risk on 114.0 billion yen of profit

repatriation received from Aflac Japan in 2016. As of December 31, 2016, we had entered into foreign exchange forwards

and options as part of a hedge on 122.6 billion yen of future profit repatriation.

Our net investment hedge was effective for the years ended December 31, 2016, 2015 and 2014.

Non-qualifying Strategies

For our derivative instruments in consolidated VIEs that do not qualify for hedge accounting treatment, all changes in

their fair value are reported in current period earnings within derivative and other gains (losses). The amount of gain or

loss recognized in earnings for our VIEs is attributable to the derivatives in those investment structures. While the change

in value of the swaps is recorded through current period earnings, the change in value of the available-for-sale fixed-

maturity or perpetual securities associated with these swaps is recorded through other comprehensive income.

117