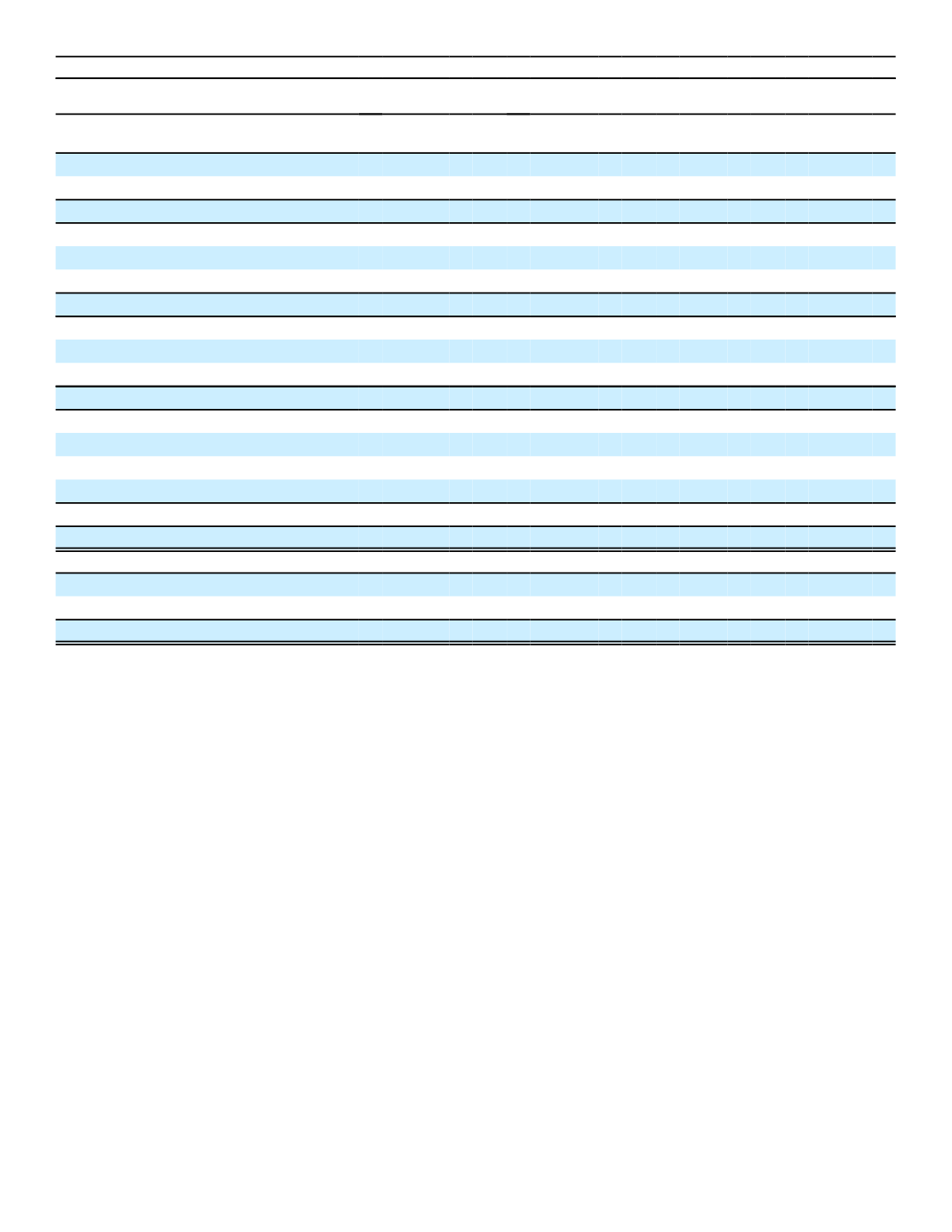

2015

(In millions)

Net Derivatives

Asset

Derivatives

Liability

Derivatives

Hedge Designation/ Derivative Type

Notional

Amount

Fair Value

Fair Value

Fair Value

Cash flow hedges:

Foreign currency swaps

$ 75

$ (15)

$ 0

$ (15)

Total cash flow hedges

75

(15)

0

(15)

Fair value hedges:

Foreign currency forwards

13,080

45

88

(43)

Foreign currency options

1,250

0

0

0

Total fair value hedges

14,330

45

88

(43)

Net investment hedge:

Foreign currency forwards

763

13

19

(6)

Foreign currency options

266

(3)

5

(8)

Total net investment hedge

1,029

10

24

(14)

Non-qualifying strategies:

Foreign currency swaps

6,599

264

563

(299)

Foreign currency forwards

11

0

0

0

Credit default swaps

83

1

1

0

Total non-qualifying strategies

6,693

265

564

(299)

Total derivatives

$22,127

$ 305

$ 676

$ (371)

Balance Sheet Location

Other assets

$11,413

$ 676

$ 676

$ 0

Other liabilities

10,714

(371)

0

(371)

Total derivatives

$22,127

$ 305

$ 676

$ (371)

The derivative notional amount increased from 2015 to 2016 primarily due to an increase in non-qualifying strategies.

The increase in non-qualifying strategies related to entering into longer duration foreign currency forwards designated as

fair value hedges that resulted in the dedesignation of existing foreign currency forwards. We also entered into offsetting

foreign currency forwards for the remaining term of the foreign currency forwards that were dedesignated, both of which

are included in the notional amounts presented for non-qualifying strategies.

Cash Flow Hedges

Certain of our consolidated VIEs have foreign currency swaps that qualify for hedge accounting treatment. For those

that have qualified, we have designated the derivative as a hedge of the variability in cash flows of a forecasted

transaction or of amounts to be received or paid related to a recognized asset (“cash flow” hedge). We expect to continue

this hedging activity for a weighted-average period of approximately nine years. The remaining derivatives in our

consolidated VIEs that have not qualified for hedge accounting are included in "non-qualifying strategies."

Fair Value Hedges

We designate and account for certain foreign currency forwards and options as fair value hedges when they meet the

requirements for hedge accounting. These foreign currency forwards and options hedge the foreign currency exposure of

certain U.S. dollar-denominated investments. We recognize gains and losses on these derivatives and the related hedged

items in current earnings within derivative and other gains (losses). The change in the fair value of the foreign currency

forwards related to the changes in the difference between the spot rate and the forward price is excluded from the

assessment of hedge effectiveness. The change in fair value of the foreign currency option related to the time value of the

option is excluded from the assessment of hedge effectiveness.

We designate and account for interest rate swaptions as fair value hedges when they meet the requirements for

hedge accounting. These interest rate swaptions hedge the interest rate exposure of certain U.S. dollar-denominated

fixed maturity securities within the investment portfolio of our Aflac Japan segment. We recognize gains and losses on

116