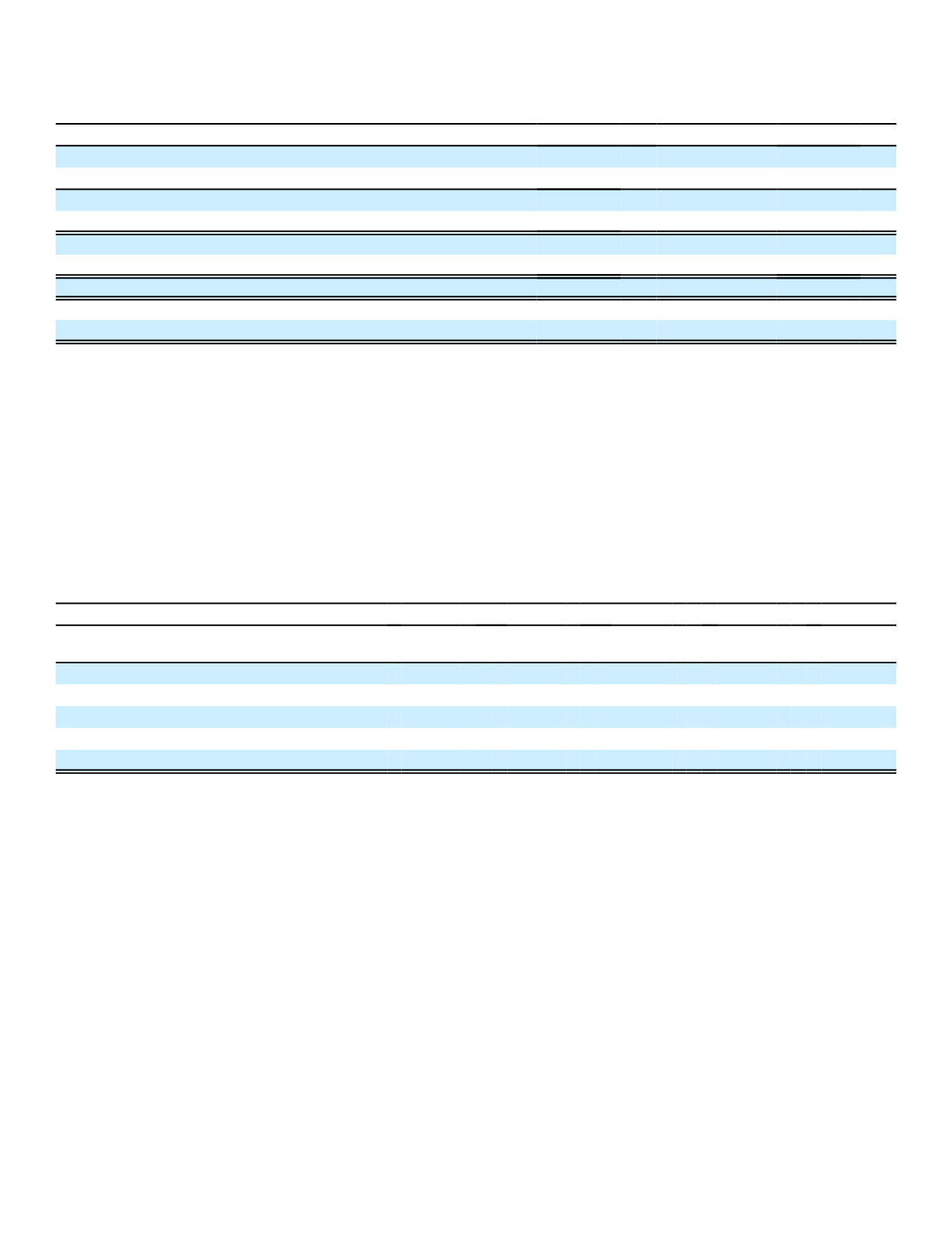

The table below reflects the growth of the future policy benefits liability for the years ended December 31.

Future Policy Benefits

(In millions of dollars and billions of yen)

2016

2015

2014

Aflac U.S.

$ 8,442

$ 8,087

$ 7,728

Growth rate

4.4%

4.6%

5.1 %

Aflac Japan

$ 68,291

$ 62,244

$ 57,916

Growth rate

9.7%

7.5%

(6.3)%

Consolidated

$ 76,106

$ 69,687

$ 65,646

Growth rate

9.2%

6.2%

(5.0)%

Yen/dollar exchange rate (end of period)

116.49

120.61

120.55

Aflac Japan (in yen)

7,955

7,507

6,982

Growth rate

6.0%

7.5%

7.2 %

The growth of the future policy benefits liability in yen for Aflac Japan and in dollars for Aflac U.S. has been due to the

aging of our in-force block of business and the addition of new business.

In computing the estimate of unpaid policy claims, we consider many factors, including the benefits and amounts

available under the policy; the volume and demographics of the policies exposed to claims; and internal business

practices, such as incurred date assignment and current claim administrative practices. We monitor these conditions

closely and make adjustments to the liability as actual experience emerges. Claim levels are generally stable from period

to period; however, fluctuations in claim levels may occur. In calculating the unpaid policy claim liability, we do not

calculate a range of estimates. The following table shows the expected sensitivity of the unpaid policy claims liability as of

December 31, 2016, to changes in severity and frequency of claims.

Sensitivity of Unpaid Policy Claims Liability

(In millions)

Total Severity

Total Frequency

Decrease

by 2%

Decrease

by 1% Unchanged

Increase

by 1%

Increase

by 2%

Increase by 2%

$ 0

$ 24

$ 48

$ 73

$ 98

Increase by 1%

(24)

0

24

49

73

Unchanged

(48)

(24)

0

24

48

Decrease by 1%

(71)

(48)

(24)

0

24

Decrease by 2%

(94)

(71)

(48)

(24)

0

Other policy liabilities, which accounted for 15% of total policy liabilities as of December 31, 2016, consisted primarily

of discounted advance premiums on deposit from policyholders in conjunction with their purchase of certain Aflac Japan

insurance products. These advanced premiums are deferred upon collection and recognized as premium revenue over

the contractual premium payment period. Advanced premiums represented 38% and 43% of the December 31, 2016 and

2015 other policy liabilities balances, respectively. See the Aflac Japan segment subsection of this MD&A for further

information.

Income Taxes

Income tax provisions are generally based on pretax earnings reported for financial statement purposes, which differ

from those amounts used in preparing our income tax returns. Deferred income taxes are recognized for temporary

differences between the financial reporting basis and income tax basis of assets and liabilities, based on enacted tax laws

and statutory tax rates applicable to the periods in which we expect the temporary differences to reverse. The evaluation

of a tax position in accordance with U.S. GAAP is a two-step process. Under the first step, the enterprise determines

whether it is more likely than not that a tax position will be sustained upon examination by taxing authorities. The second

step is measurement, whereby a tax position that meets the more-likely-than-not recognition threshold is measured to

determine the amount of benefit to recognize in the financial statements. A valuation allowance is established for deferred

tax assets when it is more likely than not that an amount will not be realized. The determination of a valuation allowance

for deferred tax assets requires management to make certain judgments and assumptions.

39