other bond sales and calls. We realized pretax investment losses of $31 million ($20 million after-tax) as a result of the

recognition of other-than-temporary impairment losses on certain securities.

See Note 3 of the Notes to the Consolidated Financial Statements for more details on these investment activities.

Impact of Derivative and Hedging Activities

Our derivative instruments include foreign currency swaps and credit default swaps held in consolidated VIEs; foreign

currency forwards and options, interest rate swaptions and futures on certain fixed-maturity securities; foreign currency

forwards and options that economically hedge certain portions of forecasted cash flows denominated in yen; and foreign

currency swaps associated with certain senior notes and our subordinated debentures. During 2016, we realized pretax

investment losses, net of gains, of $255 million, compared with pretax investment losses, net of gains, of $10 million in

2015 and pretax investment gains, net of losses, of $31 million in 2014 as a result of valuing these derivatives, net of the

effects of hedge accounting. For a description of other items that could be included in the Impact of Derivative and

Hedging Activities, see the Hedging Activities subsection of MD&A and Note 4 of the accompanying Notes to the

Consolidated Financial Statements.

Hedge Costs

Our Reconciliation of Net Earnings to Operating Earnings table above includes a line item related to the costs incurred

in using foreign currency forward contracts to hedge a portion of the foreign currency exchange risk on the U.S. dollar-

denominated assets in Aflac Japan's investment portfolio. These hedge costs are derived from the difference between the

foreign currency spot rate at time of trade inception and the contractual foreign currency forward rate. For our non-U.S.

GAAP reporting disclosures, we have historically reported the total hedge costs of these contracts in the period in which

the foreign currency forward was executed. Beginning in 2016, we changed our non-U.S. GAAP reporting for these hedge

costs by amortizing them evenly over the life of the foreign currency forward contracts. We believe amortizing the hedge

costs over the life of these contracts provides a better measure of our non-U.S. GAAP results as compared to our

historical methodology. In 2016, we began increasing the duration of the foreign currency forward contracts used to hedge

our U.S. dollar-denominated assets in Aflac Japan's investment portfolio to cover periods extending beyond one year.

Therefore, recognizing these costs over the extended hedging periods provides a better measure of our costs, and better

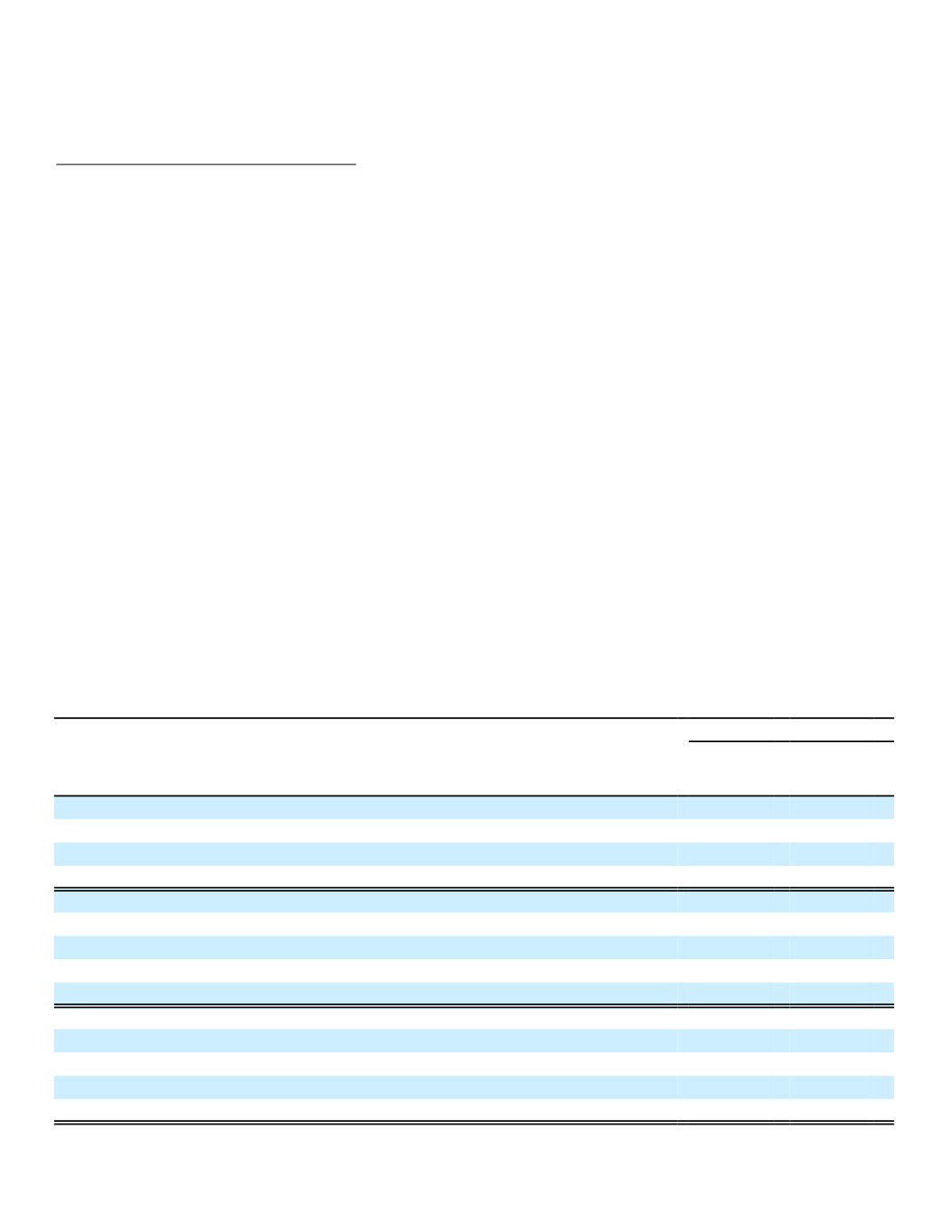

reflects the economics of how hedge costs emerge over the life of the hedge. The table below summarizes the impact of

our change in hedge cost reporting methodology:

Hedge Costs Related to Foreign Investments (Non-U.S. GAAP basis)

(In millions)

Pretax basis

Period

Historical

Reporting

Method

Revised

Reporting

Method

2016:

Quarter ended September 30,

$ (188) $ (54)

Quarter ended June 30,

(48)

(37)

Quarter ended March 31,

(44)

(32)

2015:

Year ended December 31,

$ (136) $ (72)

Quarter ended September 30,

(28)

(17)

Quarter ended June 30,

(18)

(16)

Quarter ended March 31,

(14)

(13)

2014:

Year ended December 31,

$

(37) $ (35)

Quarter ended September 30,

(1)

(10)

Quarter ended June 30,

(25)

(8)

Quarter ended March 31,

(10)

(7)

42