The increases in annualized premiums in force in yen of 1.5% in 2015 and 1.7% in 2014 reflect the sales of new policies

combined with the high persistency of Aflac Japan's business. Annualized premiums in force, translated into dollars at

respective year-end exchange rates, were $13.8 billion in 2016, $13.4 billion in 2015, and $13.2 billion in 2014

.

Aflac Japan's investment portfolios include U.S. dollar-denominated securities and reverse-dual currency securities

(yen-denominated debt securities with dollar coupon payments). U.S. dollar-denominated investment income from these

assets accounted for approximately 47% of Aflac Japan's investment income in 2016, compared with 50% in 2015 and

46% in 2014. In years when the yen strengthens in relation to the dollar, translating Aflac Japan's U.S. dollar-denominated

investment income into yen lowers growth rates for net investment income, total operating revenues, and pretax operating

earnings in yen terms. In years when the yen weakens, translating U.S. dollar-denominated investment income into yen

magnifies growth rates for net investment income, total operating revenues, and pretax operating earnings in yen terms.

Excluding foreign currency changes from the respective prior year (a non-U.S. GAAP measure), U.S. dollar-denominated

investment income accounted for approximately 50% of Aflac Japan's investment income during 2016, compared with

46% in 2015 and 44% in 2014.

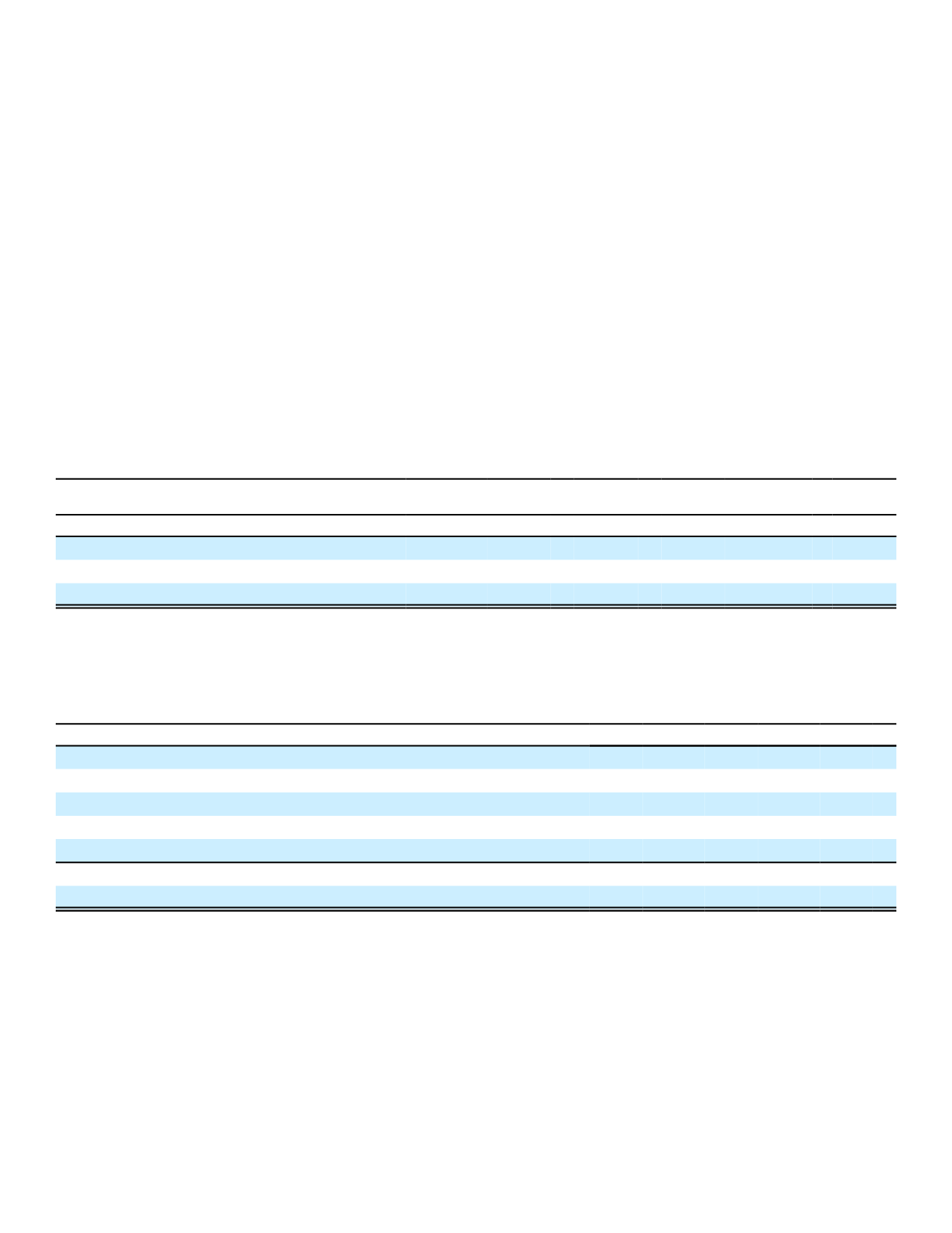

The following table illustrates the effect of translating Aflac Japan's U.S. dollar-denominated investment income and

related items into yen by comparing certain segment results with those that would have been reported had yen/dollar

exchange rates remained unchanged from the prior year. In order to compare the current year to the prior year without the

impact of foreign currency, the current year's income statement is translated at the prior year's average exchange rate.

Aflac Japan Percentage Changes Over Prior Year

(Yen Operating Results)

Including Foreign

Currency Changes

Excluding Foreign

Currency Changes

(2)

2016

2015

2014

2016

2015

2014

Net investment income

(5.8)%

4.8% 8.8%

(.8)%

(1.9)% 4.8%

Total operating revenues

(.3)

.5

1.3

.6

(.6)

.7

Pretax operating earnings

(1)

(5.7)

5.3

3.1

(2.0)

.4

.3

(1)

See the Insurance Operations section of this MD&A for our definition of segment operating earnings.

(2)

Amounts excluding foreign currency impact on U.S. dollar-denominated items (a non-U.S. GAAP measure) were determined using the

same yen/dollar exchange rate for the current year as each respective prior year.

The following table presents a summary of operating ratios in yen terms for Aflac Japan for the years ended

December 31.

Ratios to total revenues:

2016

2015

2014

Benefits and claims, net

60.9%

60.0%

60.9%

Operating expenses:

Amortization of deferred policy acquisition costs

4.0

4.0

3.9

Insurance commissions

4.9

5.0

5.1

Insurance and other expenses

9.5

9.1

9.2

Total operating expenses

18.4

18.1

18.2

Pretax operating earnings

(1)

20.7

21.9

20.9

(1)

See the Insurance Operations section of this MD&A for our definition of segment operating earnings.

In 2016, the benefit ratio increased primarily due to the effects of foreign currency translation and reserve

strengthening on a block of care policies, and the operating expense ratio increased primarily due to activities related to

sales promotions, IT infrastructure enhancement and personnel. In total, the pretax operating profit margin decreased in

2016, compared with 2015, reflecting the effect of the stronger yen and the increase in the benefit and expense ratios. For

2017, we anticipate the pretax operating profit margin to remain stable.

45