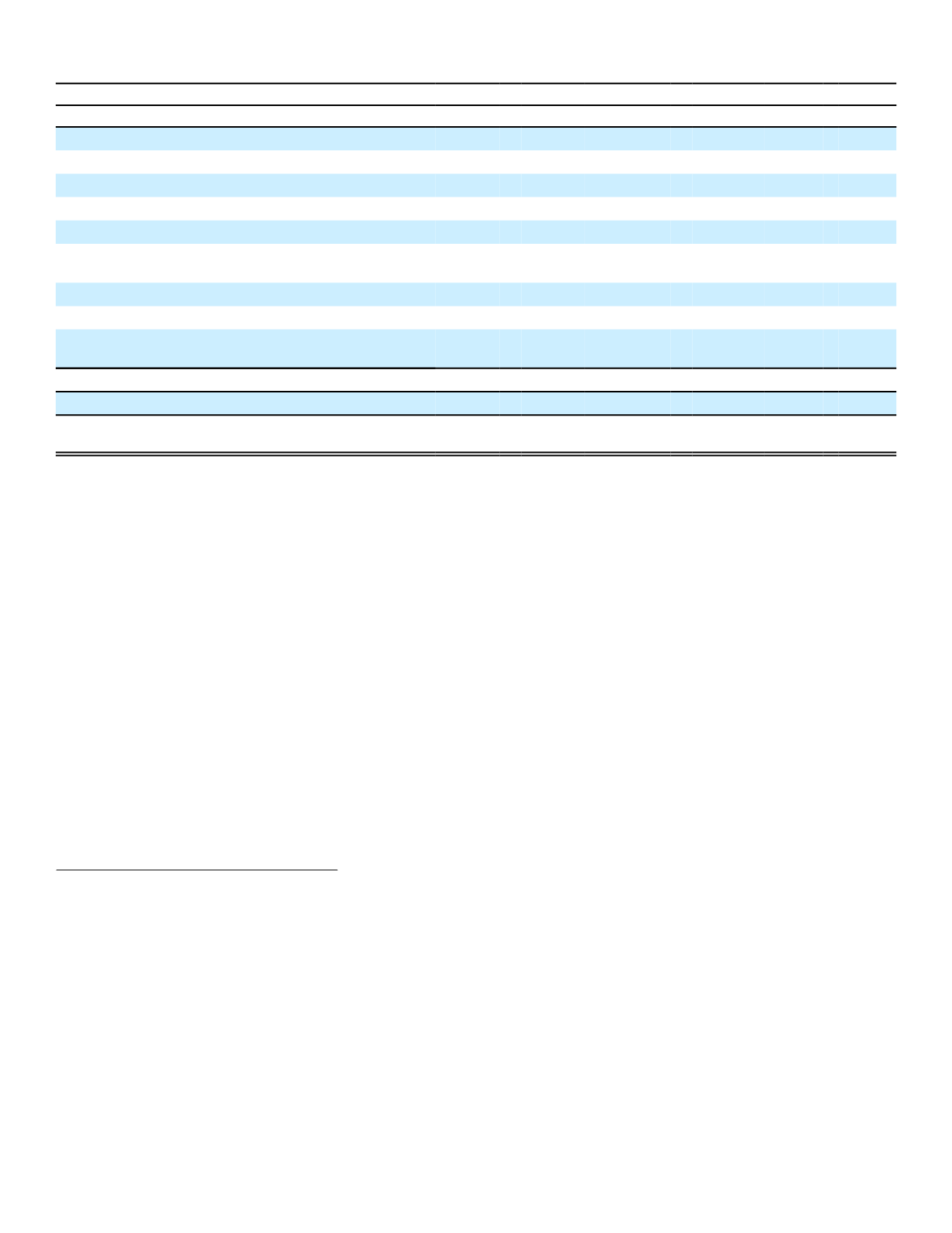

Reconciliation of Net Earnings to Operating Earnings

In Millions

Per Diluted Share

2016

2015

2014

2016

2015 2014

Net earnings

$ 2,659

$ 2,533 $ 2,951

$ 6.42

$ 5.85 $ 6.50

Items impacting net earnings:

Realized investment (gains) losses:

Securities transactions and impairments

(132)

(150)

(184)

(.32)

(.35)

(.40)

Impact of derivative and hedging activities:

Hedge costs related to foreign currency

investments

(1)

186

72

35

.45

.17

.08

Other derivative and hedging activities

(1),(2)

154

23

(22)

.37

.05

(.05)

Other and non-recurring (income) loss

28

266

(3)

(67)

.07

.61

(.15)

Income tax (benefit) expense on items excluded

from operating earnings

(1)

(83)

(74)

84

(.20)

(.17)

.18

Operating earnings

2,812

2,670

2,797

6.79

6.16 6.16

Current period foreign currency impact

(4)

(141)

N/A

N/A

(.34)

N/A N/A

Operating earnings excluding current period

foreign currency impact

(5)

$ 2,671

$ 2,670 $ 2,797

$ 6.45

$ 6.16 $ 6.16

(1)

Prior year amounts have been reclassified to reflect the change in methodology of calculating the hedge costs related to foreign

currency investments. See "Hedge Costs" discussion below for further discussion.

(2)

Excludes a gain of $85 in both 2016 and 2015 and $44 in 2014 related to the interest rate component of the change in fair value of

foreign currency swaps on notes payable which is classified as an operating gain when analyzing segment operations

(3)

Includes a loss of $20 in 2015 related to the change in value of yen repatriation received in advance of settlement of certain foreign

currency derivatives. This loss was offset by derivative gains included in other derivative and hedging activities.

(4)

Prior period foreign currency impact reflected as “N/A” to isolate change for current period only.

(5)

Amounts excluding current period foreign currency impact are computed using the average yen/dollar exchange rate for the

comparable prior-year period, which eliminates dollar-based fluctuations driven solely from currency rate changes.

Realized Investment Gains and Losses

Our investment strategy is to invest primarily in fixed-maturity securities to provide a reliable stream of investment

income, which is one of the drivers of the Company’s growth and profitability. This investment strategy incorporates asset-

liability matching (ALM) to align the expected cash flows of the portfolio to the needs of the Company's liability structure.

We do not purchase securities with the intent of generating capital gains or losses. However, investment gains and losses

may be realized as a result of changes in the financial markets and the creditworthiness of specific issuers, tax planning

strategies, and/or general portfolio management and rebalancing. The realization of investment gains and losses is

independent of the underwriting and administration of our insurance products, which are the principal drivers of our

profitability.

Securities Transactions and Impairments

During 2016, we realized pretax investment gains, net of losses, of $215 million

($140 million after-tax) from sales and

redemptions of securities. These net gains were primarily related to foreign currency gains on sale and redemption

activities as well as gains related to call activity on previously impaired securities. We realized pretax investment losses of

$83 million ($54 million after-tax) as a result of the recognition of other-than-temporary impairment losses on certain

securities.

During 2015, we realized pretax investment gains, net of losses, of $303 million

($197 million after-tax) from sales and

redemptions of securities. These net gains primarily resulted from sales of Japanese Government Bonds (JGBs) as part

of a portfolio repositioning exercise. We realized pretax investment losses of $153 million ($100 million after-tax) as a

result of the recognition of other-than-temporary impairment losses on certain securities. Investment losses were primarily

related to the recognition of an other-than-temporary impairment loss on a single holding.

During 2014, we realized pretax investment gains, net of losses, of $215 million

($140 million after-tax) from sales and

redemptions of securities. These net gains primarily resulted from gains on sales of JGBs and our U.S. Treasury holdings,

currency gains from transactions by our externally managed portfolio of U.S. dollar-denominated bank loans, and assorted

41