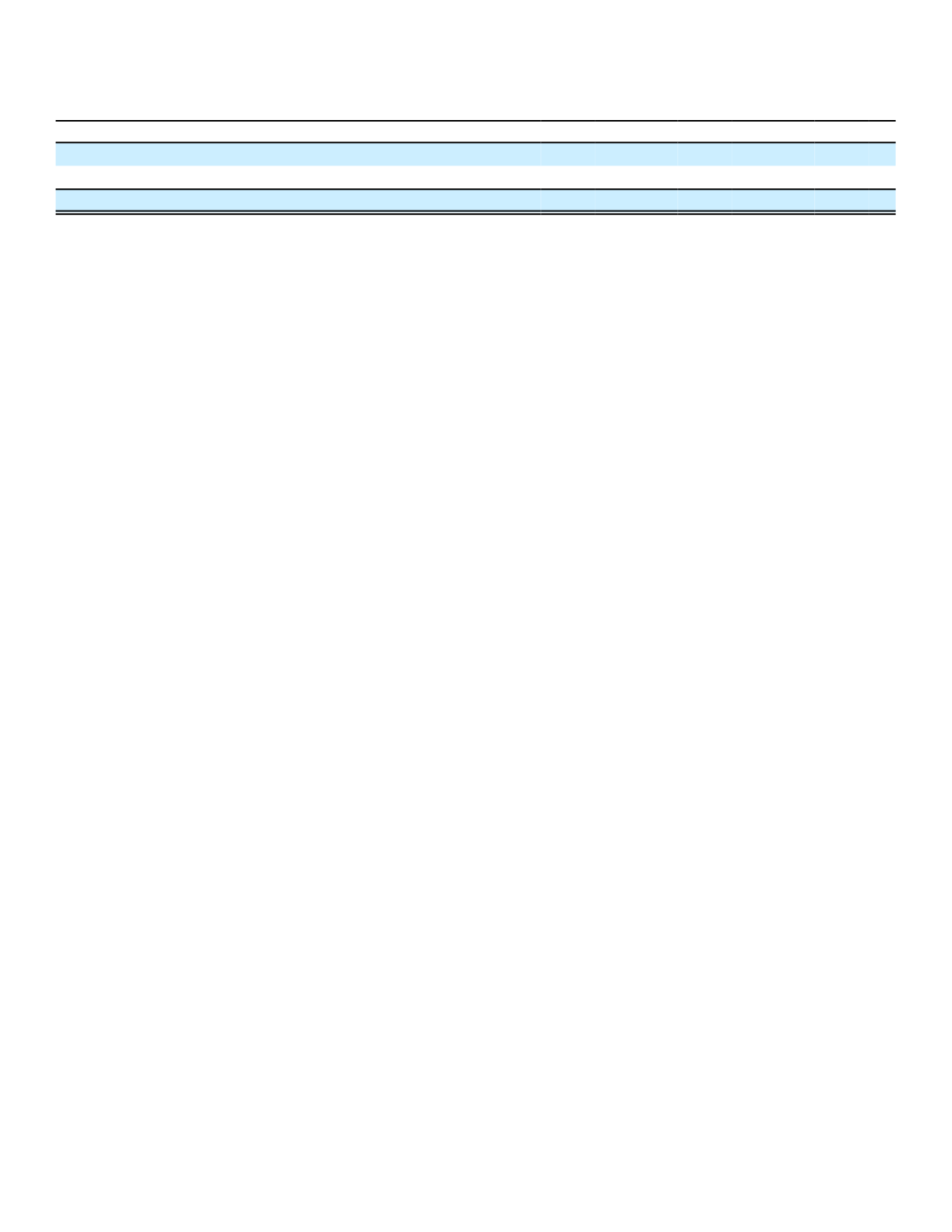

Cash dividends paid to shareholders in 2016 of $1.66 per share increased 5.1% over 2015. The 2015 dividend paid of

$1.58 per share increased 5.3% over 2014. The following table presents the dividend activity for the years ended

December 31.

(In millions)

2016

2015

2014

Dividends paid in cash

$ 658

$ 656

$ 654

Dividends through issuance of treasury shares

27

26

26

Total dividends to shareholders

$ 685

$ 682

$ 680

In January 2017, the board of directors declared the first quarter 2017 cash dividend of $.43 per share. The dividend

is payable on March 1, 2017, to shareholders of record at the close of business on February 15, 2017.

Regulatory Restrictions

Aflac and CAIC are domiciled in Nebraska and are subject to its regulations. The Nebraska Department of Insurance

imposes certain limitations and restrictions on payments of dividends, management fees, loans and advances to the

Parent Company. Under Nebraska insurance law, prior approval of the Nebraska Department of Insurance is required for

dividend distributions that exceed the greater of the net income from operations, which excludes net realized investment

gains, for the previous year determined under statutory accounting principles, or 10% of statutory capital and surplus as of

the previous year-end. In addition, the Nebraska insurance department must approve service arrangements and other

transactions within the affiliated group of companies. These regulatory limitations are not expected to affect the level of

management fees or dividends paid to the Parent Company. A life insurance company’s statutory capital and surplus is

determined according to rules prescribed by the NAIC, as modified by the insurance department in the insurance

company’s state of domicile. Statutory accounting rules are different from U.S. GAAP and are intended to emphasize

policyholder protection and company solvency. Similar laws apply in New York, the domiciliary jurisdiction of the Parent

Company's Aflac New York insurance subsidiary. As of December 2016, CAIC was redomiciled from South Carolina to

Nebraska.

The continued long-term growth of our business may require increases in the statutory capital and surplus of our

insurance operations. Aflac’s insurance operations may secure additional statutory capital through various sources, such

as internally generated statutory earnings, equity contributions by the Parent Company from funds generated through debt

or equity offerings, or reinsurance transactions. The NAIC’s risk-based capital (RBC) formula is used by insurance

regulators to help identify inadequately capitalized insurance companies. The RBC formula quantifies insurance risk,

business risk, asset risk and interest rate risk by weighing the types and mixtures of risks inherent in the insurer’s

operations. Aflac's company action level RBC ratio was 894% as of December 31, 2016, compared with 933% at

December 31, 2015. Aflac's RBC ratio remains high and reflects a strong capital and surplus position. As of December 31,

2016, Aflac's total adjusted capital of $12.0 billion exceeded the company action level required capital and surplus of $1.3

billion by $10.7 billion. The maximum amount of dividends that can be paid to the Parent Company by Aflac without prior

approval of Nebraska's director of insurance is the greater of the net income from operations, which excludes net realized

investment gains, for the previous year determined under statutory accounting principles, or 10% of statutory capital and

surplus as of the previous year-end. Dividends declared by Aflac during 2017 in excess of $2.8 billion would require such

approval. See Note 13 of the Notes to the Consolidated Financial Statements for information regarding the impact of

permitted practices by the Nebraska Department of Insurance on our statutory capital and surplus. The NAIC considers its

Solvency Modernization Initiative (SMI) process relating to updating the U.S. insurance solvency regulation framework to

be ongoing. The SMI has focused on key issues such as capital requirements, governance and risk management, group

supervision, reinsurance, statutory accounting and financial reporting matters. Many of these key issues have been

finalized and/or are near completion; however, the NAIC still has some ongoing initiatives related to SMI, such as

monitoring the international efforts on group capital requirements and group supervision as well as risk-based capital.

Aflac is subject to the NAIC’s Own Risk and Solvency Assessment (ORSA), effective January 1, 2015. Through the

ORSA requirements, Aflac is expected to regularly, no less than annually, conduct an ORSA to assess the adequacy of its

risk management framework, and its current and estimated projected future solvency position; internally document the

process and results of the assessment; and provide a confidential high-level ORSA Summary Report annually to the lead

state commissioner if the insurer is a member of an insurance group. In November 2016, Aflac filed its ORSA report with

the Nebraska Department of Insurance.

In addition to limitations and restrictions imposed by U.S. insurance regulators, Japan’s FSA may not allow profit

repatriations from Aflac Japan if the transfers would cause Aflac Japan to lack sufficient financial strength for the

protection of policyholders. The FSA maintains its own solvency standard which is quantified through the SMR. Aflac

69