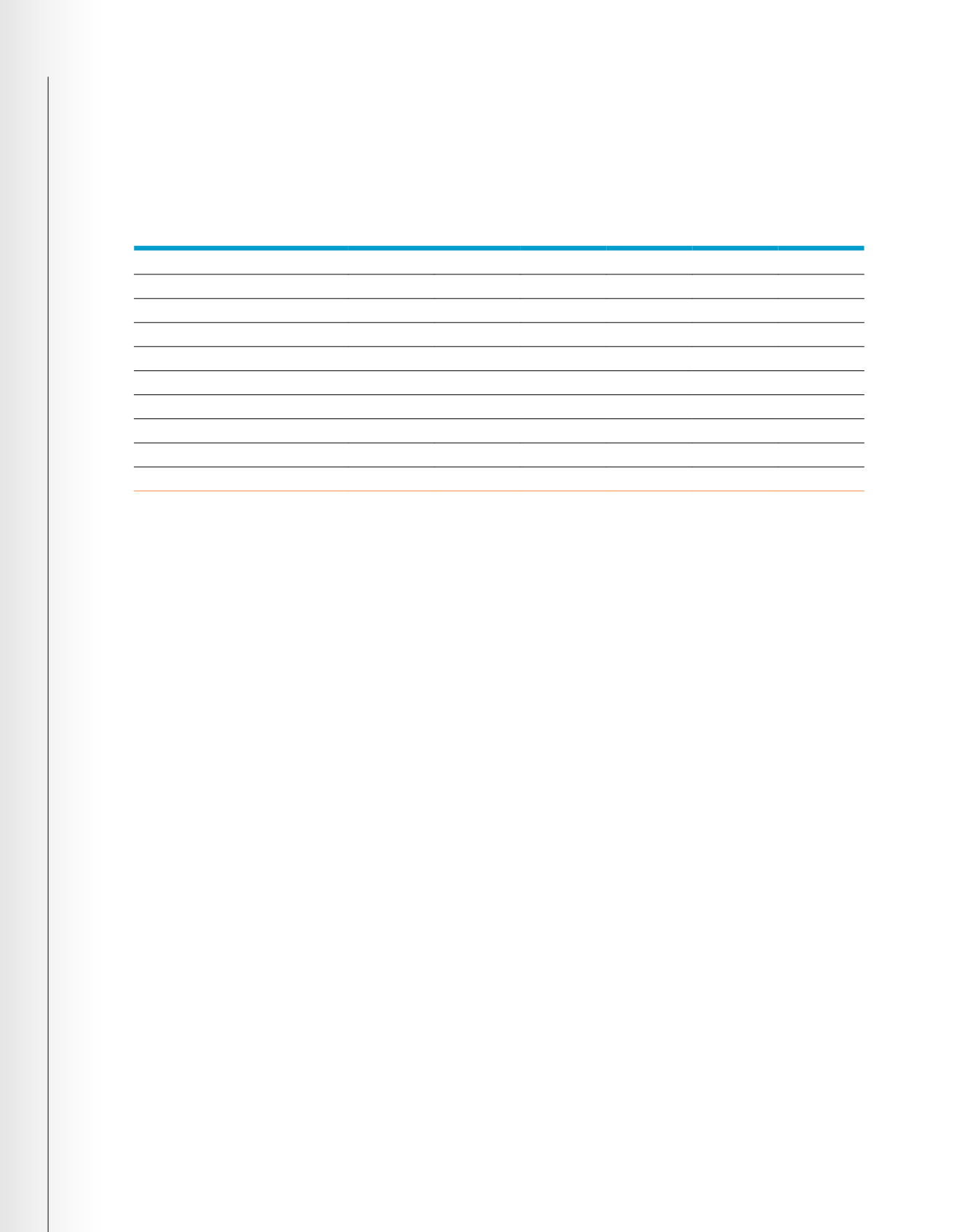

2016 Director Compensation

The following table identifies each item of compensation paid to Non-employee Directors for 2016.

* Takuro Yoshida’s term on the Board of Directors ended May 2, 2016.

(1) Daniel P. Amos, Paul S. Amos II, and Kriss Cloninger III are not included in the table; they are employees and thus do not receive compensation for their

service as Directors. The compensation received by these individuals as employees is shown in the Summary Compensation Table.

(2) Thomas J. Kenny elected to receive his annual retainer in restricted stock. The value of these shares on the grant date was $115,032.

(3) This column represents the dollar amount recognized in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic

718 (“ASC 718”) for financial statement purposes with respect to the 2016 fiscal year for the fair value of restricted stock granted in 2016. The fair values

of the awards granted in 2016 were calculated using the closing per-share stock price on the date of grant of $69.13. As of December 31, 2016, each Non-

employee Director held the following number of restricted stock awards: W. Paul Bowers, 6,740; Toshihiko Fukuzawa, 1,946; Elizabeth J. Hudson, 4,125;

Robert B. Johnson, 4,125; Thomas J. Kenny, 4,405; Joseph L. Moskowitz, 2,527; and Melvin T. Stith, 6,078. The following shares issued in 2016 to the

retirement eligible Non-employee directors, as defined in the equity agreements, were accelerated to vest within the year and are not included in the number

of restricted shares held: Elizabeth J. Hudson, 1,953; Robert B. Johnson, 1,953; Charles B. Knapp, 1,953, and Barbara K. Rimer, 1,953.

(4) In accordance with the SEC’s reporting requirements, this column represents the dollar amount recognized in accordance with ASC 718 for financial

statement purposes with respect to the 2016 stock option grants. The Company’s valuation assumptions are described in Note 12 “Share-Based

Compensation” in the Notes to the Consolidated Financial Statements in the Company’s Annual Form 10-K filed with the SEC for the year ended December

31, 2016. Stock options granted to Non-employee Directors vest in one year. As of December 31, 2016, each non-employee Director held stock options

covering the following number of shares of Common Stock: Elizabeth J. Hudson, 25,026; Douglas W. Johnson, 62,661; Robert B. Johnson, 7,000; Thomas

J. Kenny, 14,735; Charles B. Knapp, 48,749; Joseph L. Moskowitz, 9,713; Barbara K. Rimer, 38,249; and Takuro Yoshida, 31,988.

(5) Represents change in pension value. W. Paul Bowers, Toshihiko Fukuzawa, Douglas W. Johnson, Robert B. Johnson, Thomas J. Kenny, Joseph L.

Moskowitz, Melvin T. Stith and Takuro Yoshida do not participate in the Director retirement plan since they first became Directors after the plan was closed

to new participants in 2002.

Name(1)

Fees Earned or Paid

in Cash

(2)

($)

Stock

Awards

(3)

($)

Option

Awards

(4)

($)

Chang in Pension

Value and

Nonqualified

Deferred

Compensation

Earnings

(5)

($)

All Other

Compensation

($)

Total

($)

W. Paul Bowers

140,000

135,011

—

—

—

275,011

Toshihiko Fukuzawa

76,667

134,527

—

—

—

211,194

Elizabeth J. Hudson

130,000

135,011

— 4,724

—

269,735

Douglas W. Johnson

175,000

—

261,185

— 10,401

446,586

Robert B. Johnson

135,000

135,011

—

—

—

270,011

Thomas J. Kenny

115,032

135,011

—

—

—

250,043

Charles B. Knapp

145,000

135,011

— 2,993

13,473

296,477

Joseph L. Moskowitz

125,000

67,540

130,599

— 12,844

335,983

Barbara K. Rimer, DrPH

130,000

135,011

— 3,803

—

268,814

Melvin T. Stith

125,000

135,011

—

—

—

260,011

Director Compensation

AFLAC INCORPORATED

2017 PROXY STATEMENT

28