Summary of Our Executive Compensation Program

As a leader in our industry segment, we recognize that a sound management compensation program is a part of

what makes us an employer of choice.

Base salary is the smallest component of compensation for the NEOs. We consider annual and long-term incentive

compensation to be the most important compensation awarded: these pay elements represent the largest part

of total rewards for executives and provide the strongest link to Company results and shareholder value creation.

Moreover, incentive compensation enables us to attract, retain, motivate and reward talented individuals who have

the necessary skills to manage our growing global enterprise on a day-to-day basis, as well as for the future. As

shown below, our executive compensation program directly links compensation incentives with our business goals

and shareholder interests.

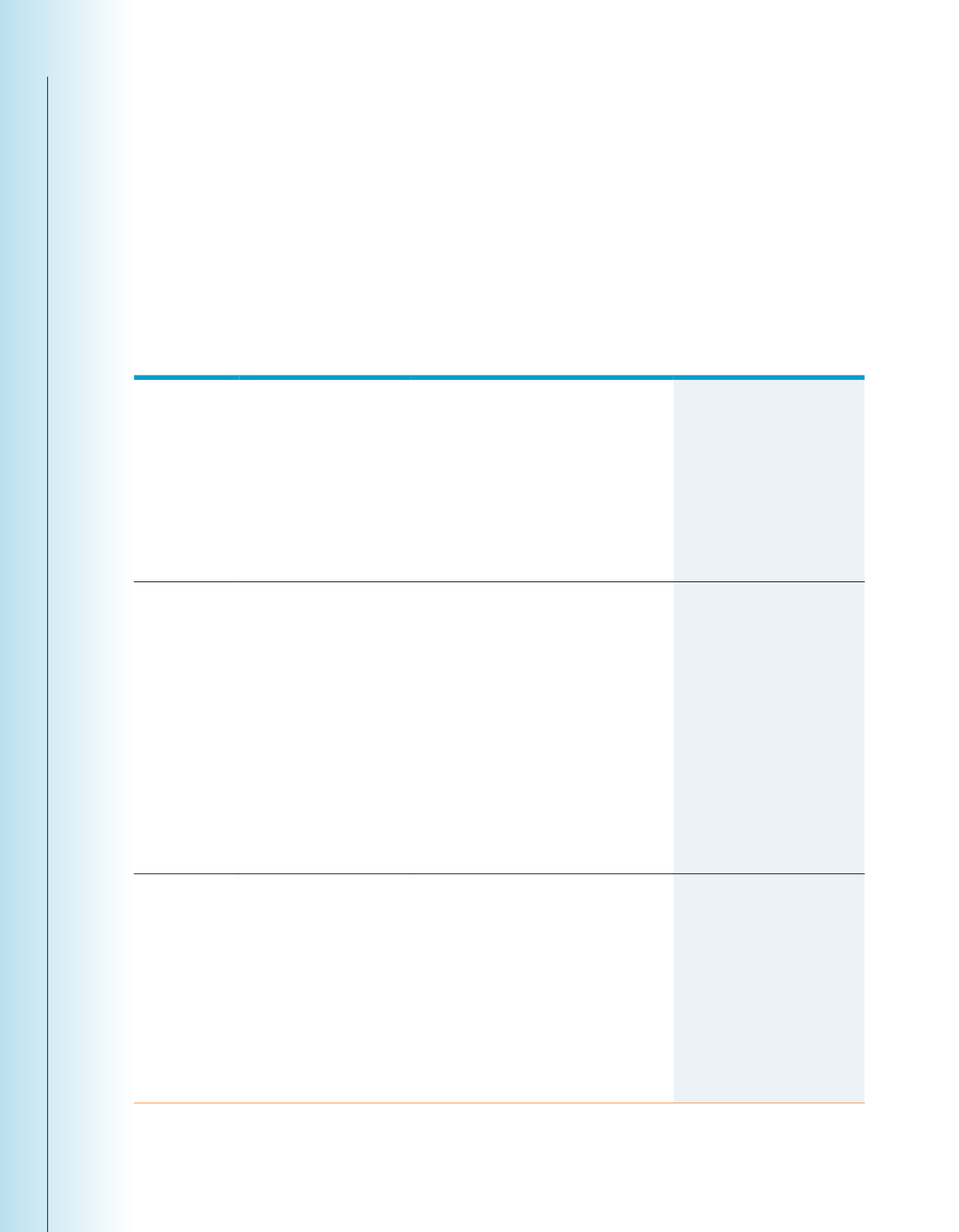

KEY ELEMENTS OF OUR 2016 EXECUTIVE COMPENSATION PROGRAM

Element

Terms

Performance Measure

Objective

Base salary

The fixed amount of annual

cash compensation for

performing day-to-day

responsibilities. Levels set

based on market data, job

scope, responsibilities and

experience. Generally reviewed

biennially for potential increase

based on a number of factors,

including market levels,

performance and internal

equity

—

Attract and retain talent

Management

Incentive Plan

(“MIP”)

Annual variable cash

compensation based on the

achievement of predetermined

annual performance goals

Annual incentive award performance metrics

align with our business strategy, geographic

segment goals, and key value drivers:

⊲⊲

Corporate Goals:

Operating Earnings per

share, OROE, Solvency Margin Ratio (SMR),

Net Investment Income

⊲⊲

U.S. Goals:

increase in new annualized

premiums, increase in premium income,

increase in pretax operating earnings

⊲⊲

Japan Goals:

new annualized premiums,

increase in premium income, increase in

pretax operating earnings

⊲⊲

Global Investments:

credit losses/

impairments.

Performance goals are rigorous and set with the

expectation of achieving target performance

⊲⊲

Motivate executives and reward

achievement toward annual

operational and strategic goals

⊲⊲

Focus on key short-term value

drivers for our business

⊲⊲

Retain key talent

⊲⊲

Exercise sound risk

management practices

Long-term

incentives

(“LTI”)

Long-term variable equity

awards granted annually as

a combination of PBRS and

stock options. PBRS vests

based on three-year financial

performance, and options cliff

vest after three years of service

⊲⊲

PBRS

(100% of LTI for CEO and President;

80% of LTI for other NEOs)

Risk-based capital (RBC) ratio metric

represents key industry performance measure

that aligns with creation of long-term value

⊲⊲

Stock Options

(0% of LTI for CEO and

President; 20% of LTI for other NEOs)

⊲⊲

Motivate executives and reward

achievement toward long-term

operational and strategic goals

⊲⊲

Focus on key long-term value

drivers for our business

⊲⊲

Align executives’ interests with

shareholder interests; stock

options only provide value if

share price increases

⊲⊲

Retain key talent

⊲⊲

Exercise sound risk

management practices

Compensation Discussion & Analysis

|

Executive Summary

AFLAC INCORPORATED

2017 PROXY STATEMENT

32