derivative instruments recorded in accumulated other comprehensive income that are expected to be reclassified to

earnings during the next twelve months were immaterial.

Credit Risk Assumed through Derivatives

For the foreign currency and credit default swaps associated with our VIE investments for which we are the primary

beneficiary, we bear the risk of foreign exchange loss due to counterparty default even though we are not a direct

counterparty to those contracts. We are a direct counterparty to the foreign currency swaps that we have entered into in

connection with certain of our senior notes, subordinated debentures, and Samurai notes; foreign currency forwards;

foreign currency options; and interest rate swaptions, and therefore we are exposed to credit risk in the event of

nonperformance by the counterparties in those contracts. The risk of counterparty default for our VIE swaps, foreign

currency swaps, certain foreign currency forwards, foreign currency options and interest rate swaptions is mitigated by

collateral posting requirements that counterparties to those transactions must meet. As of December 31, 2016, there were

16 counterparties to our derivative agreements, with five comprising 63% of the aggregate notional amount. The

counterparties to these derivatives are financial institutions with the following credit ratings as of December 31:

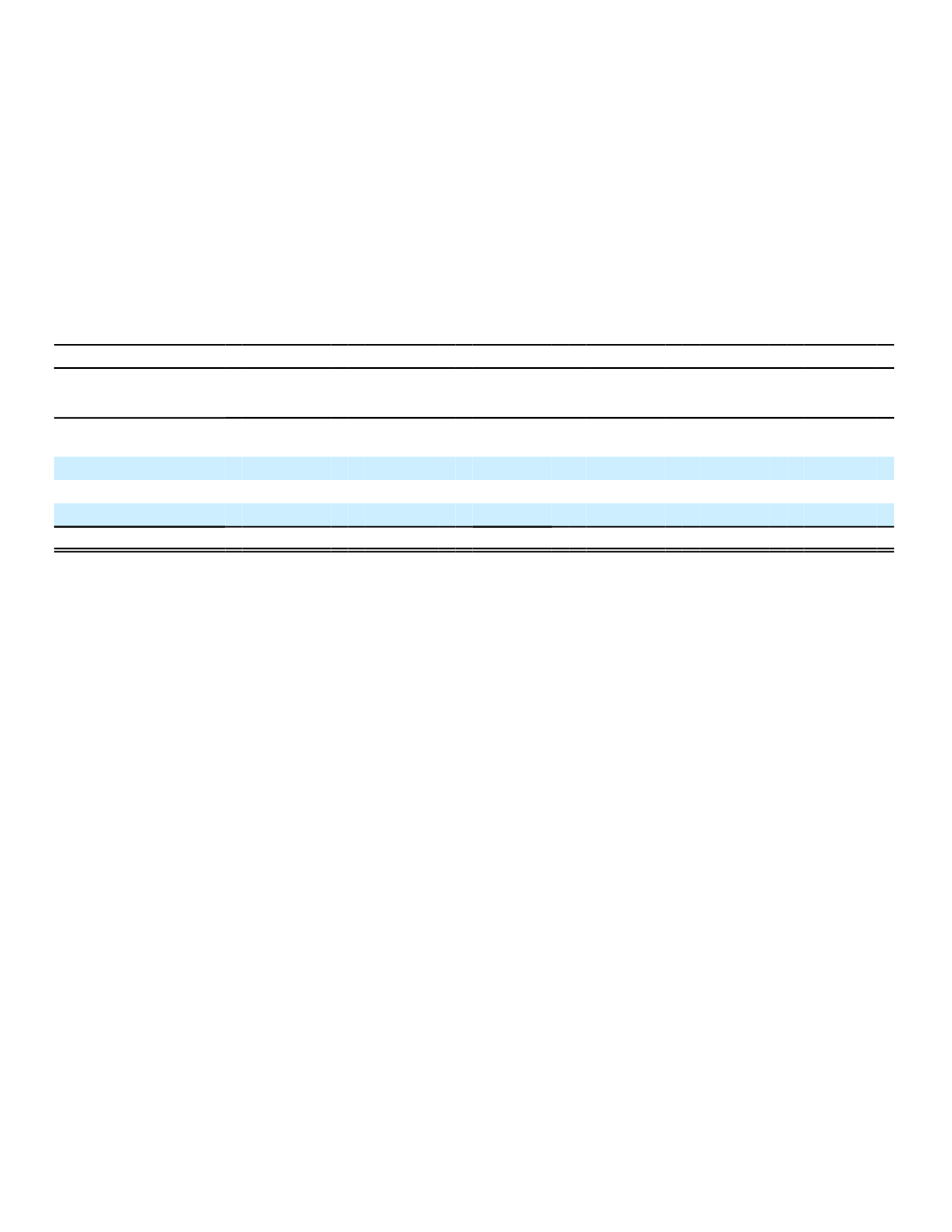

2016

2015

(In millions)

Notional

Amount

of Derivatives

Asset

Derivatives

Fair Value

Liability

Derivatives

Fair Value

Notional

Amount

of Derivatives

Asset

Derivatives

Fair Value

Liability

Derivatives

Fair Value

Counterparties' credit

rating:

AA

$ 6,844

$ 247

$ (308)

$ 2,187

$ 166

$ (35)

A

36,019

900

(1,621)

19,940

510

(336)

BBB

1,064

60

(69)

0

0

0

Total

$ 43,927

$ 1,207

$ (1,998)

$ 22,127

$ 676

$ (371)

We engage in derivative transactions directly with unaffiliated third parties under International Swaps and Derivatives

Association, Inc. (ISDA) agreements and other documentation. Most of the ISDA agreements also include Credit Support

Annexes (CSAs) provisions, which generally provide for two-way collateral postings at the first dollar of exposure. We

mitigate the risk that counterparties to transactions might be unable to fulfill their contractual obligations by monitoring

counterparty credit exposure and collateral value while generally requiring that collateral be posted at the outset of the

transaction. In addition, a significant portion of the derivative transactions have provisions that give the counterparty the

right to terminate the transaction upon a downgrade of Aflac’s financial strength rating. The actual amount of payments

that we could be required to make, depends on market conditions, the fair value of outstanding affected transactions, and

other factors prevailing at and after the time of the downgrade.

Collateral posted by us to third parties for derivative transactions can generally be repledged or resold by the

counterparties. The aggregate fair value of all derivative instruments with credit-risk-related contingent features that were

in a net liability position by counterparty was approximately $1.2 billion and $26 million as of December 31, 2016 and

2015, respectively. We are generally allowed to sell or repledge collateral obtained from our derivative counterparties,

although we do not typically exercise such rights. (See the Offsetting tables below for collateral posted or received as of

the reported balance sheet dates.)

Offsetting of Financial Instruments and Derivatives

Some of the Company's derivative instruments are subject to enforceable master netting arrangements that provide

for the net settlement of all derivative contracts between the Parent Company or Aflac and its respective counterparty in

the event of default or upon the occurrence of certain termination events. Collateral support agreements with the master

netting arrangements generally provide that the Company will receive or pledge financial collateral at the first dollar of

exposure.

We have securities lending agreements with unaffiliated financial institutions that post collateral to us in return for the

use of our fixed maturity securities (see Note 3). When we have entered into securities lending agreements with the same

counterparty, the agreements generally provide for net settlement in the event of default by the counterparty. This right of

set-off allows us to keep and apply collateral received if the counterparty failed to return the securities borrowed from us

as contractually agreed. For additional information on the Company's accounting policy for securities lending, see

Note 1.

119