We have cross-currency interest rate swap agreements related to our $400 million senior notes due February 2017,

$550 million senior notes due March 2020, $350 million senior notes due February 2022, $700 million senior notes due June

2023, $750million senior notes dueNovember 2024, $450million senior notes dueMarch 2025, and $500million subordinated

debentures due September 2052. Changes in the values of these swaps are recorded through current period earnings. For

additional information regarding these swaps, see Note 9.

In the fourth quarter of 2016, we began using foreign exchange forwards to mitigate the currency risk of our U.S.

dollar-denominated middle market loan portfolio held within the Aflac Japan segment. As of December 31, 2016, the

outstanding derivative notional amounts associated with these U.S. dollar-denominated middle market loans was

approximately $109 million. In the third quarter of 2016, we began using foreign exchange forwards to mitigate the

currency risk of our U.S. dollar-denominated commercial loan portfolio held within the Aflac Japan segment. As of

December 31, 2016, the outstanding derivative notional amounts associated with these U.S. dollar-denominated

commercial mortgage loans was approximately $710 million. We have not elected to apply hedge accounting for these

middle market loans and commercial mortgage loans. The change in fair value of the foreign exchange forwards and the

foreign currency remeasurement of the middle market loans and commercial mortgage loans are each recorded through

current period earnings, and generally offset each other.

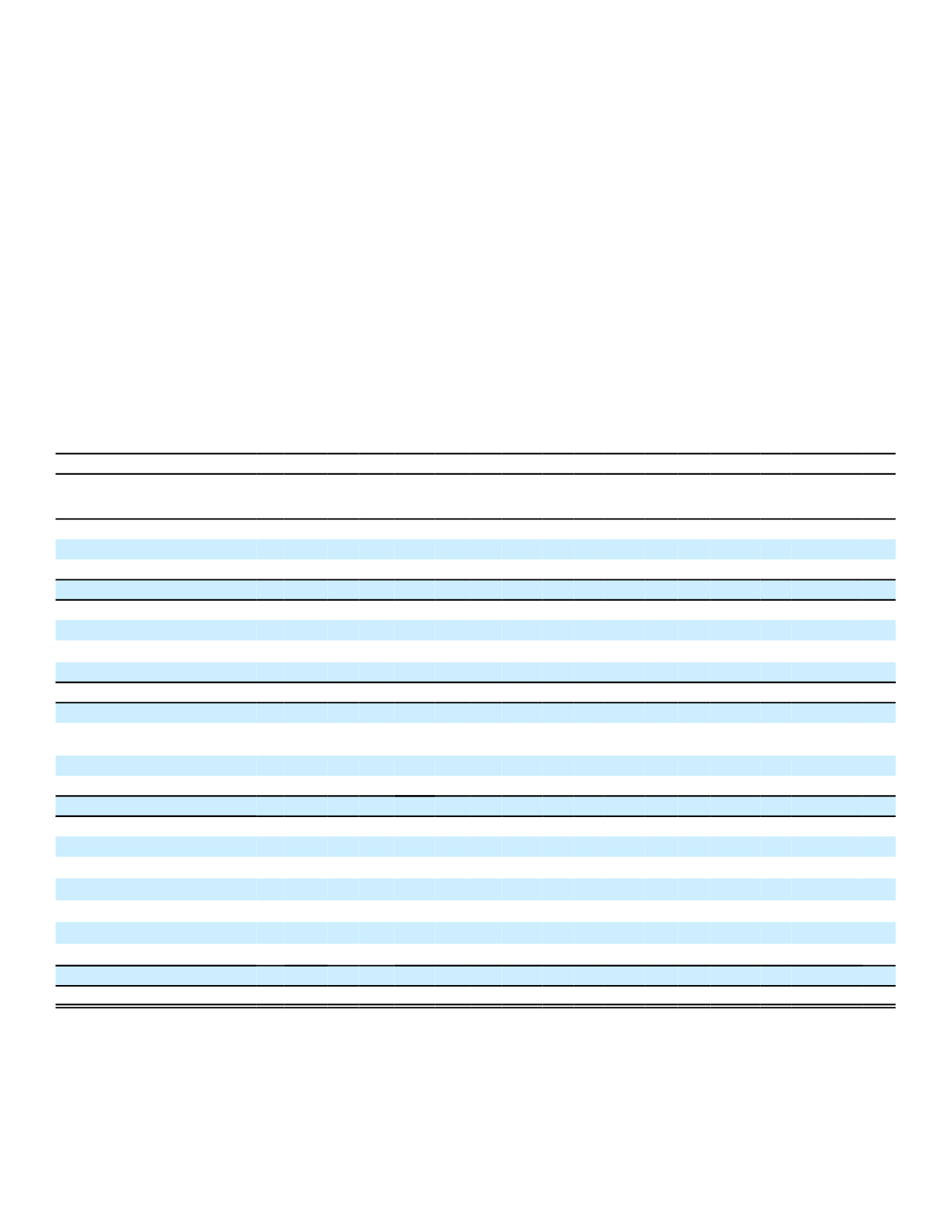

Impact of Derivatives and Hedging Instruments

The following table summarizes the impact to realized investment gains (losses) and other comprehensive income

(loss) from all derivatives and hedging instruments for the years ended December 31.

2016

2015

2014

(In millions)

Realized

Investment

Gains (Losses)

Other

Comprehensive

Income (Loss)

(1)

Realized

Investment

Gains (Losses)

Other

Comprehensive

Income (Loss)

(1)

Realized

Investment

Gains (Losses)

Other

Comprehensive

Income (Loss)

(1)

Qualifying hedges:

Cash flow hedges:

Foreign currency swaps

$ 1

$ 3

$ 0

$ 0

$ (2)

$ (17)

Total cash flow hedges

1

3

0

0

(2)

(17)

Fair value hedges:

Foreign currency forwards

(2)

(359)

0

(138)

0

(16)

0

Foreign currency options

(

2)

(25)

0

3

0

(3)

0

Interest rate swaptions

(2)

0

0

4

0

(2)

0

Total fair value hedges

(384)

0

(131)

0

(21)

0

Net investment hedge:

Non-derivative hedging

instruments

0

0

0

3

0

39

Foreign currency forwards

0

(118)

0

4

0

89

Foreign currency options

0

73

0

0

0

(3)

Total net investment hedge

0

(45)

0

7

0

125

Non-qualifying strategies:

Foreign currency swaps

117

0

16

0

151

0

Foreign currency forwards

9

0

100

0

(11)

0

Credit default swaps

2

0

1

0

3

0

Interest rate swaps

0

0

5

0

(1)

0

Interest rate swaptions

0

0

0

0

1

0

Futures

0

0

(1)

0

(89)

0

Total non- qualifying strategies

128

0

121

0

54

0

Total

$ (255)

$ (42)

$ (10)

$ 7

$ 31

$ 108

(1)

Cash flow hedge items are recorded as unrealized gains (losses) on derivatives and net investment hedge items are recorded in the unrealized

foreign currency translation gains (losses) line in the consolidated statement of comprehensive income (loss).

(2)

Impact shown net of effect of hedged items (see Fair Value Hedges section of this Note 4 for further detail)

We reclassified a de minimus amount from accumulated other comprehensive income (loss) into earnings related to

our designated cash flow hedges for the years ended December 31, 2016, 2015 and 2014, respectively. There was no

gain or loss reclassified from accumulated other comprehensive income (loss) into earnings related to the net investment

hedge for the years ended December 31, 2016, 2015 and 2014. As of December 31, 2016, deferred gains and losses on

118