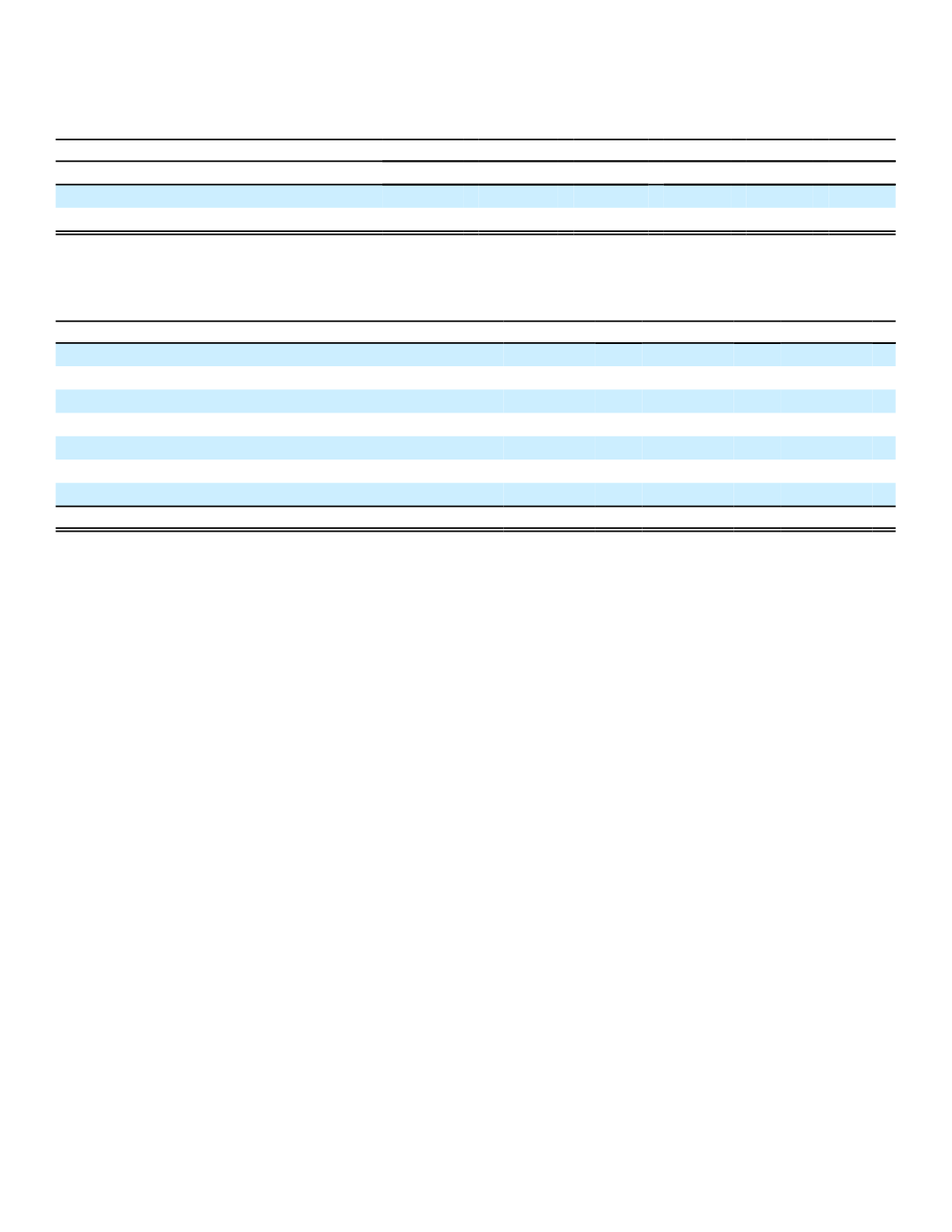

Aflac Japan Sales

The following table presents Aflac Japan's new annualized premium sales for the years ended December 31.

In Dollars

In Yen

(In millions of dollars and billions of yen)

2016

2015

2014

2016

2015

2014

New annualized premium sales

$ 1,045

$ 997 $ 1,080

113.7

120.9 114.5

Increase (decrease) over prior period

4.8%

(7.7)% (29.8)%

(5.9)%

5.5% (23.3)%

The following table details the contributions to new annualized premium sales by major insurance product for the

years ended December 31.

2016

2015

2014

Cancer

46.6

40.4

30.3

Medical

26.0

26.4

31.8

Ordinary life:

WAYS

11.9

16.7

14.0

Other ordinary life

6.2

6.2

8.3

Child endowment

6.4

8.2

10.2

Other

2.9

2.1

5.4

Total

100.0%

100.0%

100.0%

The foundation of Aflac Japan's product portfolio has been, and continues to be, our third sector cancer and medical

insurance products. Sales of third sector products on a yen basis increased 4.1% in 2016, compared with 2015. We have

been focusing more on promotion of our cancer and medical insurance products in this low-interest-rate environment.

These products are less interest-rate sensitive and more profitable compared to first sector products.

Cancer insurance sales on a yen basis were up 8.5% in 2016, compared with 2015. Aflac Japan enhanced its medical

insurance product with new riders in June 2015. This revision provides better protection against critical diseases such as

cancer, heart attack and stroke. Our 2016 sales results also benefited from the launch of a new Income Support Insurance

product in mid-July. This product provides fixed-benefit amounts in the event that a policyholder is unable to work due to

significant illness or injury and was developed to supplement the disability coverage within Japan’s social security system.

This product targets young to middle-aged consumers, and by focusing our efforts on this demographic, we believe we

are building relationships that lay the groundwork for the sale of our cancer and medical insurance later in life to the

Income Support policyholders. With continued cost pressure on Japan’s health care system, we expect the need for third

sector products will continue to rise in the future, and we remain convinced that the medical and cancer insurance

products Aflac Japan provides will continue to be an important part of our product portfolio.

As a result of the interest rate policy in Japan, we took significant actions to limit sales of certain of Aflac Japan’s first

sector products, including WAYS and child endowment. Those actions gained traction in mid-2016 as first sector product

sales were down 26.1% on a yen basis for the year, compared with 2015. We expect that for 2017, this deliberate trend

will continue, and our focus will remain on less interest-sensitive third sector products.

Independent corporate agencies and individual agencies contributed 46.7% of total new annualized premium sales for

Aflac Japan in 2016, compared with 47.0% in 2015 and 46.1% in 2014. Affiliated corporate agencies, which include Japan

Post, contributed 44.4% of total new annualized premium sales in 2016, compared with 38.1% in 2015 and 32.4% in

2014. In 2016, we recruited approximately 200 new sales agencies. At December 31, 2016, Aflac Japan was represented

by approximately 12,100 sales agencies, with more than 108,700 licensed sales associates employed by those agencies.

At December 31, 2016, we had agreements to sell our products at 372 banks, approximately 90% of the total number

of banks in Japan. Bank channel sales contributed 8.9% of Aflac Japan new annualized premium sales in 2016, compared

with 14.9% in 2015 and 21.5% in 2014.

46