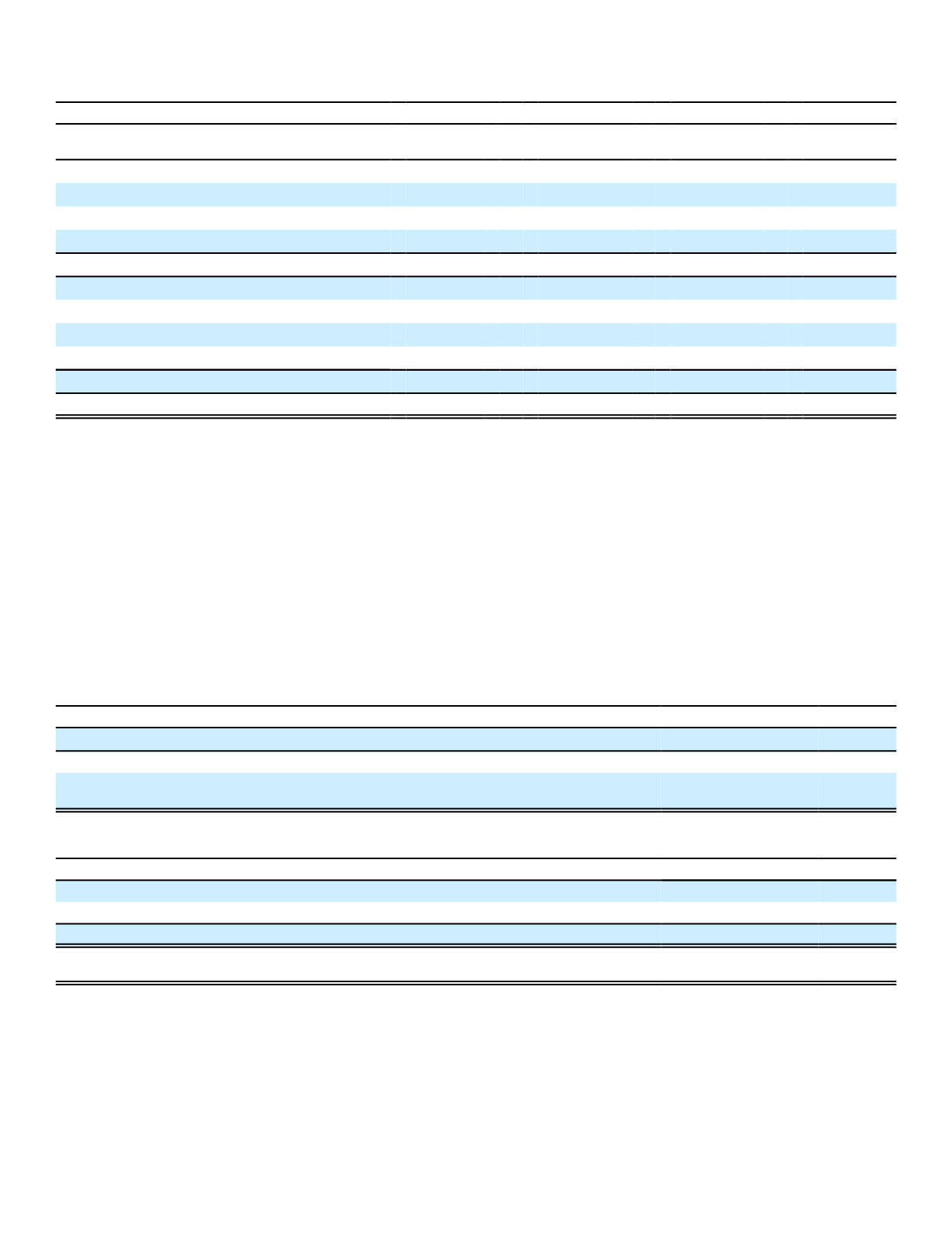

Investment Securities by Type of Issuance

2016

2015

(In millions)

Amortized

Cost

Fair

Value

Amortized

Cost

Fair

Value

Publicly issued securities:

Fixed maturities

$ 75,406

$ 86,132

$ 68,528

$ 74,933

Perpetual securities

51

75

77

111

Equity securities

1,196

1,300

473

489

Total publicly issued

76,653

87,507

69,078

75,533

Privately issued securities:

(1)

Fixed maturities

24,307

27,649

25,573

27,936

Perpetual securities

1,455

1,558

1,764

1,836

Equity securities

7

9

7

9

Total privately issued

25,769

29,216

27,344

29,781

Total investment securities

$ 102,422

$ 116,723

$ 96,422

$ 105,314

(1)

Includes Rule 144A securities

The perpetual securities we hold were largely issued by banks that are integral to the financial markets of the

sovereign country of the issuer. As a result of the issuer's position within the economy of the sovereign country, our

perpetual securities may be subject to a higher risk of nationalization of their issuers in connection with capital injections

from an issuer's sovereign government. We cannot be assured that such capital support will extend to all levels of an

issuer's capital structure. In addition, certain governments or regulators may consider imposing interest and principal

payment restrictions on issuers of hybrid securities to preserve cash and preserve the issuer's capital. Beyond the cash

flow impact that additional deferrals would have on our portfolio, such deferrals could result in ratings downgrades of the

affected securities, which in turn could result in a reduction of fair value of the securities and increase our regulatory

capital requirements. We consider these factors in our credit review process.

The following table details our privately issued investment securities as of December 31.

Privately Issued Securities

(Amortized cost, in millions)

2016

2015

Privately issued securities as a percentage of total investment securities

25.2%

28.4%

Privately issued securities held by Aflac Japan

$ 23,104

$ 24,602

Privately issued securities held by Aflac Japan as a percentage of total

investment securities

22.6%

25.5%

Reverse-Dual Currency Securities

(1)

(Amortized cost, in millions)

2016

2015

Privately issued reverse-dual currency securities

$ 5,628

$ 5,372

Publicly issued collateral structured as reverse-dual currency securities

1,349

1,303

Total reverse-dual currency securities

$ 6,977

$ 6,675

Reverse-dual currency securities as a percentage of total investment

securities

6.8%

6.9%

(1)

Principal payments in yen and interest payments in dollars

Aflac Japan has a portfolio of privately issued securities to better match liability characteristics and secure higher

yields than those available on Japanese government or other public corporate bonds. Aflac Japan’s investments in yen-

denominated privately issued securities consist primarily of non-Japanese issuers, are rated investment grade at

purchase and have longer maturities, thereby allowing us to improve our asset/liability matching and our overall

investment returns. These securities are generally either privately negotiated arrangements or issued under medium-term

note programs and have standard documentation commensurate with credit ratings of the issuer, except when internal

credit analysis indicates that additional protective and/or event-risk covenants were required. Many of these investments

56