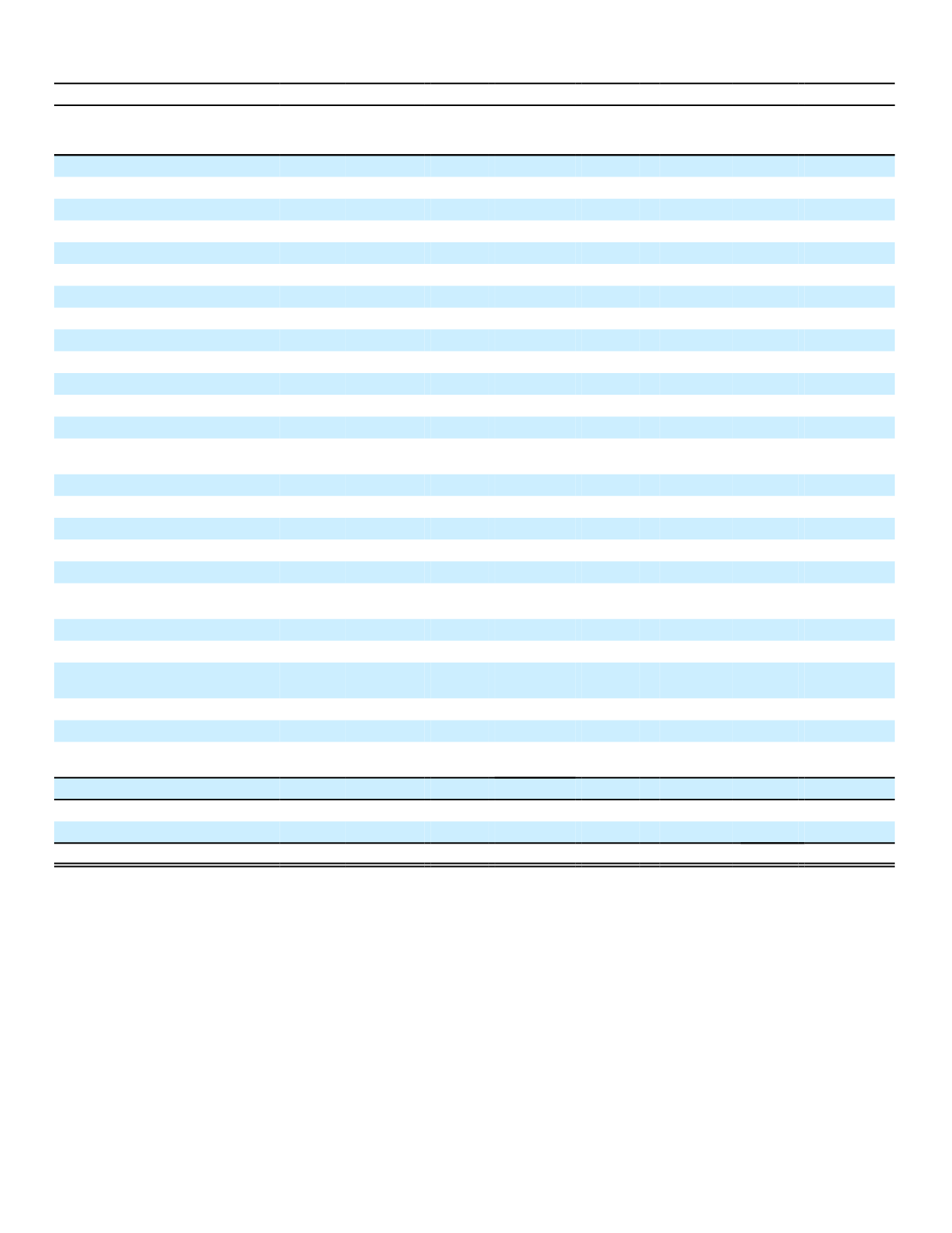

Below-Investment-Grade Securities

(1)

2016

2015

(In millions)

Par

Value

Amortized

Cost

Fair

Value

Unrealized

Gain

(Loss)

Par

Value

Amortized

Cost

Fair

Value

Unrealized

Gain

(Loss)

Investcorp Capital Limited

$ 368 $ 368 $ 346 $

(22)

$ 357 $ 357 $ 324 $

(33)

Republic of Tunisia

318

191

264

73

307

185

243

58

Navient Corp.

287

152

197

45

279

148

155

7

KLM Royal Dutch Airlines

(2)

257

189

213

24

249

183

205

22

Barclays Bank PLC

(2)

236

152

221

69

230

148

228

80

Deutsche Postbank AG

206

206

179

(27)

199

199

175

(24)

UPM-Kymmene

180

178

188

10

257

257

252

(5)

Telecom Italia SpA

172

172

212

40

166

166

214

48

Generalitat de Catalunya

154

57

111

54

149

55

126

71

Diamond Offshore Drilling Inc.

124

141

96

(45)

*

*

*

*

IKB Deutsche Industriebank AG

112

47

91

44

108

46

79

33

Alcoa, Inc.

100

80

97

17

100

77

81

4

Noble Holdings International Ltd.

95

98

68

(30)

*

*

*

*

Petrobras International

Finance Company

91

90

83

(7)

91

88

64

(24)

EMC Corp.

85

86

76

(10)

*

*

*

*

Cenovus Energy Inc.

75

78

71

(7)

*

*

*

*

Teck Resources Ltd.

70

73

66

(7)

70

69

32

(37)

Transocean Inc.

68

72

57

(15)

68

71

38

(33)

CF Industries Inc.

60

59

54

(5)

*

*

*

*

Votorantim OverseasTrading

IV Ltd.

50

49

54

5

*

*

*

*

Weatherford Bermuda

49

49

39

(10)

94

92

70

(22)

Eskom Holdings Limited

35

35

35

0

50

50

43

(7)

Commerzbank AG (includes

Dresdner Bank)

*

*

*

*

332

213

321

108

DEPFA Bank PLC

0

0

0

0

166

166

166

0

Societe Generale

(2)

0

0

0

0

83

61

73

12

Other Issuers (below $50 million

in par value)

(3)

249

237

235

(2)

333

306

277

(29)

Subtotal

(4)

3,441

2,859 3,053

194

3,688

2,937 3,166

229

Senior secured bank loans

(5)

1,758

1,855 1,764

(91)

1,400

1,327 1,362

35

High yield corporate bonds

(6)

614

602

624

22

609

621

581

(40)

Grand Total

$ 5,813 $ 5,316 $ 5,441 $

125

$ 5,697 $ 4,885 $ 5,109 $ 224

* Investment grade at respective reporting date

(1)

Excludes middle market loan portfolio which are primarily identified as below investment grade

(2)

Includes perpetual security

(3)

Includes 13 issuers in 2016 and 15 issuers in 2015

(4)

Securities initially purchased as investment grade, but have subsequently been downgraded to below investment grade

(5)

Includes 197 issuers in 2016 and 201 in 2015; all issuers below $40 million in par value

(6)

Includes 62 issuers in 2016 and 57 issuers in 2015; all issuers below $25 million in par value

We invest in senior secured bank loans and middle market loans primarily to U.S. corporate borrowers, most of which

have below-investment-grade ratings. The bank loan and middle market loan investment programs are managed

externally by third party firms specializing in this asset class and require a minimum average portfolio rating of low BB and

a minimum single investment rating of low B from one of the NRSROs. The objectives of these programs include

enhancing the yield on invested assets, achieving further diversification of credit risk, and mitigating the risk of rising

interest rates and hedge costs through the acquisition of floating rate assets. Our investments in these programs totaled

$2.3 billion at December 31, 2016, compared with $1.5 billion at December 31, 2015, on an amortized cost basis.

58