Investments

Our investment philosophy is to fulfill our fiduciary responsibility to invest assets in a prudent manner to meet the

present and future needs of our policyholders' contractual obligations while maximizing the long-term financial return on

assets consistent with the company goal of maximizing long-term shareholder value with defined risk appetites, limits, and

maintaining adequate liquidity.

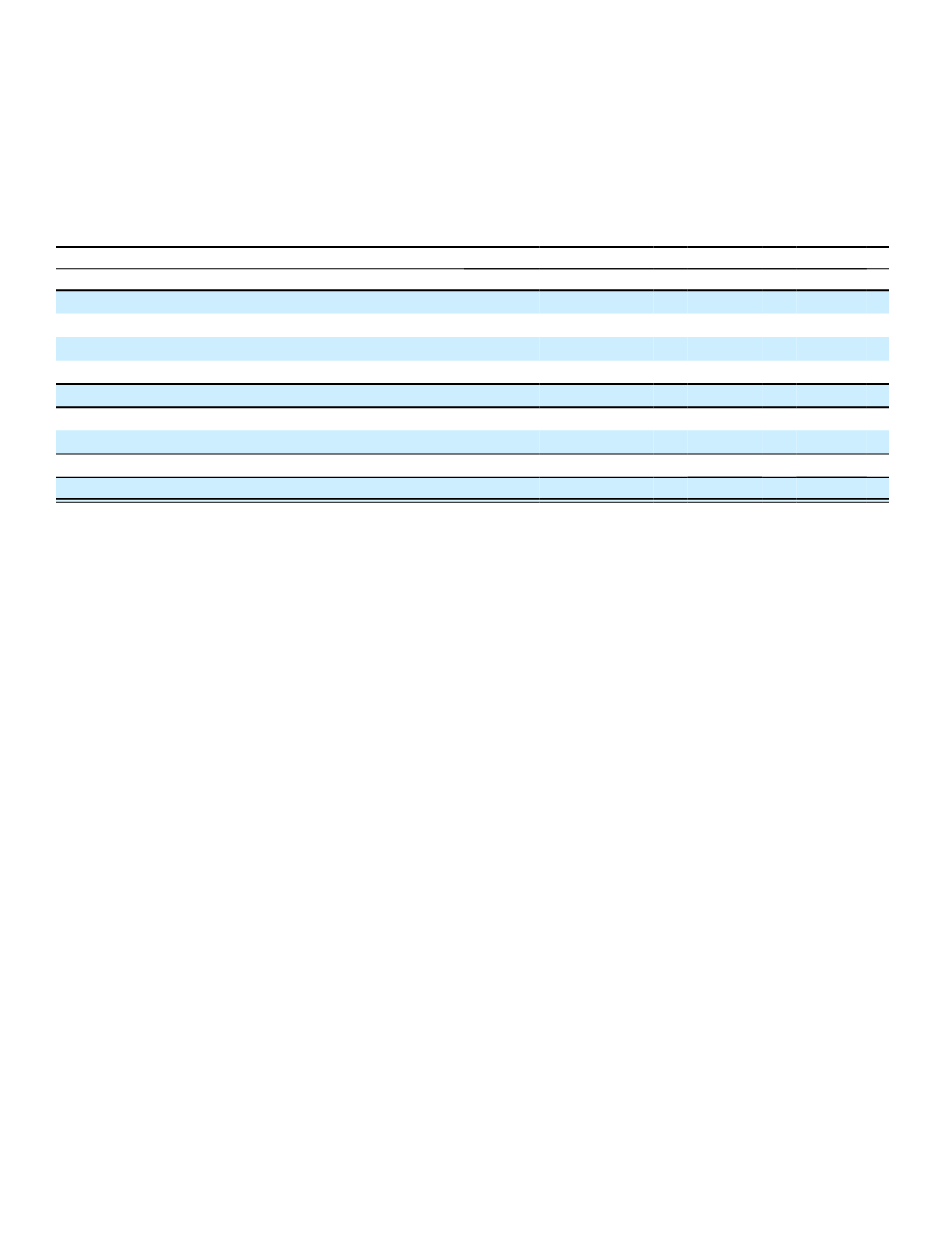

The following table details investment securities by segment as of December 31.

Investment Securities by Segment

(1)

Aflac Japan

Aflac U.S.

(In millions)

2016

2015

2016

2015

Securities available for sale, at fair value:

Fixed maturities

$ 59,903

$ 52,304

$ 13,250

$ 12,522

Perpetual securities

1,577

1,890

56

57

Equity securities

1,185

493

124

5

Total available for sale

62,665

54,687

13,430

12,584

Securities held to maturity, at amortized cost:

Fixed maturities

33,350

33,459

0

0

Total held to maturity

33,350

33,459

0

0

Total investment securities

$ 96,015

$ 88,146

$ 13,430

$ 12,584

(1)

Excludes available-for-sale fixed-maturity securities held by the Parent Company and other business segments of $607 in 2016 and

$523 in 2015.

Other investments primarily consisted of loan receivables that are recorded at amortized cost on the acquisition date

and are carried at adjusted amortized cost. The adjusted amortized cost of the loan receivables reflects allowances for

expected incurred losses estimated based on past events and current economic conditions as of each reporting date. See

the Loans and Loan Receivables section in Note 3 of the Notes to the Consolidated Financial Statements for further

discussion of these investments.

Cash and cash equivalents totaled $4.9 billion, or 4.2% of total investments and cash, as of December 31, 2016,

compared with $4.4 billion, or 4.1%, at December 31, 2015. For a discussion of the factors affecting our cash balance,

see the Operating Activities, Investing Activities and Financing Activities subsections of this MD&A.

For additional information concerning our investments, see Notes 3, 4, and 5 of the Notes to the Consolidated

Financial Statements.

The ratings of our securities referenced in the table below are based on the ratings designations provided by major

NRSROs (Moody's, S&P and Fitch) or, if not rated, are determined based on our internal analysis of such securities. For

investment-grade securities where the ratings assigned by the major credit agencies are not equivalent, we use the

second lowest rating that is assigned. For a description of the ratings methodology that we use when a security is below

investment grade or split-rated, see "Investments, Below-Investment-Grade and Split-Rated Securities" in the Analysis of

Financial Condition section of this MD&A.

The distributions of debt and perpetual securities we own, by credit rating, as of December 31 were as follows:

54