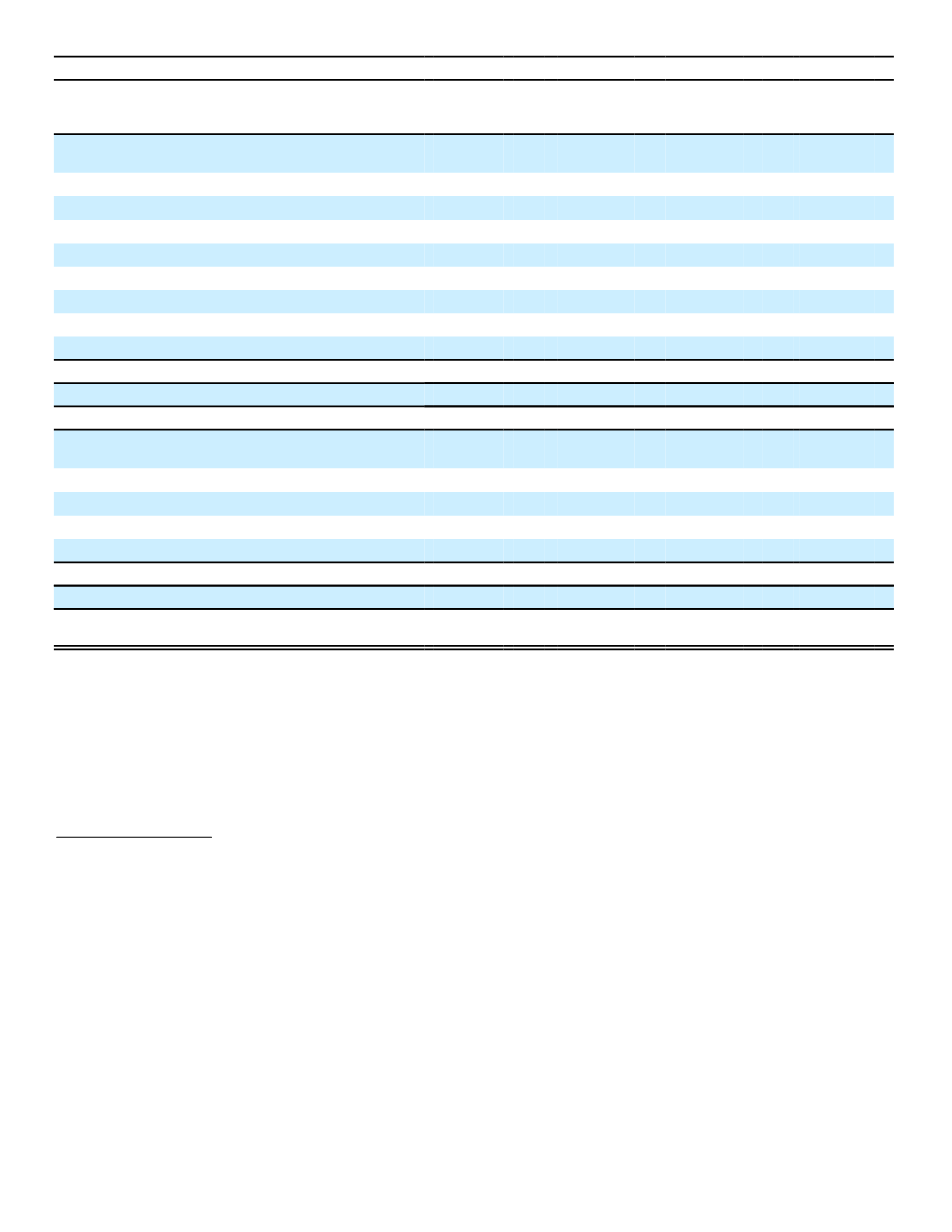

2015

Cost or

Amortized

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Fair

Value

(In millions)

Securities available for sale,

carried at fair value:

Fixed maturities:

Independent exploration and production

$ 1,270

$ 73

$ 139

$ 1,204

Integrated energy

575

55

27

603

Midstream

1,246

76

144

1,178

Oil field services

1,155

27

228

954

Refiners

460

6

30

436

Government owned - energy related

887

182

25

1,044

Natural gas utilities

344

53

1

396

Total fixed maturities

5,937

472

594

5,815

Equity securities

3

0

0

3

Total securities available for sale

5,940

472

594

5,818

Securities held to maturity,

carried at amortized cost:

Fixed maturities:

Integrated energy

242

9

0

251

Government owned - energy related

249

5

0

254

Natural gas utilities

207

18

0

225

Total fixed maturities

698

32

0

730

Total securities held to maturity

698

32

0

730

Total securities available for sale

and held to maturity

$ 6,638

$ 504

$ 594

$ 6,548

As of December 31, 2016, the weighted-average rating of our total fixed maturity energy exposure is BBB, and 88% of

our exposure to the oil and gas industry was investment grade, compared to 93% at December 31, 2015. Further declines

in oil and gas prices, unexpected increases in supply, or other company specific situations could lead to additional

negative ratings activity from the public rating agencies for energy credit issuers. We do not currently expect our

investments in the energy sector to have a material impact on our results of operations.

Hedging Activities

Net Investment Hedge

Our primary exposure to be hedged is our investment in Aflac Japan, which is affected by changes in the yen/dollar

exchange rate. To mitigate this exposure, we have taken several courses of action. First, Aflac Japan maintains certain

unhedged U.S. dollar-denominated securities, which serve as an economic currency hedge of a portion of our investment

in Aflac Japan. Second, we have designated the majority of the Parent Company’s yen-denominated liabilities (Samurai

and Uridashi notes) as non-derivative hedging instruments and certain foreign currency forwards and options as derivative

hedges of our net investment in Aflac Japan. We make our net investment hedge designation at the beginning of each

quarter. If the total of the designated Parent Company non-derivative and derivatives notional is equal to or less than our

net investment in Aflac Japan, the hedge is deemed to be effective, and the exchange effect on the yen-denominated

liabilities and the change in estimated fair value of the derivatives are reported in the unrealized foreign currency

component of other comprehensive income. We estimate that if the designated net investment hedge positions exceeded

our net investment in Aflac Japan by 10 billion yen, we would report a foreign exchange gain/loss of approximately $1

million for every 1% yen weakening/strengthening in the end-of-period yen/dollar exchange rate. Our net investment

hedge was effective during the years ended December 31, 2016, 2015 and 2014, respectively.

The yen net asset figure calculated for hedging purposes differs from the yen-denominated net asset position as

discussed in the Currency Risk subsection of MD&A. As disclosed in that subsection, the consolidation of the underlying

assets in certain VIEs requires that we derecognize our yen-denominated investment in the VIE and recognize the

61