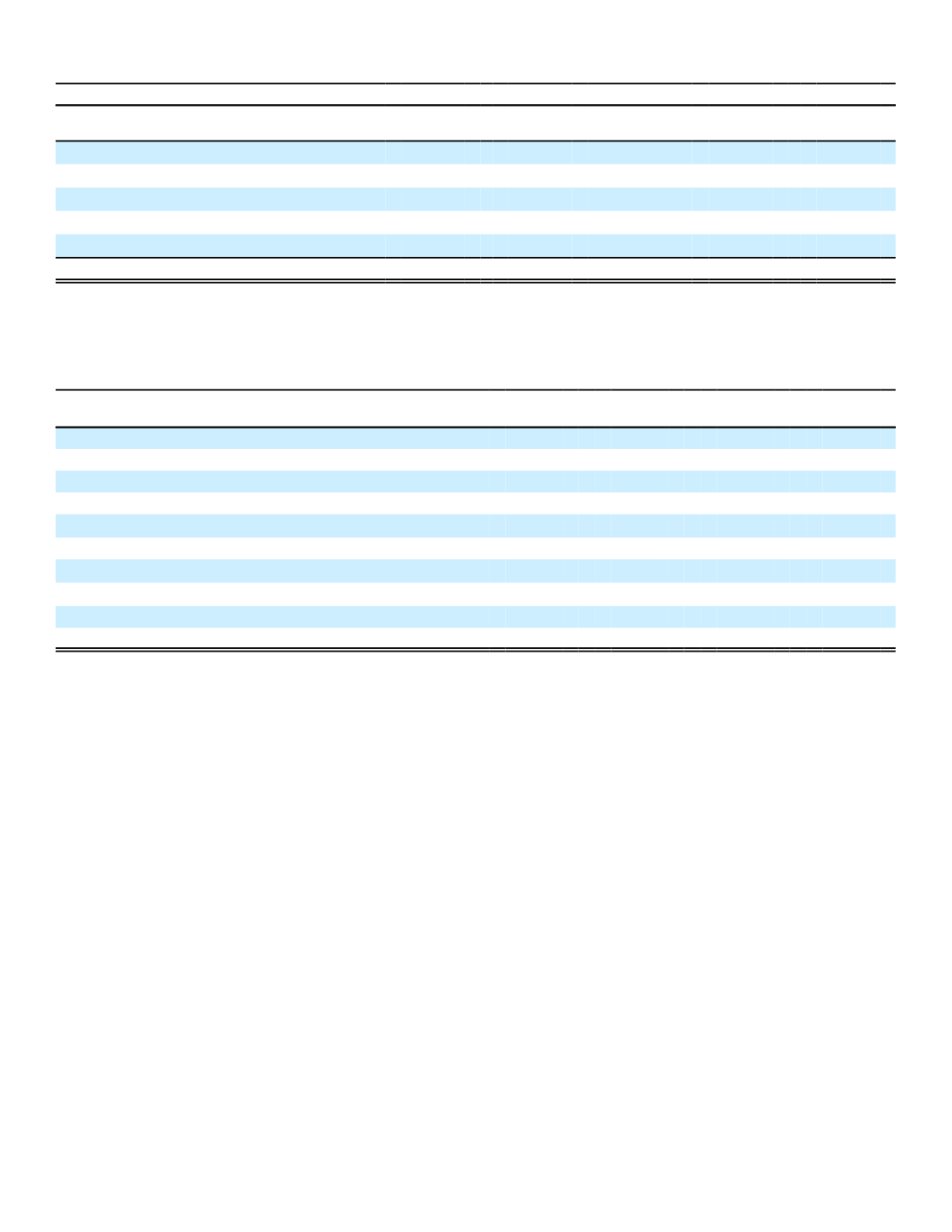

Composition of Securities Portfolio by Credit Rating

2016

2015

Amortized

Cost

Fair

Value

Amortized

Cost

Fair

Value

AAA

2.0%

1.9%

1.3%

1.3%

AA

5.0

5.0

5.7

5.7

A

63.1

65.2

61.0

63.0

BBB

24.6

23.2

26.9

25.1

BB or lower

5.3

4.7

5.1

4.9

Total

100.0% 100.0%

100.0% 100.0%

As of December 31, 2016, our direct and indirect exposure to securities in our investment portfolio that were

guaranteed by third parties was immaterial both individually and in the aggregate.

The following table presents the 10 largest unrealized loss positions in our portfolio as of December 31, 2016.

(In millions)

Credit

Rating

Amortized

Cost

Fair

Value

Unrealized

Loss

Diamond Offshore Drilling Inc.

BB

$ 141

$ 96

$ (45)

Noble Holdings International Ltd.

B

98

68

(30)

Deutsche Postbank AG

BB

206

179

(27)

Investcorp Capital Limited

BB

368

346

(22)

AXA

(1)

BBB

282

263

(19)

National Oilwell Varco Inc.

BBB

97

79

(18)

Kommunal Lanspensjonskasse (KLP)

(1)

BBB

210

193

(17)

Baker Hughes Inc.

BBB

122

107

(15)

Transocean Inc.

B

72

57

(15)

Bank of America Corp.

BBB

386

371

(15)

(1)

Includes perpetual security

Generally, declines in fair values can be a result of changes in interest rates, yen/dollar exchange rate, and changes

in net spreads driven by a broad market move or a change in the issuer's underlying credit quality. At times in 2016,

market volatility was at elevated levels, especially in the energy and commodity-related sectors. As we believe these

issuers have the ability to continue making timely payments of principal and interest, we view these changes in fair value

to be temporary and do not believe it is necessary to impair the carrying value of these securities. See the Unrealized

Investment Gains and Losses section in Note 3 of the Notes to the Consolidated Financial Statements for further

discussions of unrealized losses related to financial institutions, including perpetual securities, and other corporate

investments.

Securities by Type of Issuance

We have investments in both publicly and privately issued securities. Our ability to sell either type of security is a

function of overall market liquidity which is impacted by, among other things, the amount of outstanding securities of a

particular issuer or issuance, trading history of the issue or issuer, overall market conditions, and idiosyncratic events

affecting the specific issue or issuer.

The following table details investment securities by type of issuance as of December 31.

55