CAPITAL RESOURCES AND LIQUIDITY

Aflac provides the primary sources of liquidity to the Parent Company through dividends and management fees. The

following table presents the amounts provided for the years ended December 31.

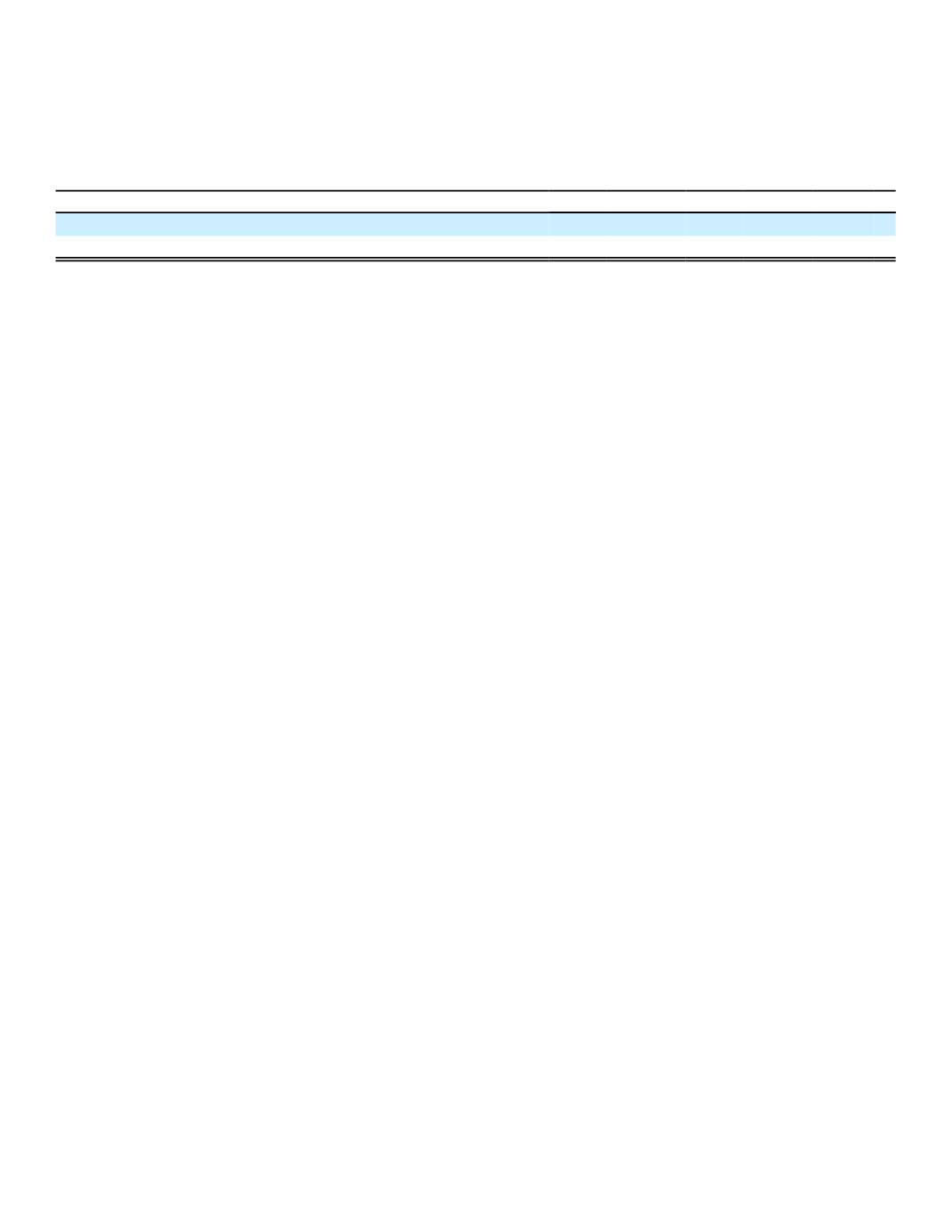

Liquidity Provided by Aflac to Parent Company

(In millions)

2016

2015

2014

Dividends declared or paid by Aflac

$2,000

$2,393

$ 1,473

Management fees paid by Aflac

260

255

267

The primary uses of cash by the Parent Company are shareholder dividends, the repurchase of its common stock and

interest on its outstanding indebtedness and operating expenses. The Parent Company's sources and uses of cash are

reasonably predictable and are not expected to change materially in the future. For additional information, see the

Financing Activities subsection of this MD&A.

The Parent Company also accesses debt security markets to provide additional sources of capital. In August 2016, we

filed a shelf registration statement with Japanese regulatory authorities that allows us to conduct public offerings of bonds

in Japan, including yen-denominated Samurai notes, up to 200 billion yen or its equivalent through August 2018. The shelf

registration statement is for possible public offerings in Japan, but the bonds issued under the shelf may be transferred by

the bondholders to U.S. persons in compliance with U.S. law. We filed a shelf registration statement with the SEC in May

2015 that allows us to issue an indefinite amount of senior and subordinated debt, in one or more series, from time to time

until May 2018. We believe outside sources for additional debt and equity capital, if needed, will continue to be available.

For additional information, see Note 9 of the Notes to the Consolidated Financial Statements.

The principal sources of cash for our insurance operations are premiums and investment income. The primary uses of

cash by our insurance operations are investments, policy claims, commissions, operating expenses, income taxes and

payments to the Parent Company for management fees and dividends. Both the sources and uses of cash are reasonably

predictable.

When making an investment decision, our first consideration is based on product needs. Our investment objectives

provide for liquidity through the purchase of investment-grade debt securities. These objectives also take into account

duration matching, and because of the long-term nature of our business, we have adequate time to react to changing

cash flow needs.

As a result of policyholder aging, claims payments are expected to gradually increase over the life of a policy.

Therefore, future policy benefit reserves are accumulated in the early years of a policy and are designed to help fund

future claims payments. We expect our future cash flows from premiums and our investment portfolio to be sufficient to

meet our cash needs for benefits and expenses.

In October 2016, the Parent Company and Aflac jointly entered into a 364-day uncommitted bilateral line of credit that

provides for borrowings in the amount of $100 million. Borrowings will bear interest at the rate quoted by the bank and

agreed upon at the time of making such loan and will have up to a three-month maturity period. There are no related

facility fees, upfront expenses or financial covenant requirements. Borrowings under this credit agreement may be used

for general corporate purposes. Borrowings under the financing agreement will mature no later than three months after

the last drawdown date of October 14, 2017. As of December 31, 2016, we did not have any borrowings outstanding

under our $100 million credit agreement.

In March 2016, the Parent Company entered into a three-year senior unsecured revolving credit facility agreement

with a group of financial institutions that provides for borrowings of up to 100.0 billion yen on a revolving basis. Borrowings

bear interest at a rate per annum equal to the TIBOR plus, at our option, either (a) the applicable TIBOR margin during the

period from the closing date to the commitment termination date or (b) the applicable TIBOR margin during the term out

period. The applicable margin ranges between .35% and .75% during the period from the closing date to the commitment

termination date and .70% and 1.50% during the term out period, depending on the Parent Company’s debt ratings as of

the date of determination. In addition, the Parent Company is required to pay a facility fee on the commitments ranging

between .30% and .50%, also based on the Parent Company’s debt ratings as of the date of determination. Borrowings

under this credit agreement may be used for general corporate purposes, including a capital contingency plan for the

operations of the Parent Company, and will expire on the earlier of (a) March 31, 2019, or (b) the date the commitments

64