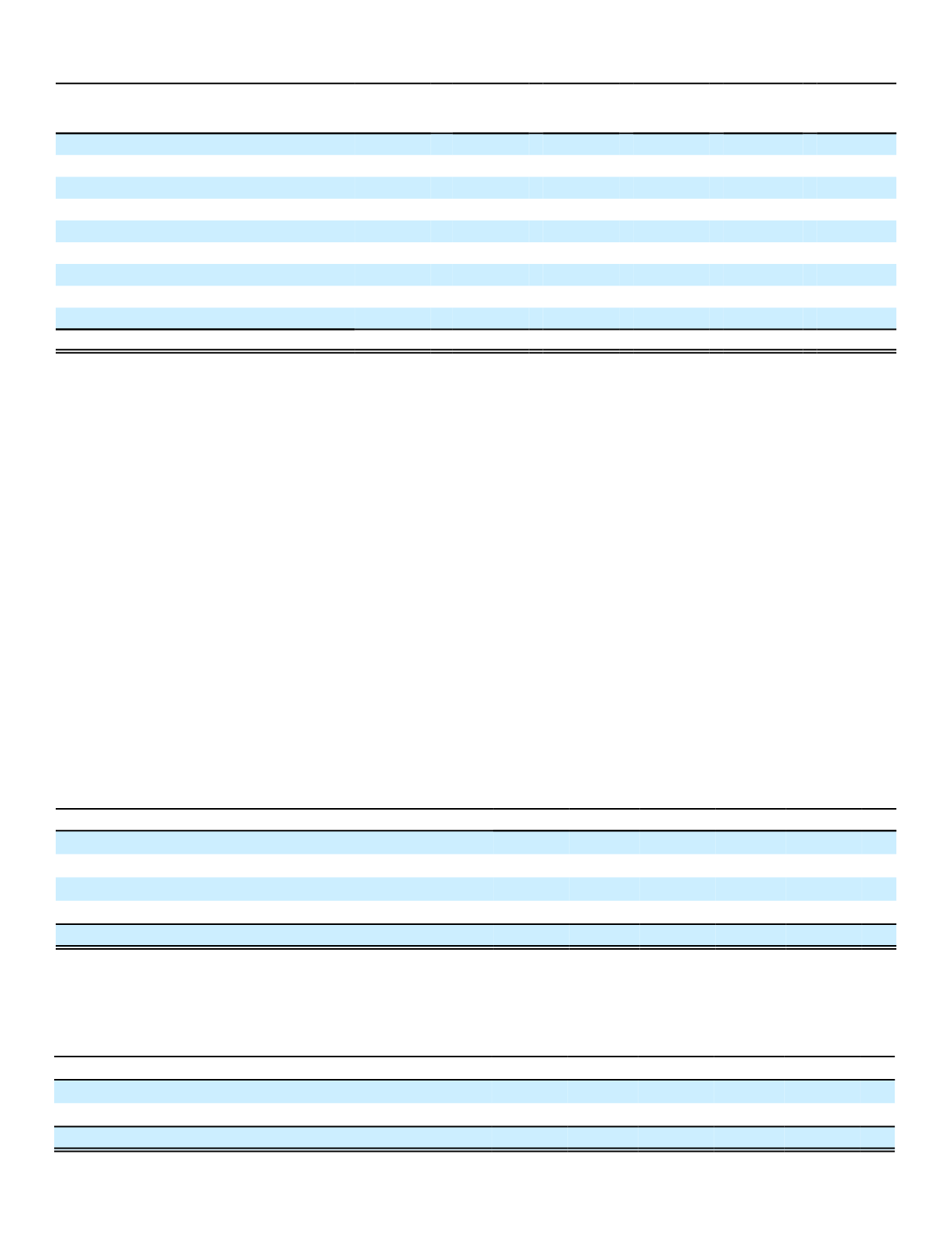

Distribution of Payments by Period

(In millions)

Total

Liability

(1)

Total

Payments

Less

Than

One Year

One to

Three

Years

Four to

Five Years

After

Five Years

Future policy benefits liability

(Note 7)

(2)

$ 76,106 $ 240,650 $ 8,410 $ 16,949 $ 16,664 $ 198,627

Unpaid policy claims liability

(Note 7)

(3)

4,045

4,046

2,644

766

348

288

Other policyholders' funds

(Note 7)

(3)

6,659

10,254

319

364

465

9,106

Long-term debt – principal

(Note 9)

5,339

5,388

650

0

593

4,145

Long-term debt – interest

(Note 9)

41

2,910

182

360

335

2,033

Cash collateral on loaned securities

(Note 3)

526

526

526

0

0

0

Operating service agreements

(Note 15)

N/A

(4)

608

167

297

144

0

Operating lease obligations

(Note 15)

N/A

(4)

145

62

59

24

0

Capitalized lease obligations

(Note 9)

21

21

6

11

3

1

Total contractual obligations

$ 92,737 $ 264,548 $ 12,966 $ 18,806 $ 18,576 $ 214,200

Liabilities for unrecognized tax benefits in the amount of $15 have been excluded from the tabular disclosure above because the timing

of cash payment is not reasonably estimable.

(1)

Liability amounts are those reported on the consolidated balance sheet as of December 31, 2016.

(2)

The estimated payments due by period reflect future estimated cash payments to be made to policyholders and others for future

policy benefits. These projected cash outflows are based on assumptions for future policy persistency, mortality, morbidity, and other

assumptions comparable with our experience, consider future premium receipts on current policies in force, and assume market

growth and interest crediting consistent with assumptions used in amortizing deferred acquisition costs. These cash outflows are

undiscounted with respect to interest and, as a result, the sum of the cash outflows shown for all years in the table of $240,650

exceeds the corresponding liability amount of $76,106. We have made significant assumptions to determine the future estimated

cash outflows related to the underlying policies and contracts. Due to the significance of the assumptions used, actual cash outflow

amounts and timing will differ, possibly materially, from these estimates.

(3)

Includes assumptions as to the timing of policyholders reporting claims for prior periods and the amount of those claims. Actual

amounts and timing of unpaid policy claims payments may differ significantly from the estimates above.

(4)

Not applicable

For more information on our major contractual obligations, see the applicable Note in the Notes to the Consolidated

Financial Statements as indicated in the line items in the table above.

Consolidated Cash Flows

We translate cash flows for Aflac Japan's yen-denominated items into U.S. dollars using weighted-average exchange

rates. In years when the yen weakens, translating yen into dollars causes fewer dollars to be reported. When the yen

strengthens, translating yen into dollars causes more dollars to be reported.

The following table summarizes consolidated cash flows by activity for the years ended December 31.

(In millions)

2016

2015

2014

Operating activities

$ 5,987

$ 6,776

$ 6,550

Investing activities

(3,855)

(4,897)

(4,241)

Financing activities

(1,619)

(2,187)

(147)

Exchange effect on cash and cash equivalents

(4)

0

(47)

Net change in cash and cash equivalents

$ 509

$ (308)

$ 2,115

Operating Activities

Consolidated cash flow from operations decreased 11.6% in 2016, compared with 2015. The following table

summarizes operating cash flows by source for the years ended December 31.

(In millions)

2016

2015

2014

Aflac Japan

$ 4,605

$ 5,285

$ 5,711

Aflac U.S. and other operations

1,382

1,491

839

Total

$ 5,987

$ 6,776

$ 6,550

66