The level of Aflac Japan operating cash flows during 2016 and 2015 was impacted by a decline in the sales of

products such as WAYS, which resulted in a reduced amount of cash received from discounted advance premiums. We

do not expect this trend to continue in 2017.

Investing Activities

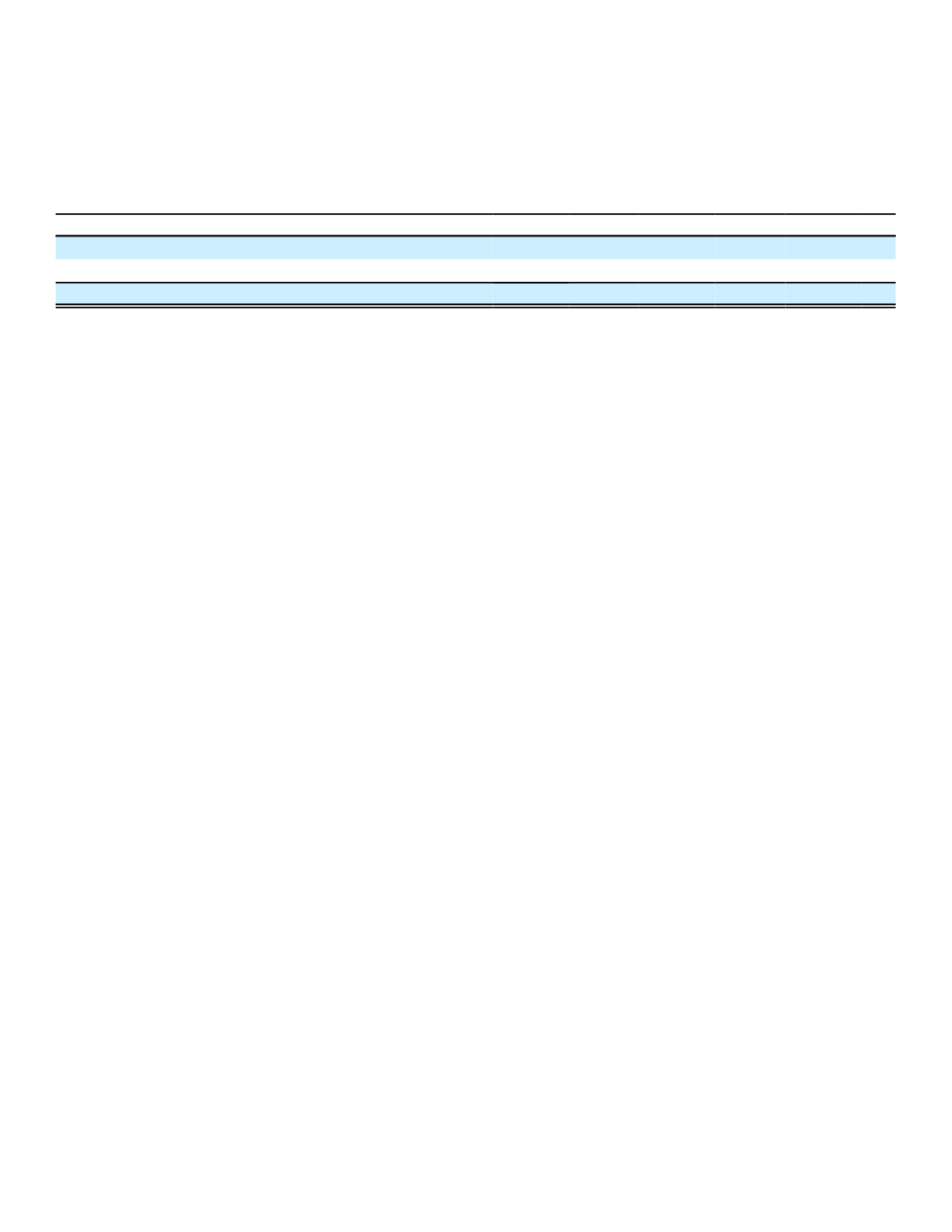

Operating cash flow is primarily used to purchase investments to meet future policy obligations. The following table

summarizes investing cash flows by source for the years ended December 31.

(In millions)

2016

2015

2014

Aflac Japan

$ (3,075)

$ (4,147)

$ (4,129)

Aflac U.S. and other operations

(780)

(750)

(112)

Total

$ (3,855)

$ (4,897)

$ (4,241)

Prudent portfolio management dictates that we attempt to match the duration of our assets with the duration of our

liabilities. Currently, when our fixed-maturity securities and perpetual securities mature, the proceeds may be reinvested at

a yield below that required for the accretion of policy benefit liabilities on policies issued in earlier years. However, the

long-term nature of our business and our strong cash flows provide us with the ability to minimize the effect of

mismatched durations and/or yields identified by various asset adequacy analyses. When needed or when market

opportunities arise, we dispose of selected fixed-maturity and perpetual securities that are available for sale to improve

the duration matching of our assets and liabilities, improve future investment yields, and/or re-balance our portfolio. As a

result, dispositions before maturity can vary significantly from year to year. Dispositions before maturity were

approximately 7% of the annual average investment portfolio of fixed maturities and perpetual securities available for sale

during the year ended December 31, 2016, compared with 5% in 2015 and 6% in 2014.

Financing Activities

Consolidated cash used by financing activities was $1.6 billion in 2016, $2.2 billion in 2015 and $147 million in 2014.

In September 2016, the Parent Company issued two series of senior notes totaling $700 million through a U.S. public

debt offering. The first series, which totaled $300 million, bears interest at a fixed rate of 2.875% per annum, payable

semi-annually, and has a 10-year maturity. The second series, which totaled $400 million, bears interest at a fixed rate of

4.00% per annum, payable semi-annually, and has a 30-year maturity.

In September 2016, the Parent Company entered into two series of senior unsecured term loan facilities totaling 30.0

billion yen. The first series, which totaled 5.0 billion yen, bears an interest rate per annum equal to the TIBOR, or alternate

TIBOR, if applicable, plus the applicable TIBOR margin. The applicable margin ranges between .20% and .60%,

depending on the Parent Company's debt ratings as of the date of determination. The second series, which totaled 25.0

billion yen, bears an interest rate per annum equal to TIBOR, or alternate TIBOR, if applicable, plus the applicable TIBOR

margin. The applicable margin ranges between .35% and .75%, depending on the Parent Company's debt ratings as of

the date of determination.

In December 2016, the Parent Company completed a tender offer in which it extinguished $176 million principal of its

6.90% senior notes due 2039 and $193 million principal of its 6.45% senior notes due 2040. The pretax non-operating

loss due to the early redemption of these notes was $137 million ($89 million after-tax, or $.21 per diluted share).

In September 2016, we extinguished 8.0 billion yen of 2.26% fixed rate Uridashi notes upon their maturity and in July

2016, we extinguished 15.8 billion yen of 1.84% fixed rate Samurai notes upon their maturity.

In August 2015, we extinguished $300 million of 3.45% fixed-rate senior notes upon their maturity. In August 2015, we

extinguished a 5.0 billion yen loan at its maturity date (a total of approximately $41 million using the exchange rate at the

maturity date). In July 2015, we extinguished a 10.0 billion yen loan at its maturity date (a total of approximately $81

million using the exchange rate at the maturity date).

In March 2015, the Parent Company issued two series of senior notes totaling $1.0 billion through a U.S. public debt

offering. The first series, which totaled $550 million, bears interest at a fixed rate of 2.40% per annum, payable semi-

annually, and has a five-year maturity. The second series, which totaled $450 million, bears interest at a fixed rate of

3.25% per annum, payable semi-annually, and has a ten-year maturity. We have entered into cross-currency swaps that

convert the U.S. dollar-denominated principal and interest on the senior notes into yen-denominated obligations which

67