Operating earnings per diluted share excluding foreign currency effect rose 7.5% in 2015, presenting a challenging

comparison for 2016. Aflac Japan earnings are impacted by the low rate environment and an expected

premium decline from the Company’s tactical decision to de-emphasize first sector savings products. For Aflac

U.S., expense ratios were expected to increase modestly in 2016 as a result of investment in overall IT, group

product administration and everwell platforms. This combination of natural sales patterns in Japan, the low rate

environment’s impact on net investment income, and increased investment in the business led to modestly

lowered consolidated profitability targets for 2016.

TARGET BONUS OPPORTUNITY

Target bonuses for 2016 for the NEOs, which were determined to be competitive relative to comparable positions

within our peer group, were as follows:

The MIP opportunities for all NEOs are capped at 200% of their target opportunities.

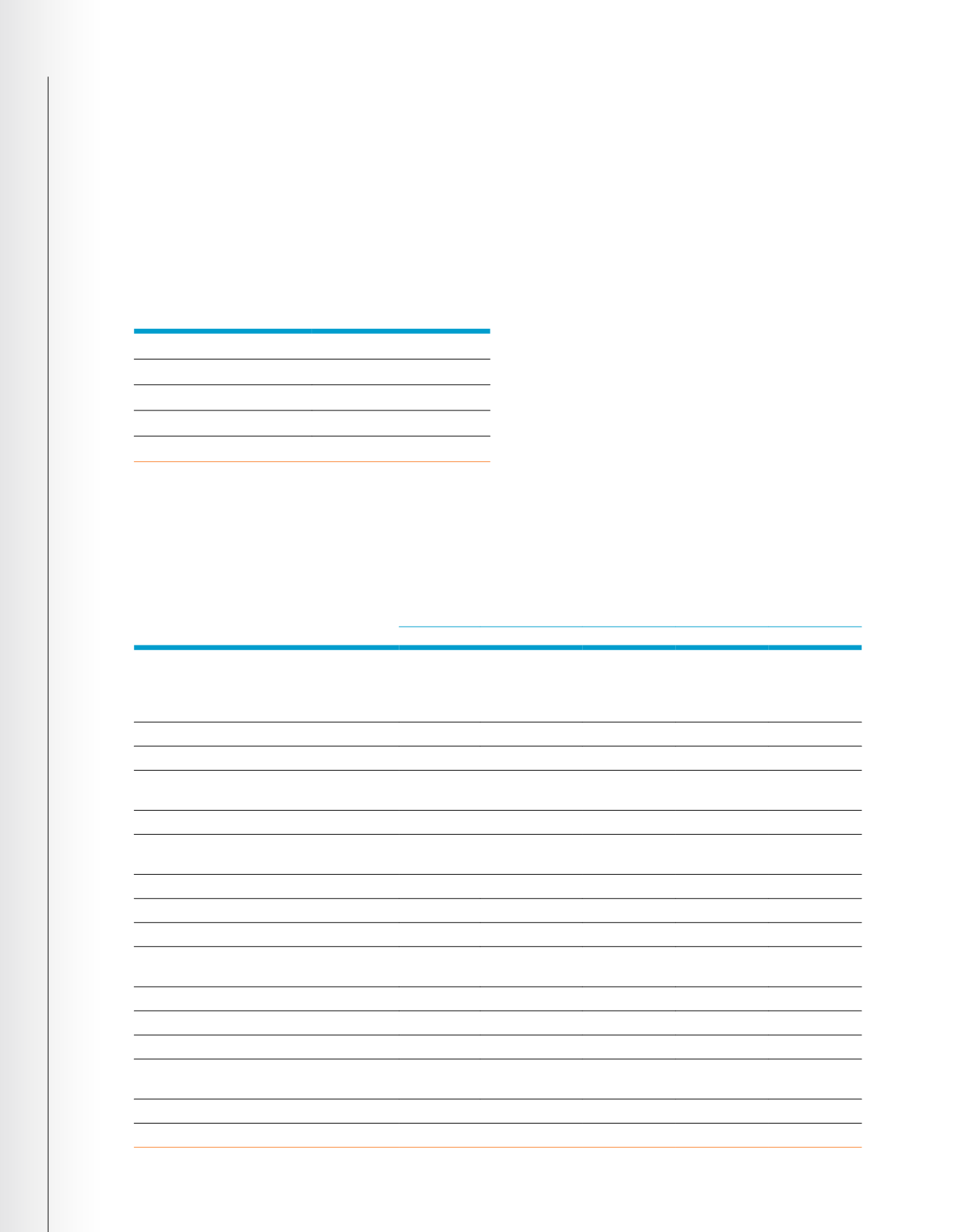

WEIGHTINGS OF EACH PERFORMANCE OBJECTIVE FOR 2016

The performance measures are weighted differently for each NEO and for all other officer levels in the Company.

We vary the weightings to reflect how each position can and should influence the outcome of particular metrics.

Weightings of Annual Incentive Metrics as a Percent of Target

Daniel P. Amos Frederick J. Crawford Kriss Cloninger III

Paul S. Amos II

Eric M. Kirsch

Corporate Objectives:

Operating earnings per diluted share on

a consolidated basis for the Company

(excluding foreign currency effect)

22.73%

24.00%

22.67%

24.00%

30.00%

OROE (excluding foreign currency effect)

11.36%

8.80%

9.33%

8.00%

15.00%

SMR

11.36%

8.80%

9.33%

8.00%

15.00%

Net Investment Income excluding hedge costs

(Consolidated)

9.10%

8.00%

8.67%

8.00%

30.00%

Subtotal Aflac Incorporated

54.55%

49.60%

50.00%

48.00%

90.00%

U.S. Segment:

New Annualized Premium

6.81%

5.20%

5.33%

–

–

Direct Premiums

4.55%

5.20%

5.33%

–

–

Pretax Operating Earnings

4.55%

5.60%

6.01%

8.00%

–

Subtotal

15.91%

16.00%

16.67%

8.00%

–

Japan Segment:

New Annualized Premium (third sector sales)

11.36%

10.40%

10.00%

16.00%

–

Direct Premiums

9.09%

10.40%

10.00%

8.00%

–

Pretax Operating Earnings

9.09%

13.60%

13.33%

20.00%

–

Subtotal

29.54%

34.40%

33.33%

44.00%

–

Global Investments:

Credit Losses/Impairments

–

–

–

–

10.00%

Subtotal

–

–

–

–

10.00%

GRAND TOTAL

100.00%

100.00% 100.00% 100.00% 100.00%

Named Executive Officer

Target MIP

(as percent of base salary)

Daniel P. Amos

220%

Frederick J. Crawford

125%

Kriss Cloninger III

150%

Paul S. Amos II

125%

Eric M. Kirsch

200%

Compensation Discussion & Analysis

|

Elements of Our Executive Compensation Program

AFLAC INCORPORATED

2017 PROXY STATEMENT

36