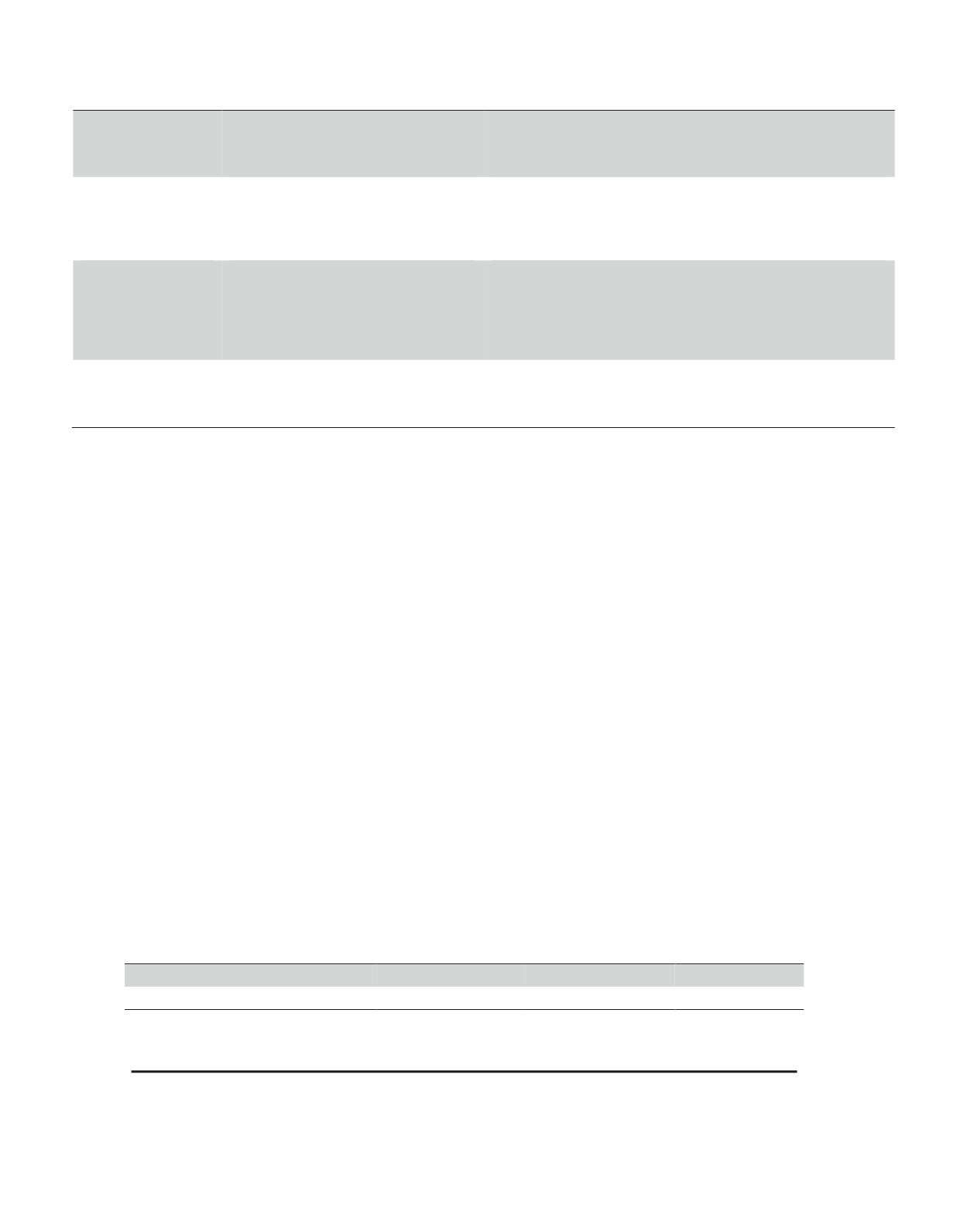

Key Elements of Our Executive Compensation Programs

Element

Objective

Purpose

Base Salary

Talent attraction and retention

Alignment with shareholder value

creation

Provide annual cash income that is both market

competitive and commensurate with an individual’s talents

and level in the organization

Motivate and retain key talent

Management

Incentive Plan

(“MIP”)

Pay-for-performance

Alignment with operating growth

metrics that drive shareholder

value creation

Motivate executives and reward achievement for

performance on key annual operational and strategic goals

Focus on key short-term value drivers for our business

Motivate and retain key talent

Long-term Incentives

(“LTI”)

Pay-for-performance

Alignment with shareholder value

creation

Motivate executives and reward achievement for

performance on key long-term operational and strategic

goals

Focus on key long-term value drivers for our business

Motivate and retain key talent

Retirement &

Benefits

Talent retention

Tax effective pay

Security

Provide market competitive retirement benefits (pension,

401(k), etc.) to aid in talent retention

Satisfy employee health and welfare needs

Peer Group

Each year, the Compensation Committee reviews the

composition of the peer group against which the

Company’s executive compensation programs and

financial performance are benchmarked. Key factors

the Compensation Committee considers during its

annual review of companies in the peer group include

the following: operating characteristics, revenue size,

asset size, profitability, market value, and total number

of employees. Based on the annual review, a peer

group is selected among companies that are engaged

in businesses similar to that of the Company, are of size

similar to that of the Company, and compete against the

Company for talent. The following 17 companies, which

were unchanged from the 2013 peer group, were

selected to comprise the 2014 peer group:

Aetna Inc.

Lincoln National Corporation

The Allstate Corporation

Manulife Financial Corporation

Assurant, Inc.

MetLife, Inc.

The Chubb Corporation

Principal Financial Group, Inc.

CIGNA Corporation

The Progressive Corporation

CNO Financial Group, Inc.

Prudential Financial, Inc.

Genworth Financial, Inc.

The Travelers Companies, Inc.

The Hartford Financial Services Group, Inc.

Unum Group

Humana Inc.

Overall, the Company’s revenues were near the median

of the peers, total assets were larger than the median of

the peer group, and our market value was higher than

the peer group median. The data shown below reflect

those metrics relevant at the time of the peer group

review:

(in millions)

Revenue

(1)

Total Assets

(2)

Market Value

(3)

Aflac Incorporated

$24,668

(4)

$137,112

(4)

$27,526

Peer Median

$24,337

$104,522

$22,024

(1)

(2)

(3)

(4)

For the trailing 12 months ending September 30, 2014

As of September 30, 2014

As of December 31, 2014 when data was compiled for the performance review by the Compensation Committee

Figures are net of foreign currency effect

The assessment of the Company’s 2014 performance relative to the peer group can be found below in the “CEO

Compensation and Pay-for Performance” section of this CD&A.

29