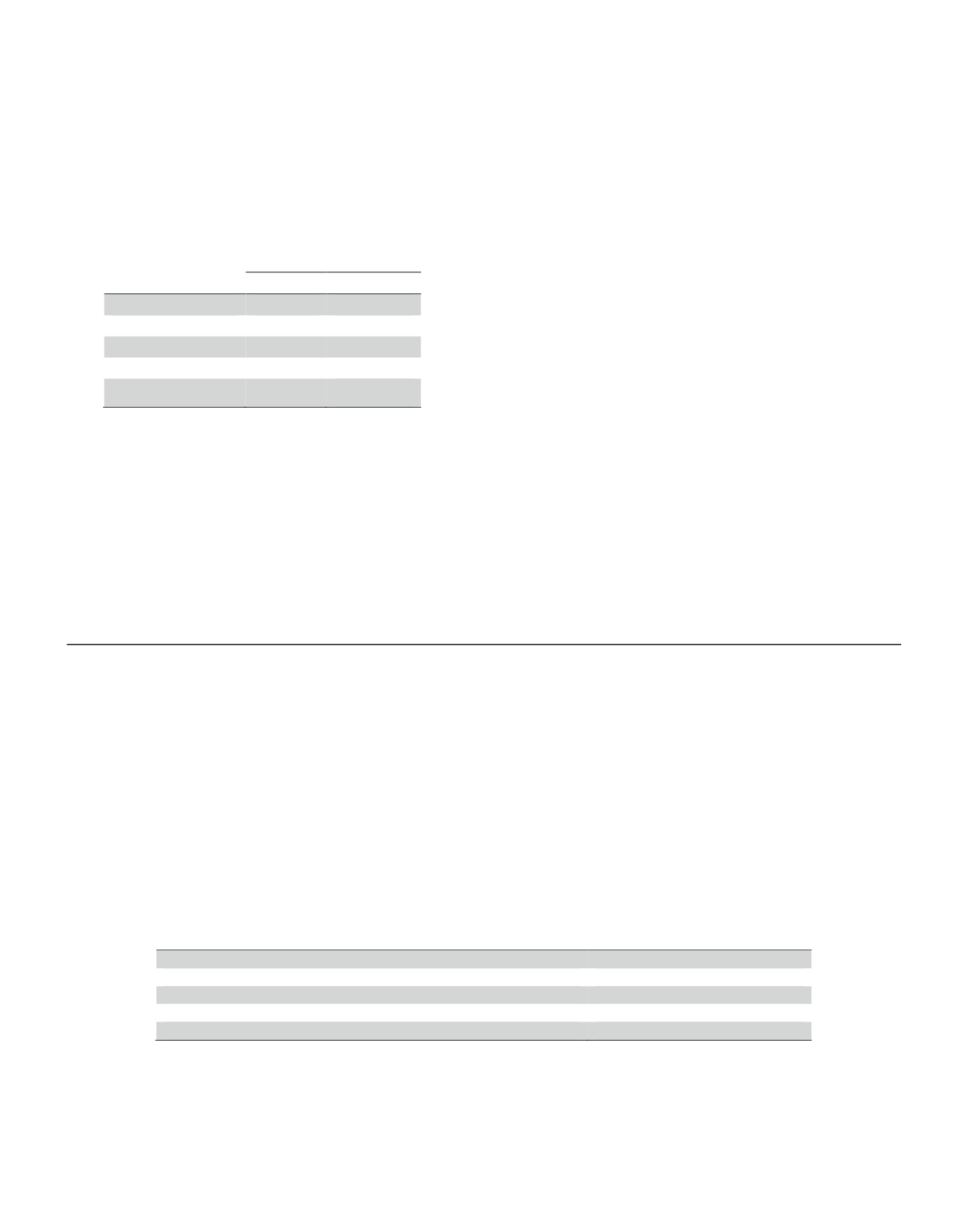

2014 MIP Payouts:

The following table reflects target, earned and paid

percentages of salary for the non-equity incentive

measures based on 2014 performance results for the

NEOs:

Percent of Base

Salary

NEO

Target

Earned

Daniel P. Amos

220%

335%

Kriss Cloninger III

150%

225%

Paul S. Amos II

125%

185%

Eric M. Kirsch

200%

324%

Tohru Tonoike

100%

122%

*

Includes amounts accrued for a deferred retirement benefit for

Mr. Tonoike as more fully described in connection with the 2014

Summary Compensation Table and the 2014 Nonqualified

Deferred Compensation Table.

The Compensation Committee has the discretion in

certain limited circumstances to adjust the MIP results

related to performance measures if it deems that a

class of MIP participants would be unduly penalized or

rewarded due to the incomparability of the result to the

performance measure as determined by the

Compensation Committee. The Compensation

Committee did not adjust the NEOs’ MIP results for

2014.

For additional information about the MIP, please refer to

the 2014 Grants of Plan-Based Awards table below,

which shows the threshold, target, and maximum award

amounts payable under the MIP for 2014, and the 2014

Summary Compensation Table, which shows the actual

amount of non-equity incentive plan compensation paid

to the NEOs for 2014.

Long-term Equity Incentives

In 2014, LTI awards were provided in the form of

performance-based restricted stock (“PBRS”) (for

executive officers including all NEOs) and stock options

(for all officers, except the CEO). For 2014, the CEO’s

long-term incentive award was made entirely in PBRS.

PBRS awards will be reduced or cancelled if

management fails to maintain appropriate risk-based

capital levels. In addition, in such case, the value of

existing awards and other shares held by our

executives likely will decline, providing strong economic

incentive to manage capital and risk. Options only

provide value if our share price appreciates and the

option vests.

LTI targets as a percent of base salary for the NEOs were as follows:

Named Executive Officer

Target LTI

(as Percent of Base Salary)

Daniel P. Amos (Chairman & CEO)

Performance-based

Kriss Cloninger III (President, CFO & Treasurer)

350%

Paul S. Amos II (President, Aflac)

250%

Eric M. Kirsch (EVP, Global Chief Investment Officer, Aflac)

250%

Tohru Tonoike (President & COO Aflac Japan)

250%

34