The CEO and President/CFO recommend to the

Compensation Committee the specific Company

performance objectives and their ranges. In

recommending the incentive performance objectives to

the Compensation Committee, the CEO and

President/CFO

take

into

consideration

past

performance results and scenario tests of the

Company’s financial outlook as projected by a complex

financial model. The model projects the impact on

various financial measures using different levels of total

new annualized premium sales, investment returns,

budgeted expenses, morbidity, and persistency. This

enables the Company to set ranges around most

performance objectives.

The Compensation Committee may consider the

probability of attainment of each of the various

measures. Generally, it is expected that target

performance will be attained 50% to 60% of the time,

minimum performance attained at least 75% of the time,

and maximum performance attained not more than 25%

of the time. During its annual review in February, the

Compensation Committee reviews and approves or, if

deemed appropriate, modifies the annual incentive

goals for that year.

For each of the performance measures, a target

performance level is established. In addition, a

minimum and maximum level is established. The

payout for a minimum result is one-half of the target

result, while the payout for a maximum result is two

times that of the target result. Typically, the target result

is equidistant between the minimum result and the

maximum result. Interpolation is used to calculate

incentive payouts for results between minimum and

target or target and maximum.

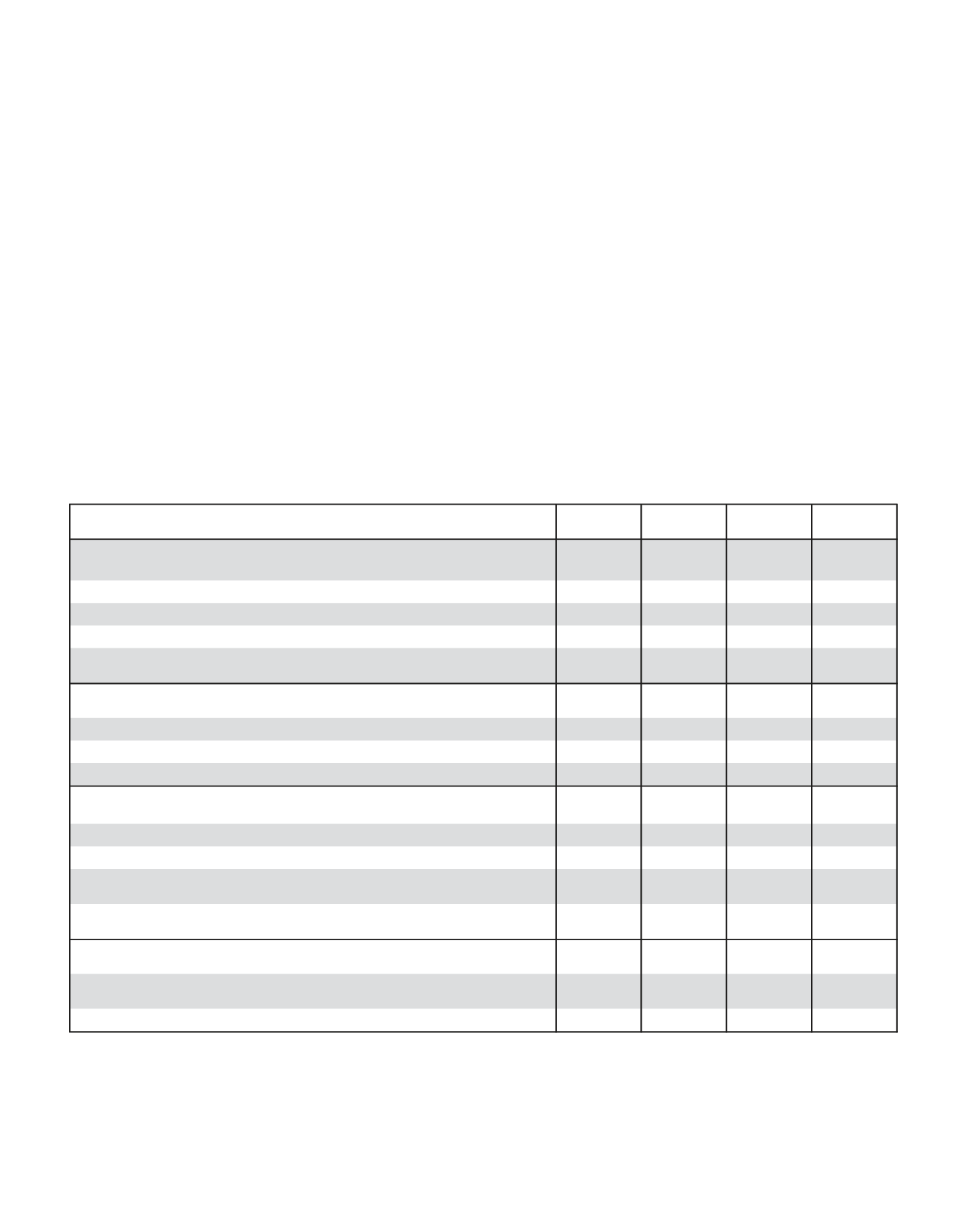

2014 MIP Targets and Actual Performance:

The following descriptions of the corporate and

business segment metrics and objectives for 2014 MIP

apply to the NEOs.

Corporate Metrics:

Minimum

Goal

Target

Goal

Maximum

Goal

2014 Actual

N/A

$6.31

$6.49

$6.42

16% 20% 24% 22.9%

550% 650% 750% 945%

Growth of operating earnings per diluted share on a consolidated basis for the

company (excluding foreign currency effect)

Statutory Risk Based Capital Ratio

Solvency Margin Ratio

500% 575% 650% 857%

Net Investment Income (Consolidated)

Budget

minus 2% Budget

Budget plus

2%

Budget plus

1%

0.00% 2.50% 5.00% 0.70%

0.75% 1.50% 2.25% 1.20%

Increase in Premium Income

Increase in Pretax Operating Earnings

2.00% 3.50% 5.00% 3.30%

2.00% 4.50% 7.00% 6.12%

Increase in New Annualized Premiums (increase in third sector sales)

Increase in Premium Income

1.50% 2.25% 3.00% 1.91%

Budget plus

1% Budget

Budget

minus 1%

Budget plus

1.5%

Operating expenses compared to budget

Increase in Pretax Operating Earnings before allocated expenses and foreign

currency change

-2.50% -1.50% -0.50% 0.24%

Global Investments Metrics (Eric M. Kirsch only):

Net Investment Income (Consolidated)-

-same as above

Budget

minus 2% Budget

Budget plus

2%

Budget plus

1%

Credit Losses/Impairments

(in millions)

($500)

($350)

($200)

$184

In establishing our 2014 MIP objectives, we considered

certain headwinds previously disclosed to the public in

October 2013 that pressured expected EPS growth,

direct premium growth and pretax operating earnings

growth in Japan. Therefore, these objectives were

lower than the prior year. The incentive measures

described above include statistical and non-GAAP

financial measures as more fully described as follows:

Our corporate performance measure is based

on operating earnings per diluted share,

31

U.S. Segment Metrics:

Increase in New annualized Premiums

Japan Segment Metrics:

Operating Return on Shareholder Equity (excluding foreign currency effect)