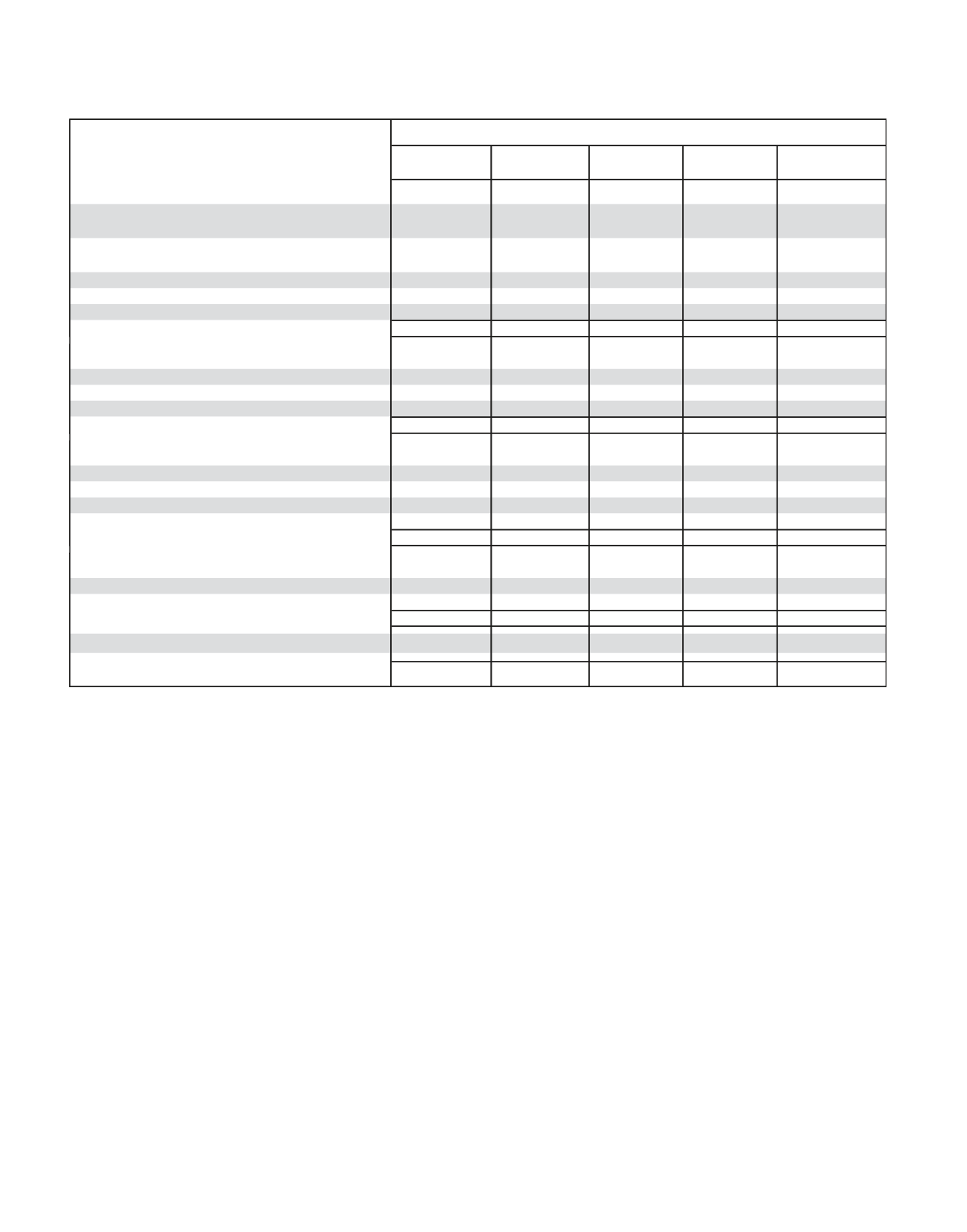

Weightings of Each Performance Objective for 2014:

Daniel P.

Amos

Kriss

Cloninger III

Paul S.

Amos II

Eric M.

Kirsch Tohru Tonoike

Corporate Objectives:

Operating Earnings per share (excluding foreign

currency effect)

27.27% 23.32% 24.00% 20.00%

15.00%

Operating Return on Shareholder Equity (excluding

foreign currency effect)

6.82% 6.67% 6.00% 7.50%

5.00%

Statutory Risk Based Capital Ratio

6.82% 6.67% 6.00% 5.00%

—

Solvency Margin Ratio

6.82% 6.67% 6.00% 5.00%

5.00%

Net Investment Income (Consolidated)

6.82% 6.67% 6.00%

—

5.00%

Subtotal Aflac Inc.

54.55% 50.00% 48.00% 37.50%

30.00%

U.S. Segment:

New Annualized Premium

4.55% 5.33%

—

—

—

Direct Premiums

4.55% 5.33%

—

—

—

Pretax Operating Earnings

4.55% 6.01% 8.00%

—

—

Subtotal

13.65% 16.67% 8.00%

—

—

Japan Segment:

New Annualized Premium

11.36% 10.00% 12.00%

—

15.00%

Direct Premiums

9.08% 10.00% 4.00%

—

5.00%

Operating Expenses

—

— 4.00%

—

5.00%

Pretax Operating Earnings

11.36% 13.33% 12.00%

—

15.00%

Subtotal

31.80% 33.33% 32.00%

—

40.00%

Global Investments:

Net Investment Income (Consolidated)

—

—

— 40.00%

—

Credit Losses/Impairments

—

—

— 15.00%

—

Subtotal

—

—

—

55.00%

—

Qualitative

12.00% 7.50%

30.00%

GRAND TOTAL

100.00% 100.00% 100.00% 100.00% 100.00%

Weightings of Annual Incentive Metrics as a Percent of Target

The performance measures are weighted for the NEOs

and all other officer levels of the Company. The intent

is to weight them according to how each position can

and should influence their outcome.

Qualitative Goals:

Actual performance relative to MIP targets was

determined after the end of the year and presented to

the Compensation Committee for discussion and

approval at its February 2015 meetings. The actual

non-equity incentive plan payments to the NEOs are

reflected in the 2014 Summary Compensation Table

below in the column labeled Non-Equity Plan

Compensation.

Further, for Mr. Paul S. Amos II and Aflac Japan

executive officers (including Mr. Tonoike), we added a

qualitative Aflac Japan business segment performance

metric for the management of the corporate value

enhancement project (“CVEP”) for 2014. Aflac Japan’s

CVEP is a business transformation program that was

designed to strengthen our business systems and

processes to maintain our leadership position in

Japan’s third sector products. During 2014, a review of

the program led to certain changes in the

transformation strategy. The performance achievement

was quantified based upon each officer’s involvement

with CVEP before and after management adopted

various adjustments to the transformation effort. Based

on this review, it was determined that Mr. Paul S. Amos

II and Mr. Tonoike achieved 100% and 25%,

respectively.

For 2014, Mr. Kirsch’s MIP metrics further emphasized

corporate and quantitative Global Investment

objectives, while Global Investments qualitative

measures were reduced significantly as those metrics

were focused on the initial development and

implementation of the Global Investment strategy. The

remaining qualitative measure was based on

succession planning to ensure that the critical function

of Global Investments leadership is a focus. For Mr.

Kirsch’s qualitative

Global Investments metrics, the

performance achievement was 100%.

33

—

—