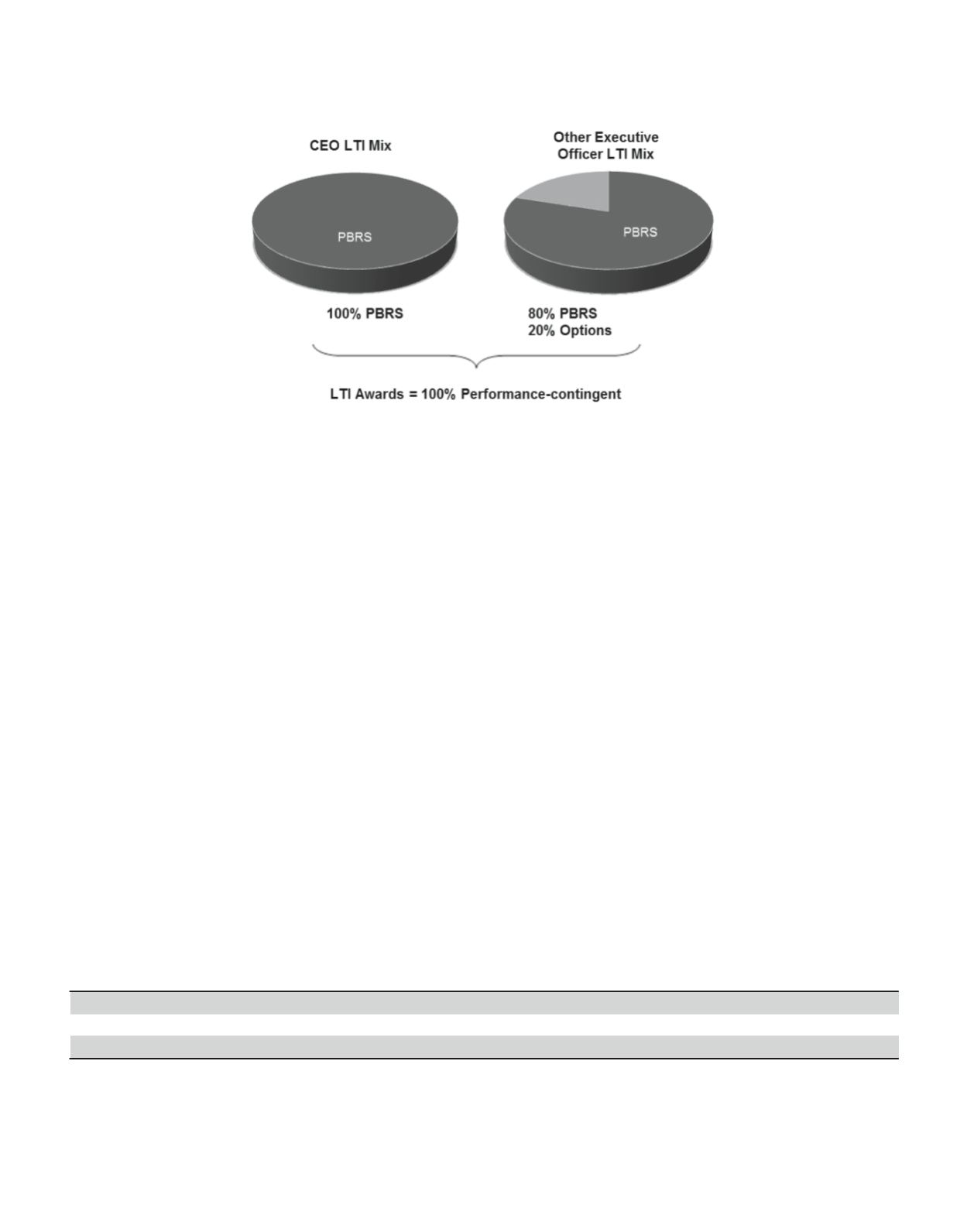

The targeted LTI mix for 2014 by officer group is as follows:

For PBRS awards that were granted in 2014, the

performance period is January 1, 2014 through

December 31, 2016. The performance measures for

determining vesting for these awards are based on the

achievement of the following specified ratios:

RBC as determined on a U.S. statutory

accounting basis at each calendar year end.

This performance measure was selected

because of the Company’s belief that capital

adequacy is a significant concern for the

financial markets and shareholder confidence.

SMR, associated with our regulatory reporting

to the Financial Services Agency in Japan, was

added as a performance metric for 2014. We

view maintaining a strong capital position as an

important priority. From a corporate

perspective, SMR is an equally important

capital metric as RBC. By adding the SMR

metric, we have included both the U.S. and

Japan

regulatory

capital

metrics

as

performance targets.

Operating return on shareholders’ equity

excluding foreign currency effect (“OROE”),

which was also added in 2013 as a MIP

performance metric for senior vice presidents

and above, is part of our financial management

process as this return metric measures our

earnings relative to our capital as reported to

our shareholders. The use of this metric allows

our shareholders to evaluate our financial

achievements relative to other organizations in

terms of how effectively we are using capital to

generate earnings. We believe this metric has a

significant influence on the value our

shareholders place on the Company.

We believe the capital measures (RBC and SMR) and

OROE results are equally important to our

shareholders. Accordingly, we have assigned equal

weights to RBC and SMR (target 25% each) to assess

how well we have met our performance based financial

objectives over the three year period beginning in 2014.

OROE has been assigned 50% weighting for target.

Performance Based Restricted

Credit for

Credit for

Credit for

Stock Performance Objectives Minimum Minimum Target

Target

Maximum Maximum

2014 to 2016

Value Attainment

Value Attainment Value Attainment

RBC

500% 12.5% 625% 25% 750% 37.5%

SMR

500% 12.5% 575% 25% 650% 37.5%

OROE

16% 25% 20% 50% 50% 75%

35

Stock

Options