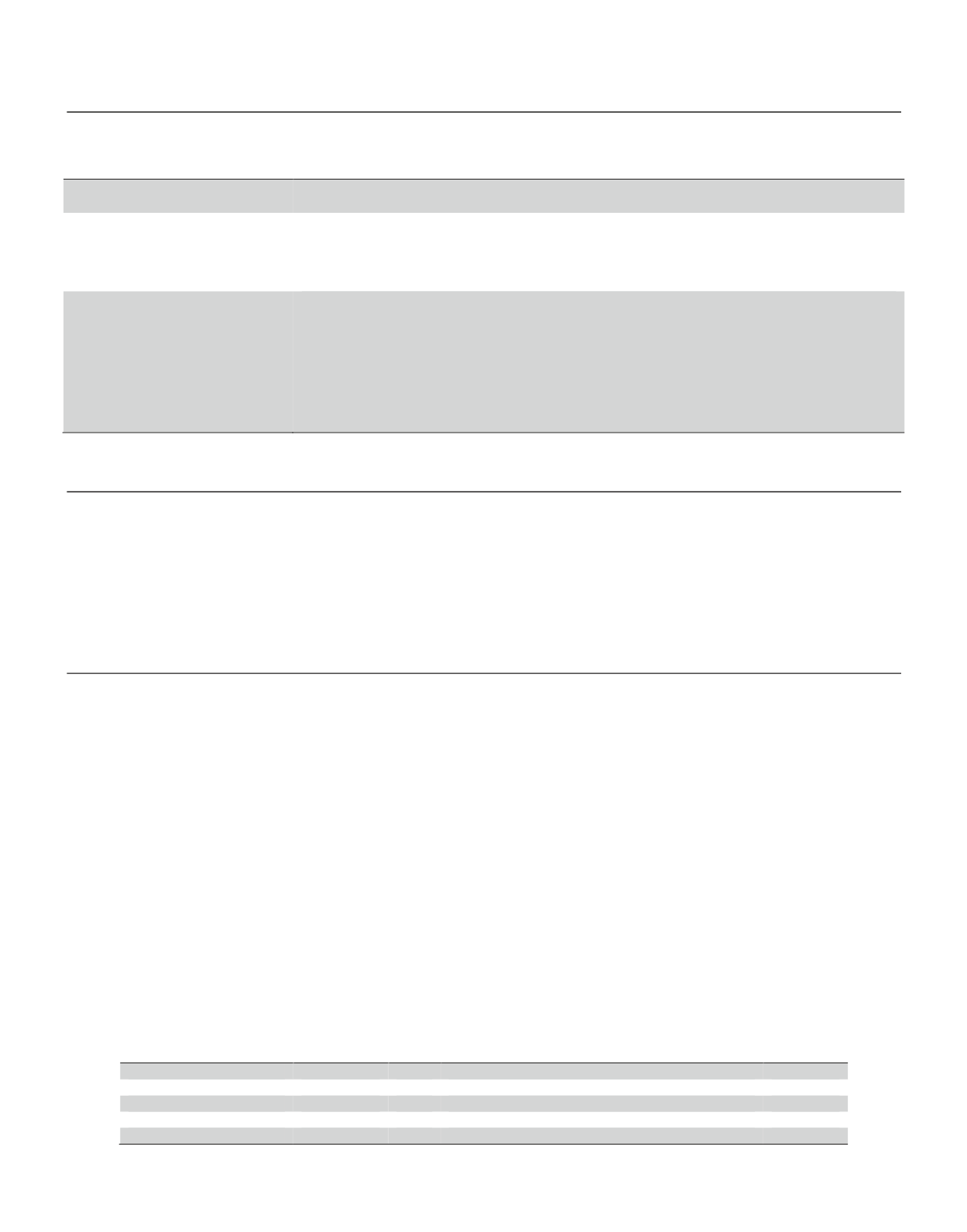

Timing and Key Features of the Program

The revised process for determining the CEO’s compensation, as was used in 2014, is as follows:

Element

Timing of Decision

Base Salary*

Established in December 2013 and paid during 2014

Annual Incentive Award (MIP)

Paid in cash in March of the following year after the Compensation Committee’s

review of performance

p

arameters set in February of the performance year

(e.g., fiscal

2014 MIP award paid in March 2015)

Long-term Incentives (LTI)

Two phases:

Contingent PBRS grant made in February (equal to 60% of prior year’s total

LTI grant date award value)

Final “true up” PBRS award (additional PBRS grant or reduction of contingent

February PBRS grant) made based upon current year performance to-date at

time of the Compensation Committee decision

Details regarding the base salary determination are included in the section titled “Base Salary” of this CD&A.

Annual Incentive Award (MIP)

The CEO’s annual cash incentive award is based on

the metrics and weightings detailed above in the section

titled “Management Incentive Plan (MIP)” of this CD&A.

As is the case with the other NEOs, parameters for

each of the goals are established in February of each

year and are prospective in nature (i.e., goals are set in

February 2014 for 2014 performance). The MIP

opportunity for the CEO is capped at 200% of his target

opportunity. The CEO’s MIP award for 2014

performance was $4,829,415.

Long-term Equity Incentive (LTI) Award

The CEO’s LTI award is made 100% in performance-

based restricted stock (PBRS) contingent upon, for

2014, the Company’s performance over a three-year

period on three metrics: RBC, SMR, and OROE, similar

to the PBRS awards granted to our other NEOs. The

metrics and their associated weightings for the PBRS

awards to the CEO are the same as those disclosed

previously in the section titled ”Long-term Equity

Incentives” beginning on page 34.

Similar to prior years, the size of the CEO’s 2014 LTI

award was based upon the Company’s relative

performance against its peers across the metrics shown

in the table below. In previous years, the Company’s

prior year’s relative performance to its peers was used

to set the CEO’s LTI award after information regarding

the compensation and financial performance for the

prior year was available for the peers. As the year-end

relative performance was used, the timing of the

process resulted in total compensation for a given year

being reported over two proxy statement cycles.

For 2014, the performance period for all non-total

shareholder return (TSR) metrics was the trailing twelve

month period ending September 30, 2014; for the two

TSR metrics, the Company’s TSR was compared

against the peers as of December 31, 2014. As

summarized below, the contingent grant to the CEO in

February 2014 was trued-up on December 31, 2014.

These modifications to the program relative to the

approach used in prior years help to better align the

CEO’s 2014 LTI grant and overall compensation with

our relative performance for the current year (i.e., 2014)

and removes the timing disconnect (i.e., amounts being

granted and reported over two years) that existed under

the previously-used approach.

Performance Metric

Weighting

Performance Metric

Weighting

Revenue Growth

1

Return on Average Equity

2

Net Income Growth

1

Return on Average Assets

2

Premium Income Growth

1

1-year Total Shareholder Return (2014)

4

EPS Growth

1

3-year Total Shareholder Return (2012 – 2014)

4

Return on Revenues

2

37