Based upon an analysis of the Company’s relative

financial performance and total shareholder return, the

Company ranked 14 out of 18 companies (17 peers

plus the Company); the lower the total weighted

composite score, the higher a company’s overall

ranking (rankings on each metric are out of 18

companies):

2014 Financial Performance Ranking Matrix

Aflac Incorporated Relative Ranking Among Peer Group

Aflac

Incorporated

Revenue

1-Year

Growth

Net

Income

1-Year

Growth

Premium

Income

1-Year

Growth

EPS

1-Year

Growth

Return on

Revenues

2014

Return on

Average

Equity

2014

Return on

Average

Assets

2014

1Yr

Indexed

TSR

(12/31/13-

12/31/14)

3Yr

Indexed

TSR

(12/31/11-

12/31/14)

Composite

Score

Performance

Rank

Relative

Ranking

(out of 18

companies)

14

14

12

14

3

1

8

17

17

—

—

Weightings

1

1

1

1

2

2

2

4

4

—

—

Totals

14

14

12

14

6

2

16

68

68

214

14

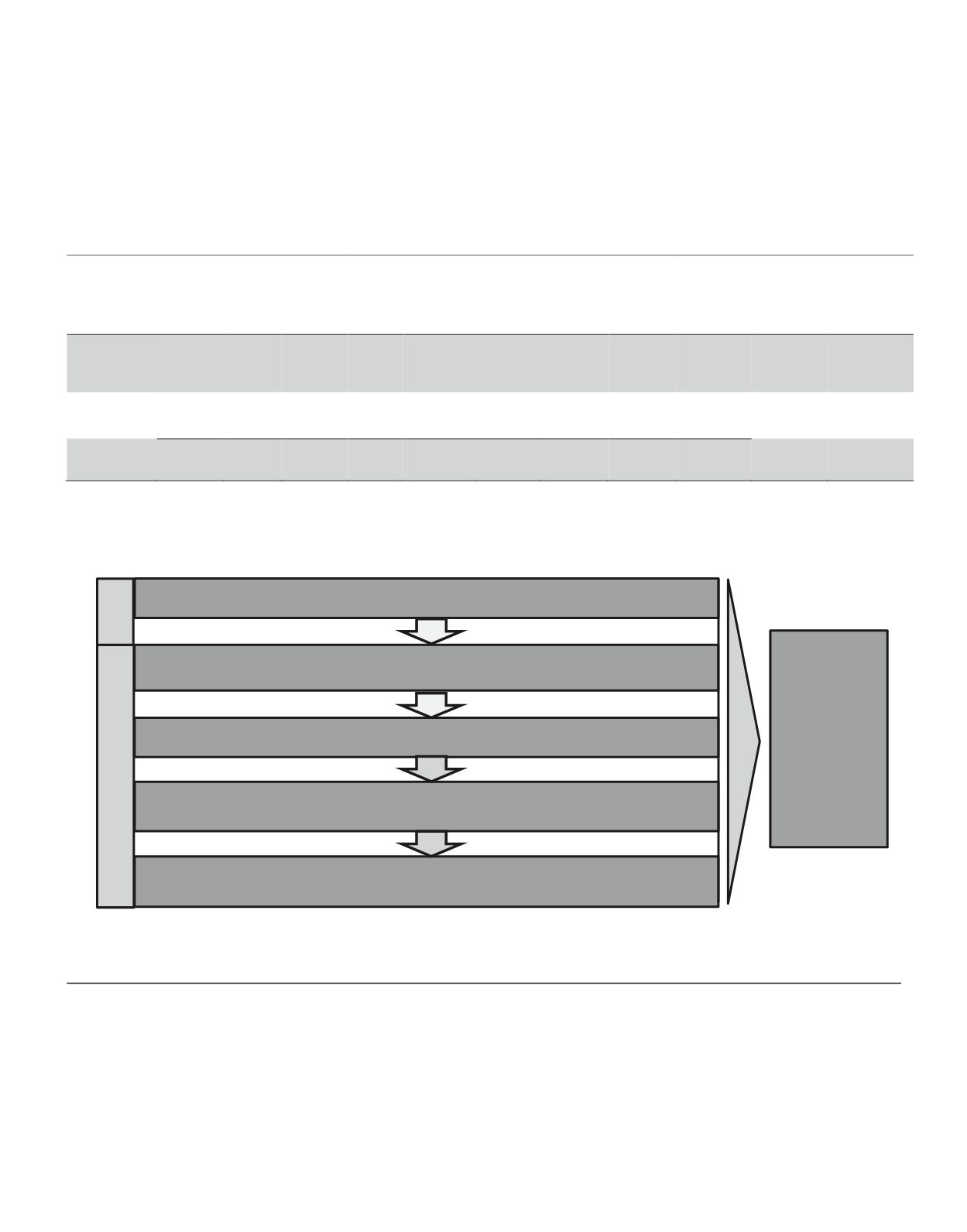

The CEO PBRS grant process is summarized below:

Determination of CEO Compensation

In conjunction with the relative performance

assessment, CEO total compensation relative to the

peer group is evaluated with the help of the Consultant.

The highest and lowest paid CEOs among the peers

are removed from the data set to mitigate the effect of

the outliers. Then, the Company’s relative performance

percentile ranking (14 out of 18, or 24

th

percentile

ranking) is applied to the remaining peer CEO

compensation data for the applicable year to derive an

implied total compensation amount for the Company’s

CEO. The resulting implied compensation level was

used in determining the CEO’s PBRS grant for 2014.

In addition to having to earn the PBRS grant amount

based upon the Company’s relative performance, the

grant of PBRS is not guaranteed and is contingent

Step 2:

Determine Aflac Incorporated’s relative financial performance against its peers

Step 3: Assess CEO TDC at peers

Step 4: Calculate TDC amount for Aflac Incorporated’s CEO based upon the Company’s

performance percentile ranking versus peers

Step 5: Determine CEO’s

final PBRS grant based on prior steps

—

adjust contingent

PBRS grant from February to reflect actual relative performance ranking

December

ecember

Step 1: Contingent PBRS grant issued

based on prior year’s performance

February

Grant

received

contingent on

performance

over next

three years;

thus, CEO has

to earn award

twice

38