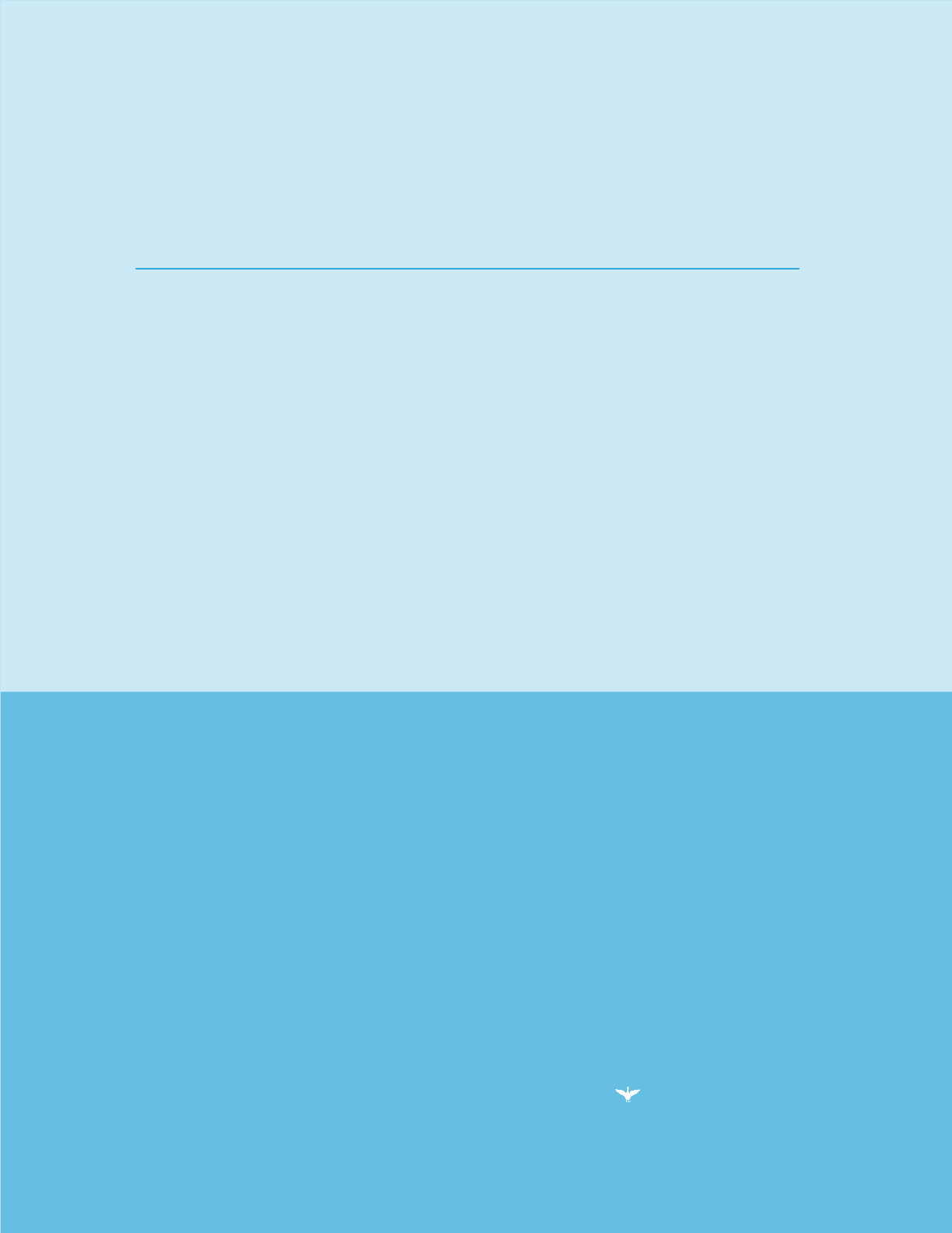

Aflac Japan – Key Operational Metrics

Total Number

of Agencies

Total Policies

Annualized

New

and Banks

Licensed

and Riders

Premiums

Annualized Representing

Sales

in Force*

in Force**

Premiums**

Aflac

Associates

2014

37,028 ¥1,594,433 ¥114,513

14,870

121,143

2013

36,117

1,567,112

149,308

16,293

126,584

2012

34,880

1,492,451

210,620

18,855

125,266

2011

33,372

1,343,663

161,033

20,146

120,744

2010

31,665

1,255,600

135,813

19,982

115,406

2009

29,934

1,200,437

122,345

19,635

110,528

2008

29,020

1,161,662

114,692

18,882

107,458

2007

28,443

1,125,561

114,636

18,461

100,810

2006

27,334

1,083,127

117,455

18,432

90,226

2005

26,014

1,027,762

128,784

17,960

81,751

*In thousands

**In millions

are many other Japanese citizens who both need and want our products. We are

striving to simultaneously reach them while serving our current policyholders with

compassion and dedication.

As consumers contend with ongoing challenges related to Japan’s strained

financial system, growing medical expenses and an aging population, it is likely

the national health care system will face additional financial pressure. This means

Japanese citizens will bear even more of the health care burden. We believe these

additional costs will continue to drive consumers to pursue financial solutions to help

manage financial costs related to the increasing health care burden. Aflac Japan will

be there to provide relevant solutions that can help.

As we look to the future, we believe Aflac products will continue to provide

valuable insurance options for consumers. As we plan upcoming product and distri-

bution activities, we believe consumers will continue to benefit from our policy offerings

in the future and we will continue the solid legacy we’ve built over the last 40 years.

AFLAC JAPAN

21