24

In 2014, Aflac U.S. continued its legacy and longstanding vision to be the number

one provider of voluntary insurance at the worksite in the United States* – a position

we’ve held for many years. We strive to accomplish our vision by remaining true

to our strategy for growth: offering relevant products through expanded distri-

bution channels to reach more accounts and customers. This requires being both

proactive and reactive to changes in the U.S. health care environment and workplace

demographics while also leveraging our company’s strengths.

In 2014, we concentrated our efforts on the following strategic pillars that are

core to our growth strategy in the United States:

• Focusing on our product innovation

• Improving and expanding our distribution

• Owning our customer experience

• Strengthening our low-cost model

We believe focusing on these strategic pillars affords us the opportunity to increase our

presence in the voluntary worksite markets and enhance profitability going forward.

In 2014, new annualized premium sales for Aflac U.S. were $1.4 billion, repre-

senting an increase of .7% over prior year sales. In the latter half of 2014, we made

structural changes to our sales management model and infrastructure designed

to improve our future

growth. We believe these changes will enhance the value we

deliver to our shareholders and bondholders.

We believe the need for our productswill continue to grow, andwe are supporting

various distribution channels to reach more businesses of all sizes. At the same time,

we seek opportunities to leverage our strong brand to support product growth in the

evolving health care environment.

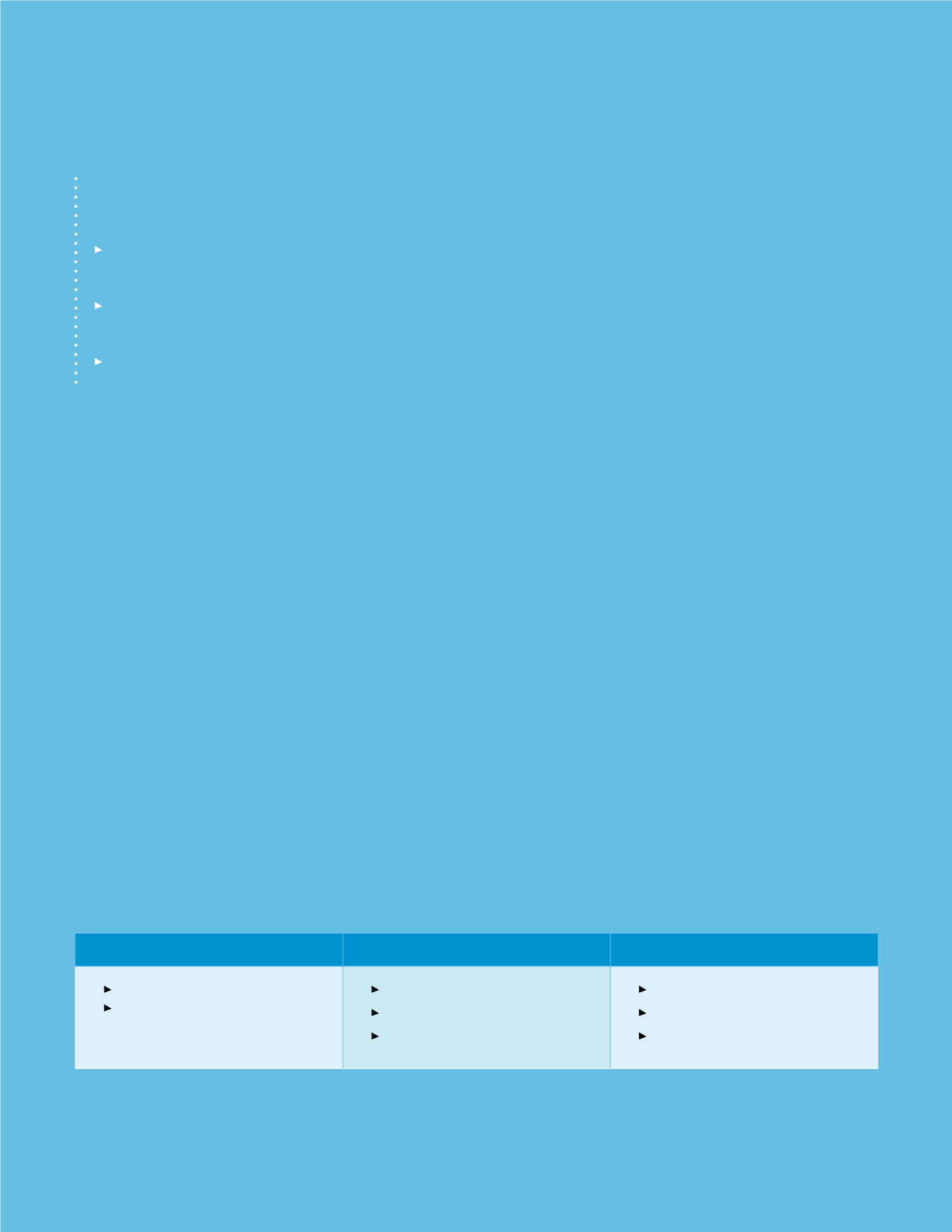

AFLAC U.S. PRODUCTS

INCOME-LOSS PROTECTION

ASSET-LOSS PROTECTION

SUPPLEMENTAL MEDICAL

Short-Term Disability

Life (term, whole)

Accident

Cancer

Critical Illness

Hospital Indemnity

Dental

Vision

Note: Cancer, Hospital Indemnity and Vision products are available as individual policies only in the U.S.; Benefits of group and individual policies may vary.

AFLAC U.S. 2014

FINANCIAL HIGHLIGHTS:

Premium income

rose

1.1% to $5.2 billion.

Total revenues

rose 1.2%

to $5.9 billion.

Pretax operating earnings

rose by 3.3% to $1.1 billion.

*Source: Eastbridge Consulting Group, Inc. U.S. Worksite/Voluntary Sales Report. Carrier

Results for 2013. Avon, CT: April 2014

Aflac U.S.

Living the Legacy of Protecting our Policyholders