134

IMI plc

SECTION 4 – CAPITAL STRUCTURE AND FINANCING COSTS

Continued

4.7.6

Share-based payment charge for the year

The total expense recognised for the year arising from share-based payments

was £4.4m (2013: £8.5m) which comprises a charge of £14.4m (2013: £9.8m)

for the year offset by a credit of £10.0m (2013: £1.3m) in respect of lapses.

£4.9m (2013: £6.1m) of the total charge and £3.3m (2013: £0.4m) of the total

credit is in respect of options granted to directors.

4.7.7

Share-based payment valuation

methodology

The fair value of services received in return for share options granted are

measured by reference to the fair value of share options granted, based on a

Black-Scholes option pricing model. The assumptions used for grants in 2014

included a dividend yield of 2.8% (2013: 2.1%), expected share price volatility

of 31% (2013: 38%), a weighted average expected life of 3.5 years (2013:

3.5 years) and a weighted average interest rate of 1.1% (2013: 0.5%). The

expected volatility is wholly based on the historical volatility (calculated based

on the weighted average remaining life of the share options), adjusted for any

expected changes to future volatility due to publicly available information.

4.7.8

Other share-based payment disclosures

The weighted average remaining contractual life for the share options

outstanding as at 31 December 2014 is 7.24 years (2013: 7.15 years)

and the weighted average fair value of share options granted in the

year at their grant date was £8.03 (2013: £7.56).

The weighted average share price at the date of exercise of share

options exercised during the year was £14.68 (2013: £13.12).

4.8

Non-controlling interests

Non-controlling interests are recorded as reductions from the income and

equity recorded in the Group’s financial statements. In accordance with IFRS,

these arise because if the Group controls an operation, it accounts for that

operation as if the Group were the only party holding an interest in it, but in

spite of this control, when other parties have an interest in the operation,

that interest should be reflected.

The deduction from income and equity therefore reflects the reduction in

the Group’s interest resulting from the third party’s interest.

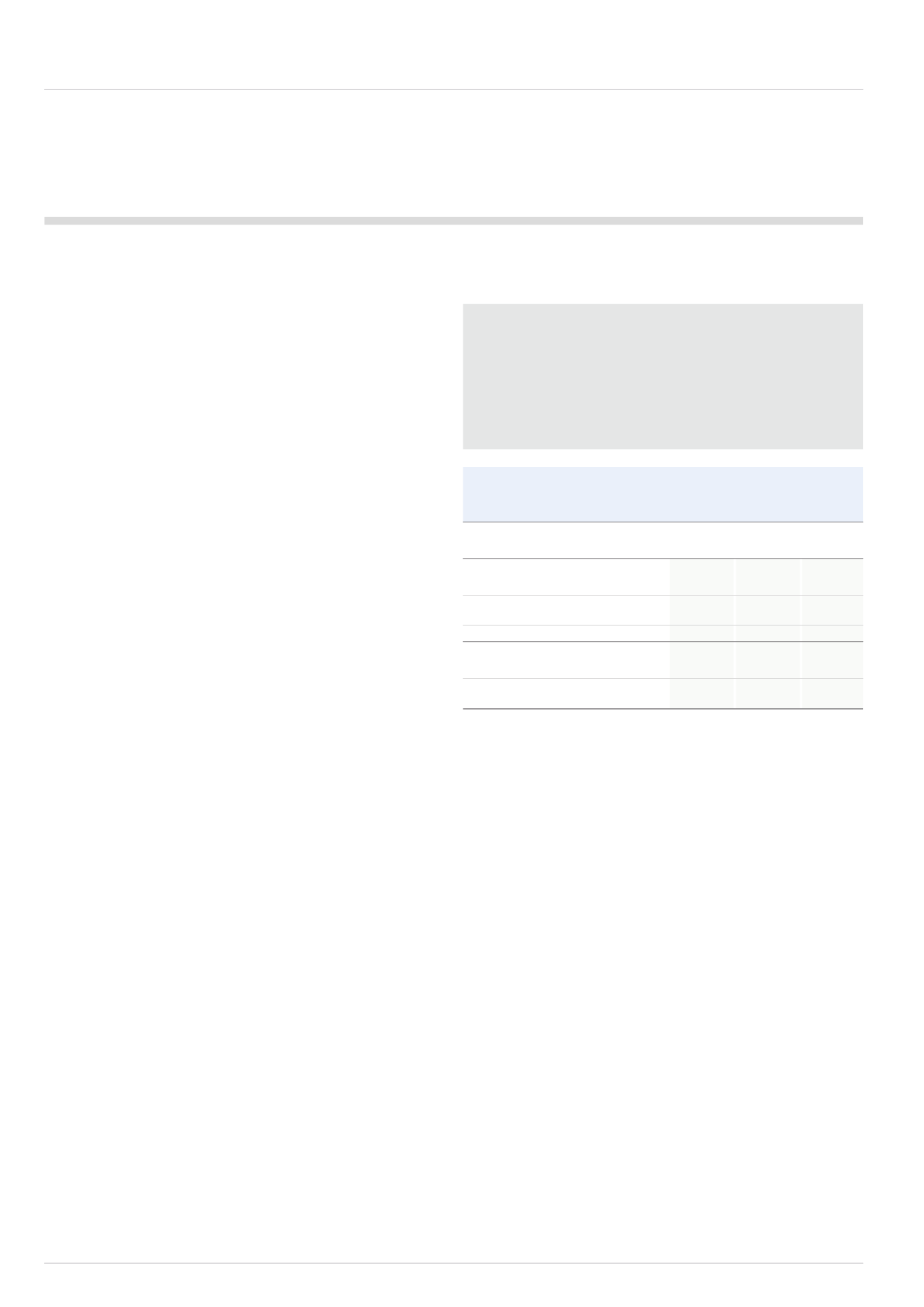

Shanghai

CCI

SLP

Total

£m

£m

£m

Non-controlling interests as at

1 January 2014

2.7

43.9

46.6

Profit for the year attributable to

non-controlling interests

-

2.8

2.8

Dividends paid to

non-controlling interests

(0.2)

-

(0.2)

Income earned by partnership

(4.4)

(4.4)

2014 movement in

non-controlling interest

(0.2)

(1.6)

(1.8)

Non-controlling interest as

at 31 December 2014

2.5

42.3

44.8

The non-controlling interest denoted Shanghai CCI in the above table

represents the 30% ownership interest in the ordinary shares of Shanghai

CCI Power Control Equipment Co Limited held by Shanghai Power Station

Auxiliary Equipment Works Co Limited.

The non-controlling interest denoted SLP relates to an interest in the IMI

Scottish Limited Partnership which was owned by the IMI Pension Fund

(‘The Fund’), which provided the Fund with a conditional entitlement to receive

income of £4.4m per annum unless the Group has not paid a dividend in the

prior year or the Fund was fully funded. As referred to in section 4.5.2, during

the year the IMI Pension Fund commenced winding up procedures and the

relevant liabilities were transferred to one of two new funds, IMI 2014 Deferred

Fund and IMI 2014 Pensioner Fund (together ‘The Funds’). The interest in the

SLP is now held jointly by the Funds and will continue to provide income of

£4.4m per annum unless the Group has not paid a dividend in the prior year

or the Funds are fully funded.