129

Annual Report and Accounts 2014

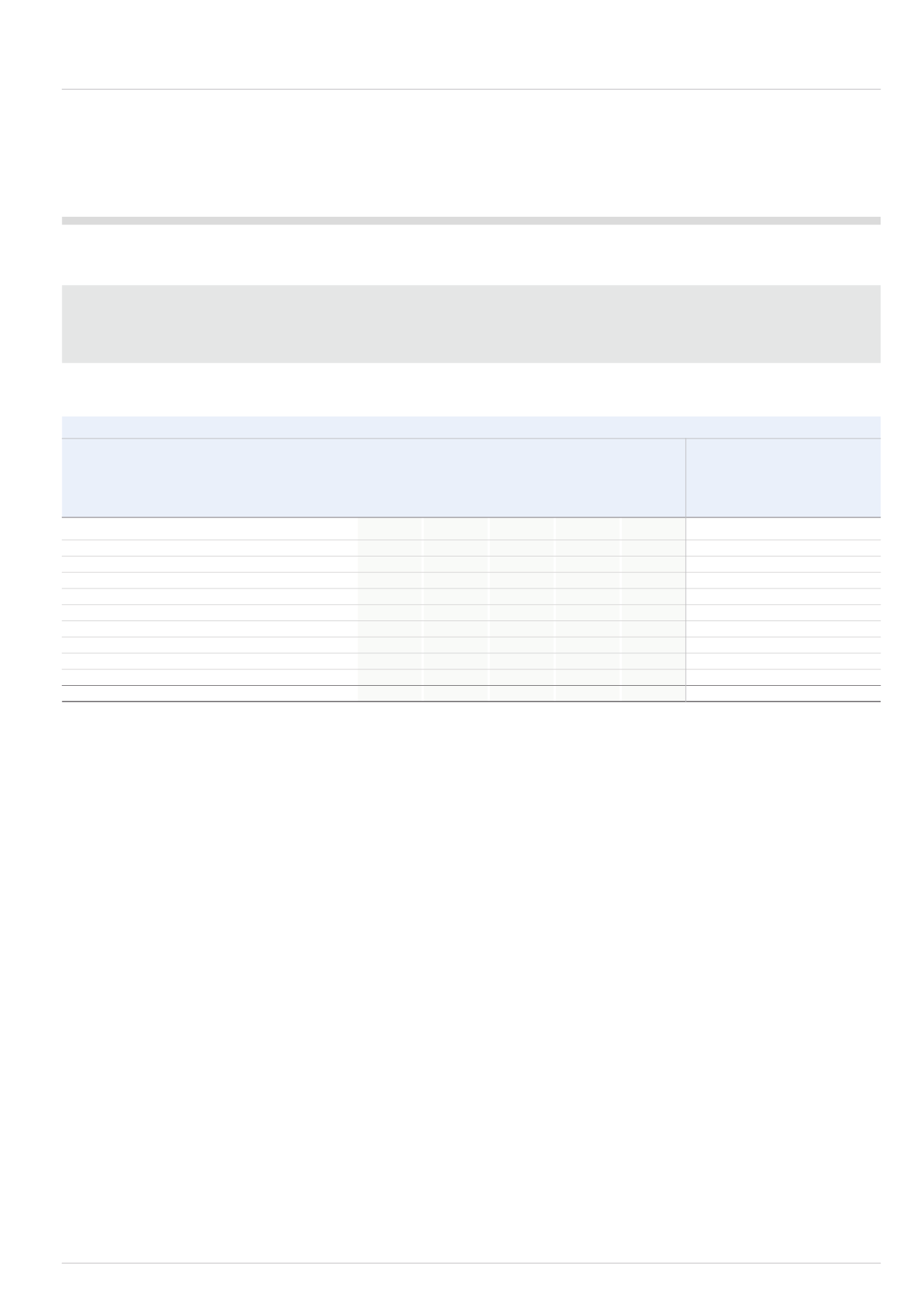

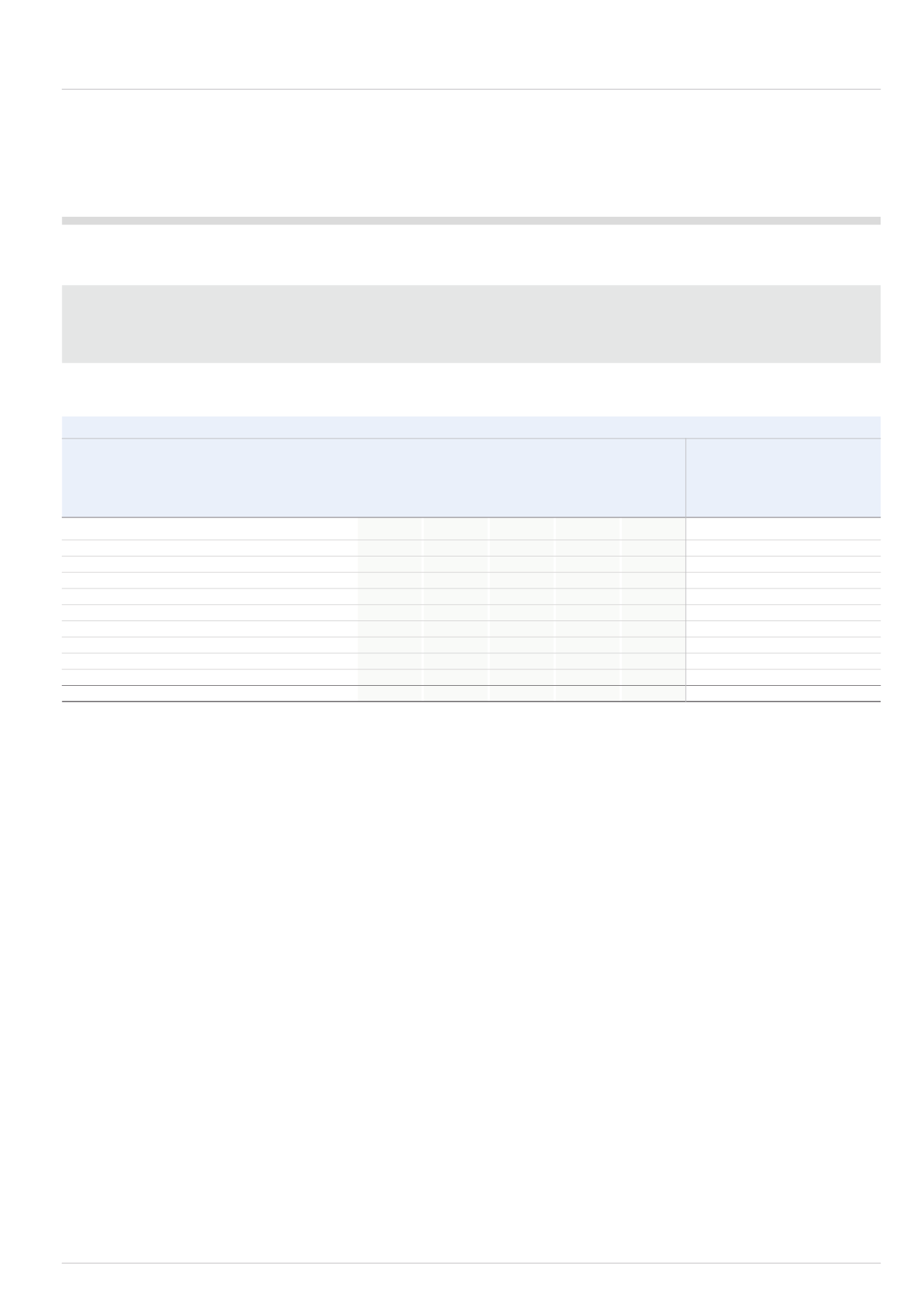

4.6 Share capital

The ordinary shareholders of the Group own the Company. This section shows how the total number of ordinary shares in issue has changed during the

year and how many of these ordinary shares are held as Treasury shares or in Employee Benefit Trusts, to be used to satisfy share options and awards to

Directors and employees of the Company, as part of employee share ownership programmes. This section also sets out the dividends paid or proposed to

be paid to shareholders.

4.6.1 Number and value of shares

2014

2013

Ordinary

Ordinary

Deferred

Shares

Shares ‘B’ Shares ‘C’ Shares

shares

25p per 28 4/7p per

200p per 0.001p per 0.001p per

share

share

share

share

share

Ordinary shares of 25p each

Number (m) Number (m) Number (m)

Number (m) Number (m)

Value (£m)

Number (m)

Value (£m)

In issue at the start of the year

341.0

-

-

-

-

85.3

340.7

85.3

Share cancellations

(14.6)

-

-

-

-

(3.7)

-

-

Share consolidation

(326.4)

285.6

-

-

-

-

-

-

Issued to satisfy employee share schemes

-

0.4

-

-

-

0.1

0.3

-

Issue of ‘B’ shares - Immediate Capital Option

-

-

75.9

-

-

151.9

-

-

Issue of ‘B’ shares - Deferred Capital Option

-

-

5.5

-

-

10.9

-

-

Redemption of ‘B’ shares at nominal value

-

-

(81.4)

-

-

(162.8)

-

-

Issue of ‘C’ shares - Income Option

-

-

-

228.7

-

-

-

-

Dividend paid on ‘C’ shares

-

-

-

(228.7)

228.7

-

-

-

Cancellation of deferred shares

-

-

-

-

(228.7)

-

-

-

In issue at the end of the year

-

286.0

-

-

-

81.7

341.0

85.3

Share consolidation

The B and C Share Scheme was accompanied by a share consolidation, which is a commonly used arrangement to ensure that the Group’s share price after the

return of capital is broadly equivalent to the share price prior to the return of capital, which ensures that targets and prices in the Group’s various share-based

remuneration schemes remain appropriate.

On 16 January 2014 the Company cancelled 14,598,706 ordinary shares that had been held as treasury shares. On 13 February 2014 the Company cancelled

a further 5 ordinary shares that had been held as treasury shares.

On 17 February 2014, the Group effected the return of cash to shareholders. 75,928,619 ‘B’ shares of 200 pence each were issued under the Immediate

Capital Option; 5,475,074 ‘B’ shares of 200 pence each were issued under the Deferred Capital Option; and 228,744,051 ‘C’ shares of 0.001 pence each

were issued under the Income Option.

‘B’ shares for both the Immediate Capital Option and Deferred Capital Option were redeemed at their nominal value of 200 pence per share on 17 February

2014 and 6 April 2014, respectively.

A dividend of 200 pence per share was declared on the ‘C’ shares, which was paid on 4 March 2014. Following declaration of the dividend the ‘C’ shares

became deferred shares.

On 17 February 2014, a share consolidation was performed whereby the existing ordinary shares of 25 pence per share were replaced by new ordinary

shares of 28 4/7 pence per share at a ratio of 7 new shares for 8 existing shares.

On 26 February 2014 the deferred shares were cancelled.