125

Annual Report and Accounts 2014

4.5.2

The IMI Pension Funds (now ‘The UK Funds’)

The United Kingdom constitutes 84% of Group defined benefit liabilities and

90% of Group defined benefit assets. Historically ‘the UK Funds’ offered final

salary benefits to UK employees until it closed to new entrants in 2005 and to

future accrual on 31 December 2010. The UK Trustee Board and the Company

have continued a gradual programme of de-risking activities. Recently this

has included:

In 2013 the Group increased its inflation hedging and reduced the investment

in higher risk assets to reduce the funding volatility. In 2014 £70m cash was

injected following the disposal of the Retail Dispense businesses, £53.2m of

which was paid in January 2014 which enabled the Trustee to remove

all exposure to public equities:

In December 2014, winding-up procedures commenced, with over 2,500

members accepting either trivial commutation payments or winding-up lump

sums as full settlement of their Fund pension. The total of the lump sum

payments was £25.2m and led to a £3.5m settlement gain. Those members

who were not eligible or did not take up the offer of a single cash lump sum

transferred to one of two new Funds (IMI 2014 Pensioner Fund or the IMI 2014

Deferred Fund). Both Funds will continue to be run by the same Trustee Board

as the IMI Pension Fund with assets held via the IMI Common Investment Fund.

The UK Trustee has determined an investment objective to achieve, over time,

a position of self-sufficiency, defined using a discount rate of gilts + 0.25%.

The last full actuarial valuation was undertaken as at 31 March 2014 and the six

year recovery plan agreed with the Company as a result of the 2011 Valuation

was re-ratified, with payments of £16.8m being paid each July until 2016.

Contributions paid or to be paid into the Group’s UK Funds since 2011,

are shown in the table below, split between the six year recovery plan and

additional contributions.

Recovery

Additional

plan

amounts

Total

£m

£m

£m

2011

16.8

36.1

52.9

2012

16.8

-

16.8

2013

16.8

16.8

33.6

2014

16.8

53.2

70.0

2015

16.8

-

16.8

2016

16.8

-

16.8

Total

100.8

106.1

206.9

The two new UK Funds will have actuarial valuations as at 31 March 2015

which, on completion, will lead to two new recovery plans (if required). As at

31 December 2014 the two UK Funds were, in total, 64% (2013: 54%) hedged

against interest rates and 70% (2013: 48%) hedged against UK inflation on

the Trustee’s self-sufficiency basis.

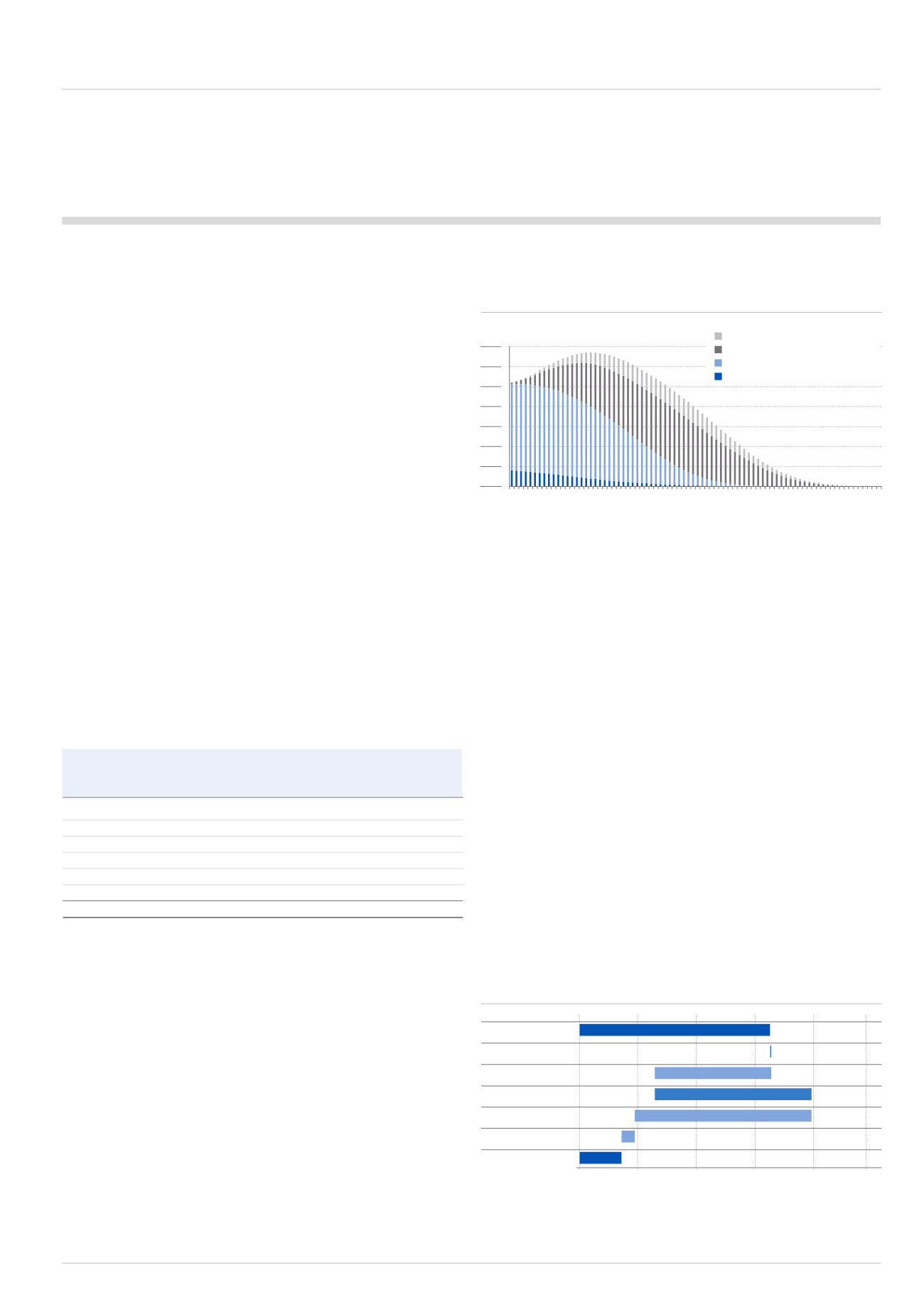

The following chart shows the projected liability cash flows by year of the

Group’s UK defined benefit liabilities:

4.5.3

Specific effect on financial statements

The corresponding entries for increases and decreases in the net pension

deficit reported in the balance sheet are reflected as follows:

•

Cash flow statement:

When the Group makes cash contributions to

fund the deficit they are reflected in the cash flow statement and reduce

the net deficit.

•

Other comprehensive income (‘OCI’):

Movements in the overall net

pension deficit are recognised through OCI when they relate to changes in

actuarial assumptions or the difference (‘experience gain or loss’) between

previous assumptions and actual results.

•

Income statement:

Movements in the overall net pension deficit are

recognised in the income statement when they relate to changes in the

overall pension promise, due to either an additional period of service (known

as ‘current service cost’), changes to pension terms in the scheme rules

(known as ‘past service cost’), or closure of all or part of a scheme (known as

settlements and curtailments). The interest charge/income on the net deficit/

surplus position is also recognised in the income statement.

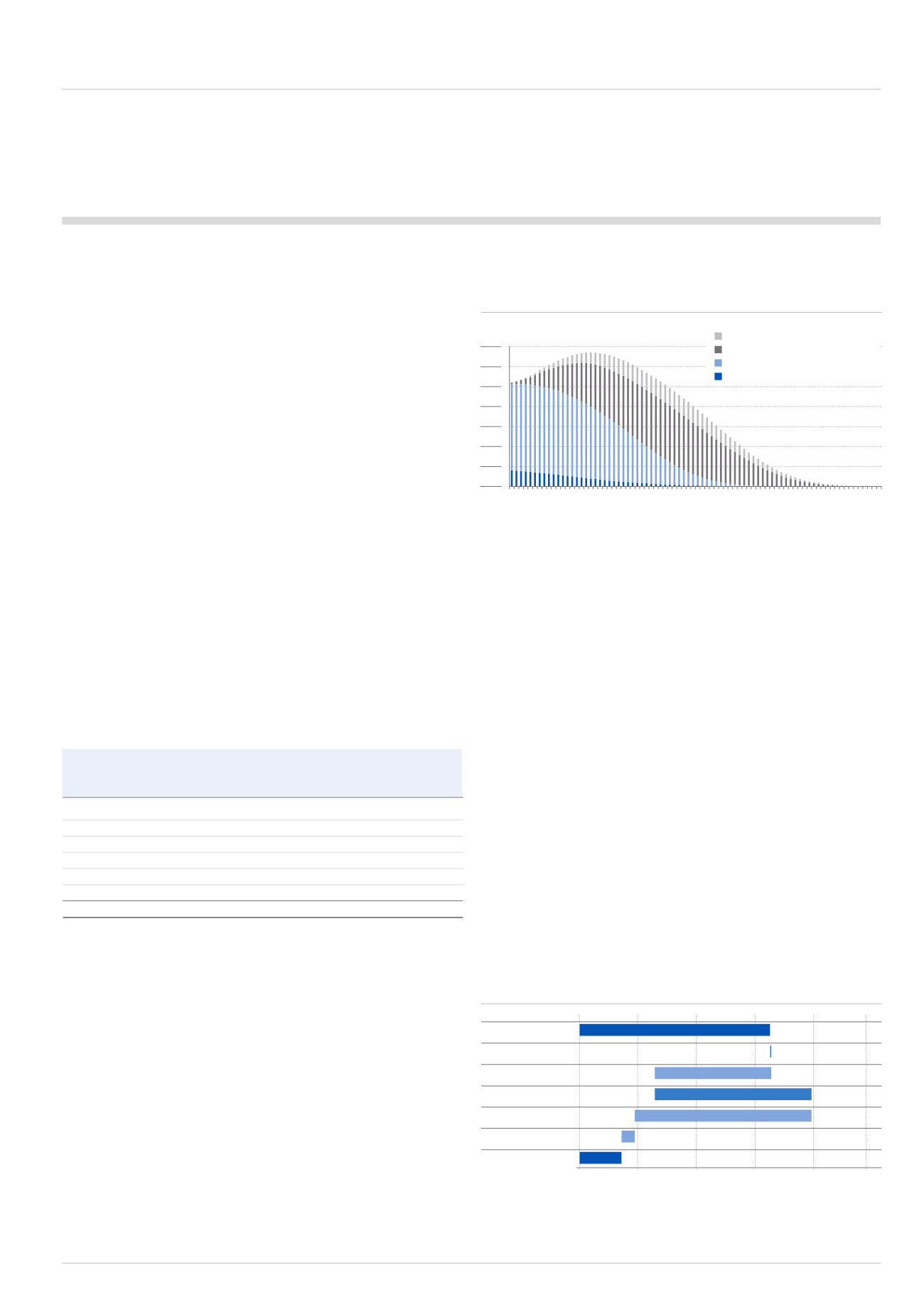

The following chart shows how the movements in the total net defined benefit

obligation in the balance sheet in the year were reflected in the financial

statements. As discussed earlier in this report, the comparative assets and

liabilities associated with the Retail Dispense businesses were separately

reported as assets or liabilities held for sale.

Net IAS19 Pension Deficit £m

As at 31.12.14

Other movements

OCI - Asset Returns

OCI - Assumptions

Contributions

Service Cost & Interest

As at 01.1.14

0.0

50.0

100.0

150.0

200.0

250.0

157.9

0.9

96.6

130.0

146.6

10.9

34.7

Current pensioners

Current dependents

Current preserved employed members

Current deferred pensioners

Split by membership type

20

10

30

40

50

60

£ millions

Year

1 APR 2014

MAY 2014

JUN 2014

JUL 2014

AUG 2014

SEP 2014

OCT 2014

NOV 2014

DEC 2014

JAN 2015

FEB 2015

MAR 2015

31 MAR 2015

70