128

IMI plc

SECTION 4 – CAPITAL STRUCTURE AND FINANCING COSTS

Continued

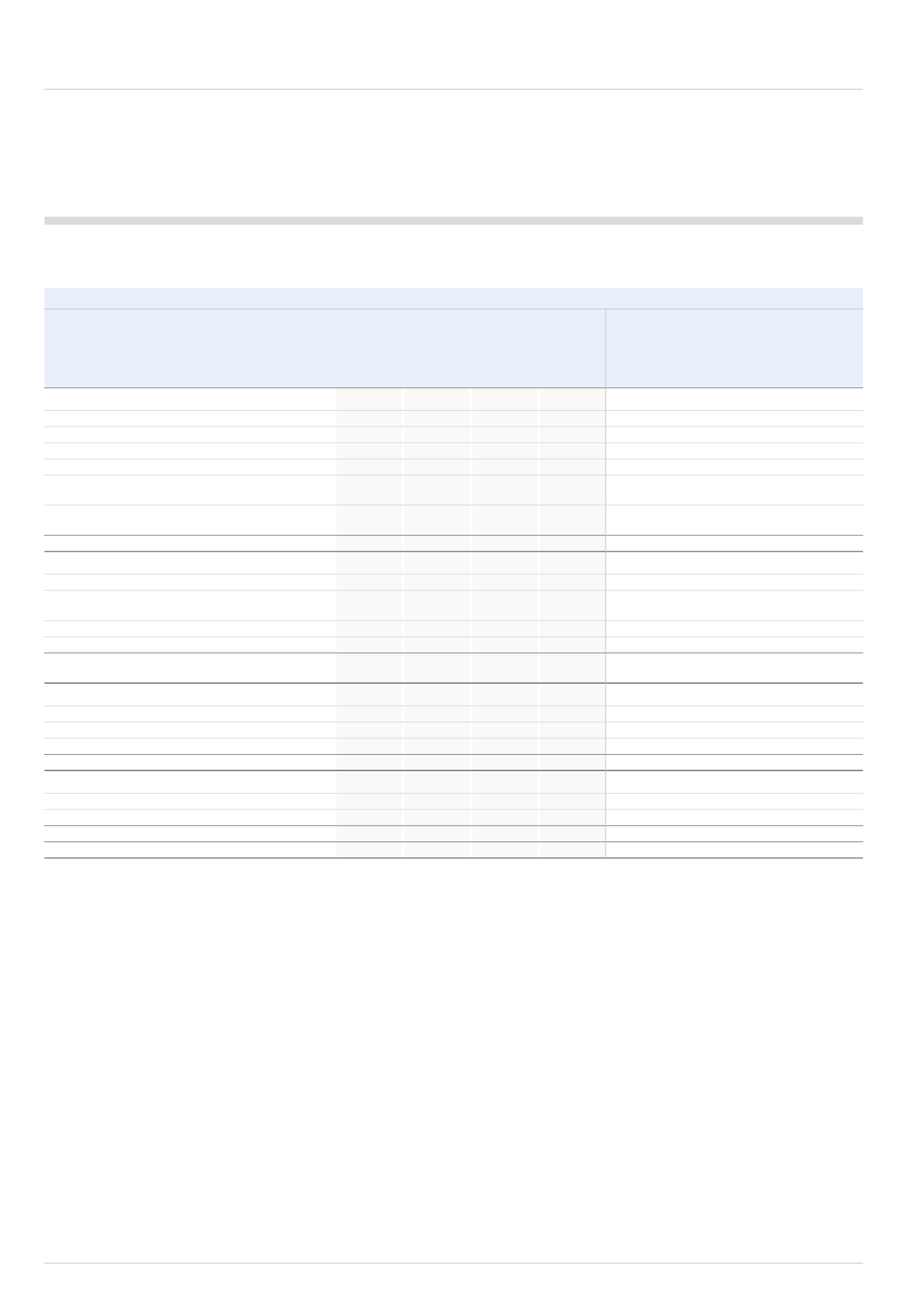

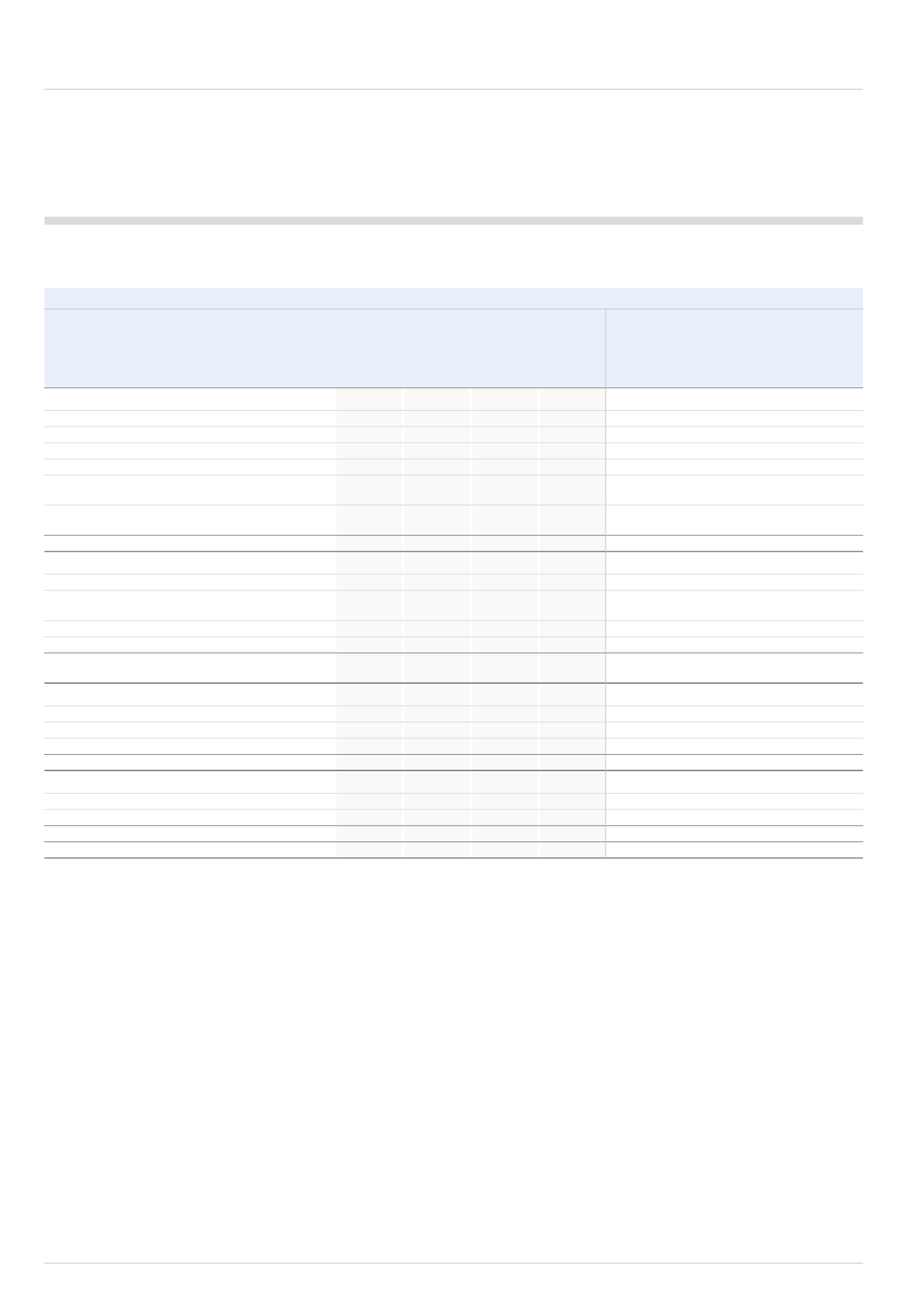

4.5.4 Overall reconciliation of changes in the net liability for defined benefit obligations

2014

2013

Net defined

Net defined

Defined

benefit

Defined

benefit

benefit

Asset

asset/

benefit

Asset

asset/

obligation

Assets

Ceiling

(liability)

obligation

Assets

Ceiling

(liability)

£m

£m

£m

£m

£m

£m

£m

£m

Brought forward at start of year

(1,450.2)

1,292.6

(0.3)

(157.9)

(1,442.5)

1,210.5

(0.2)

(232.2)

Current service cost

(4.9)

-

-

(4.9)

(6.1)

-

-

(6.1)

Past service cost - plan amendments

0.1

-

-

0.1

(0.7)

-

-

(0.7)

Past service cost - curtailment

-

-

-

-

0.1

-

-

0.1

Settlement

33.0

(25.0)

-

8.0

-

-

-

-

Net Interest (Cost)/Income on Net Defined Benefit

(Liability)/Asset

(59.7)

56.6

-

(3.1)

(56.4)

48.1

-

(8.3)

Immediate Recognition of losses -

Other Long-Term Benefits

(1.0)

-

-

(1.0)

(0.3)

-

-

(0.3)

Total (charged)/credited to income statement

(32.5)

31.6

-

(0.9)

(63.4)

48.1

-

(15.3)

Actuarial Gain due to Experience

13.1

-

-

13.1

8.6

-

-

8.6

Actuarial Loss due to Financial Assumption Changes

(146.4)

-

-

(146.4)

(22.8)

-

-

(22.8)

Actuarial Gain due to Demographic

Assumption Changes

3.3

-

-

3.3

0.4

-

-

0.4

Return on Plan Assets* Greater than Discount Rate

-

146.4

-

146.4

-

55.3

-

55.3

Change in Effect of Asset Ceiling

-

-

0.2

0.2

-

-

(0.1)

(0.1)

Total remeasurements recognised in other

comprehensive income

(130.0)

146.4

0.2

16.6

(13.8)

55.3

(0.1)

41.4

Employer contributions

-

74.4

-

74.4

-

41.2

-

41.2

Employee contributions

(3.1)

3.1

-

-

(3.2)

3.2

-

-

Benefits and settlements paid directly by the Company

22.2

-

-

22.2

7.7

-

-

7.7

Benefits paid from plan assets

65.0

(65.0)

-

-

65.4

(65.4)

-

-

Net cash outflow/(inflow)

84.1

12.5

-

96.6

69.9

(21.0)

-

48.9

Disposals

11.0

(3.9)

-

7.1

-

-

-

-

Transfer to liabilities held for sale

-

-

-

-

1.8

(1.0)

-

0.8

Changes in exchange rates

7.2

(3.4)

-

3.8

(2.2)

0.7

-

(1.5)

Total other movements

18.2

(7.3)

-

10.9

(0.4)

(0.3)

-

(0.7)

Carried forward at end of year

(1,510.4)

1,475.8

(0.1)

(34.7)

(1,450.2)

1,292.6

(0.3)

(157.9)

* Net of asset management costs