124

IMI plc

SECTION 4 – CAPITAL STRUCTURE AND FINANCING COSTS

Continued

The table below reconciles the movement in the UK and overseas defined

benefit obligation between 1 January 2014 and 31 December 2014.

UK Overseas

Total

£m

£m

£m

Net Defined Benefit Obligation

at 1 January 2014

(63.1)

(94.8)

(157.9)

Movement recognised in:

Income statement

3.4

(4.3)

(0.9)

Other comprehensive income

49.8

(29.4)

20.4

Cash flow statement

70.0

26.6

96.6

Disposals

-

7.1

7.1

Net Defined Benefit Surplus/

(Obligation) at 31 December 2014

60.1

(94.8)

(34.7)

Asset profile of schemes

The following table sets out the profile of the overall assets of the schemes

(to give an indication of their risk profile), the comparative amounts of the funded

and unfunded DBO and a split of the balance sheet impact between schemes

with a net pension surplus and a net pension deficit. As noted later in this section,

further de-risking was undertaken in January 2014, following the payment into the

UK Funds from the proceeds of the sale of the Retail Dispense businesses.

2014

2013

£m

£m

Quoted equities

22.9

32.0

Quoted bonds

703.1

558.4

Total quoted assets

726.0

590.4

Private equities

85.0

69.8

Insurance policies

287.9

286.6

IMI Scottish Limited Partnership

15.1

13.0

Hedge Funds

185.4

169.0

Property

34.8

40.1

Private finance initiatives

76.8

71.7

Other*

64.8

53.0

Total unquoted assets

749.8

703.2

Fair value of assets

1,475.8

1,293.6

Restriction due to asset ceiling

(0.1)

(0.3)

DBOs for funded schemes

(1,445.0)

(1,373.0)

DBOs for unfunded schemes

(65.4)

(79.0)

Included in liabilities held for sale

-

0.8

Net liability for DBOs

(34.7)

(157.9)

Schemes in net pension deficit

(94.9)

(158.2)

Schemes in net pension surplus

60.2

0.3

* ‘Other’ assets include the market value of interest, inflation, equity and

currency swaps relating to UK scheme assets and liabilities.

The overseas assets of £152.1m (2013: £147.1m) comprise equities of

£22.9m (2013: £32.0m), bonds of £88.7m (2013: £70.3m), property of

£9.5m (2013: £9.4m) and other assets of £31.0m (2013: £35.4m).

Funded:

The majority of the Group defined benefit and other post-employment

benefit arrangements are funded, which means they are linked to specific plan

assets that have been segregated in a trust or foundation.

Unfunded:

Plans that are not funded are those that are not backed by

segregated assets. These include some pension plans but also a number of other

long-term arrangements for the benefit of our employees, with benefits payable

while they are employed by the Group but more than 12 months after the related

service is rendered. Actuarial gains and losses on other long-term arrangements

are recognised in the income statement in the period in which they arise.

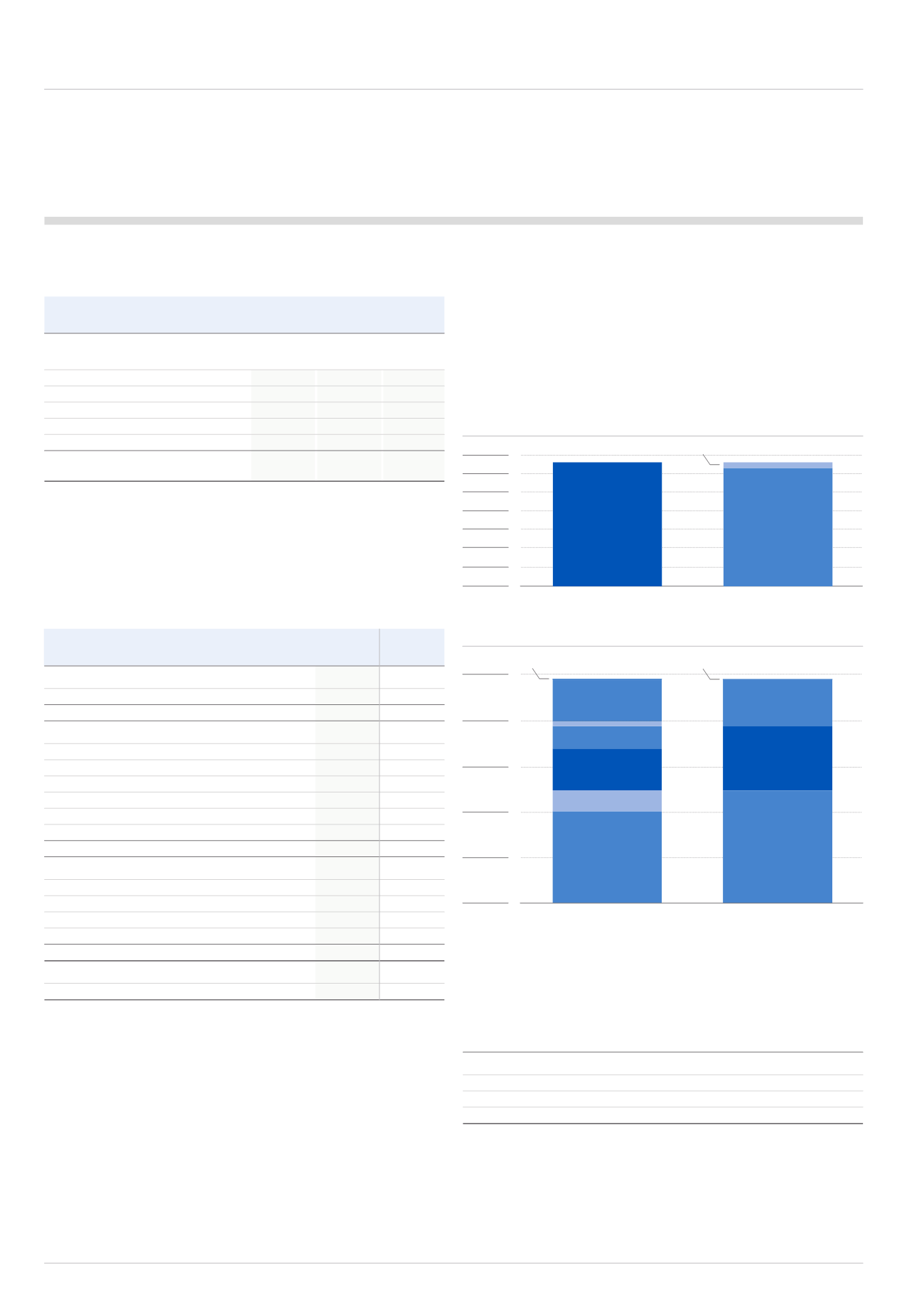

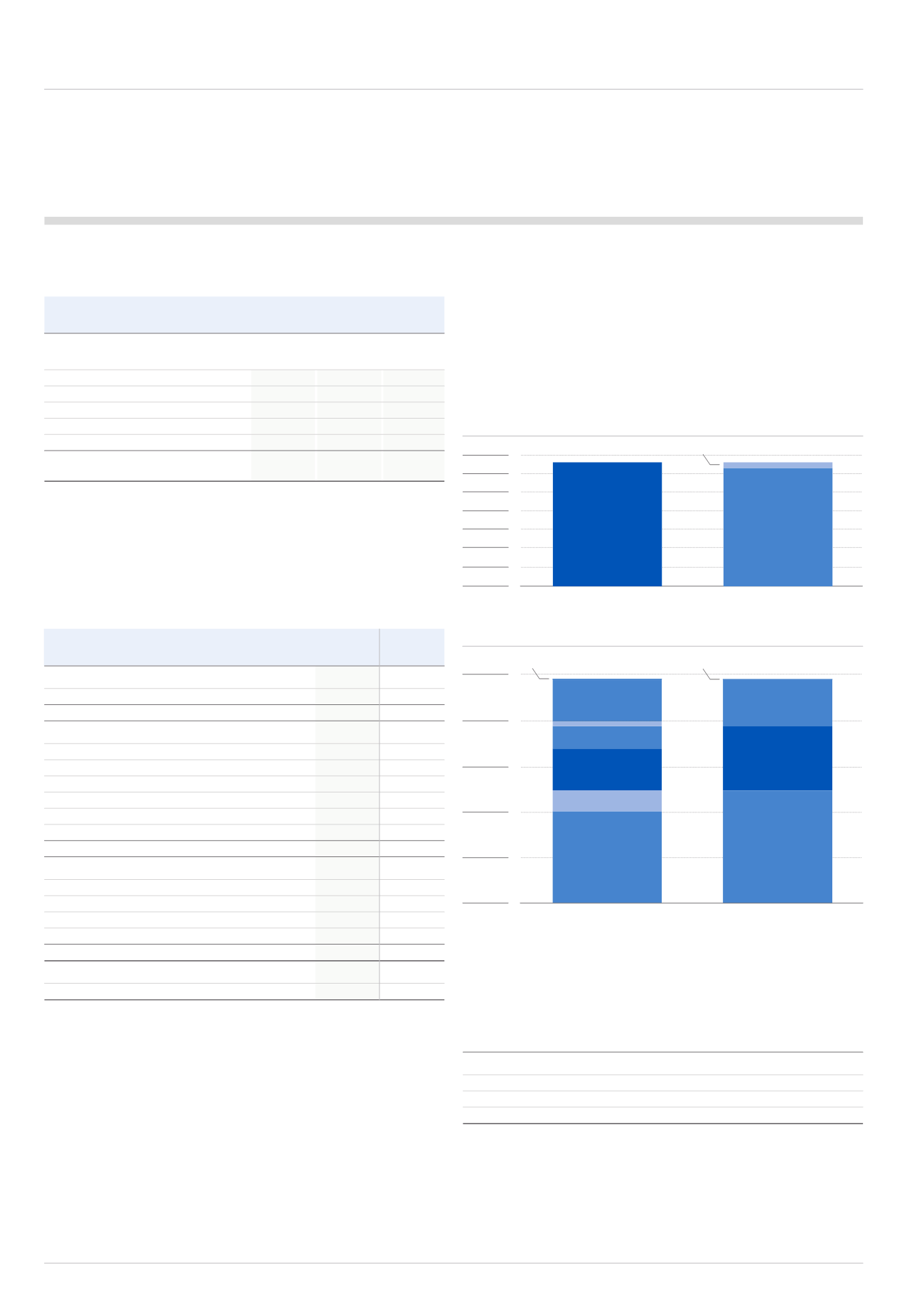

Regional split of defined benefit obligation

The following charts show the geographical profile of the total defined

benefit obligations:

UK pension assets & liabilities

Overseas pension assets & liabilities

The USA deficit above excludes £18.9m of assets relating to unqualified plans

classified as investments (see section 4.4.6).

Average Duration by geography

The following table shows the weighted average number of years (or duration)

over which pension benefits are expected to be paid:

Location

Years

UK

15.7

Switzerland

14.4

USA

14.1

Eurozone

15.4

Assets

Liabilities

£200.0

£400.0

£600.0

£800.0

£1,000.0

£1,200.0

£1,400.0

UK - £1,323.8m

UK - £1,263.7m

£50.0

£100.0

£150.0

£200.0

£250.0

Assets

Liabilities

USA - £46.0m

USA - £70.5m

USA Deficit - £24.5m

Switzerland - £101.0m

Switzerland - £124.2m

Eurozone - £5.0m

Switzerland Deficit - £23.2m

Eurozone - £51.4m

Other Deficit - £0.7m

Other - £0.7m

UK Surplus £60.1m

Eurozone Deficit - £46.4m