127

Annual Report and Accounts 2014

2014 Years

2013 Years

2012 Years

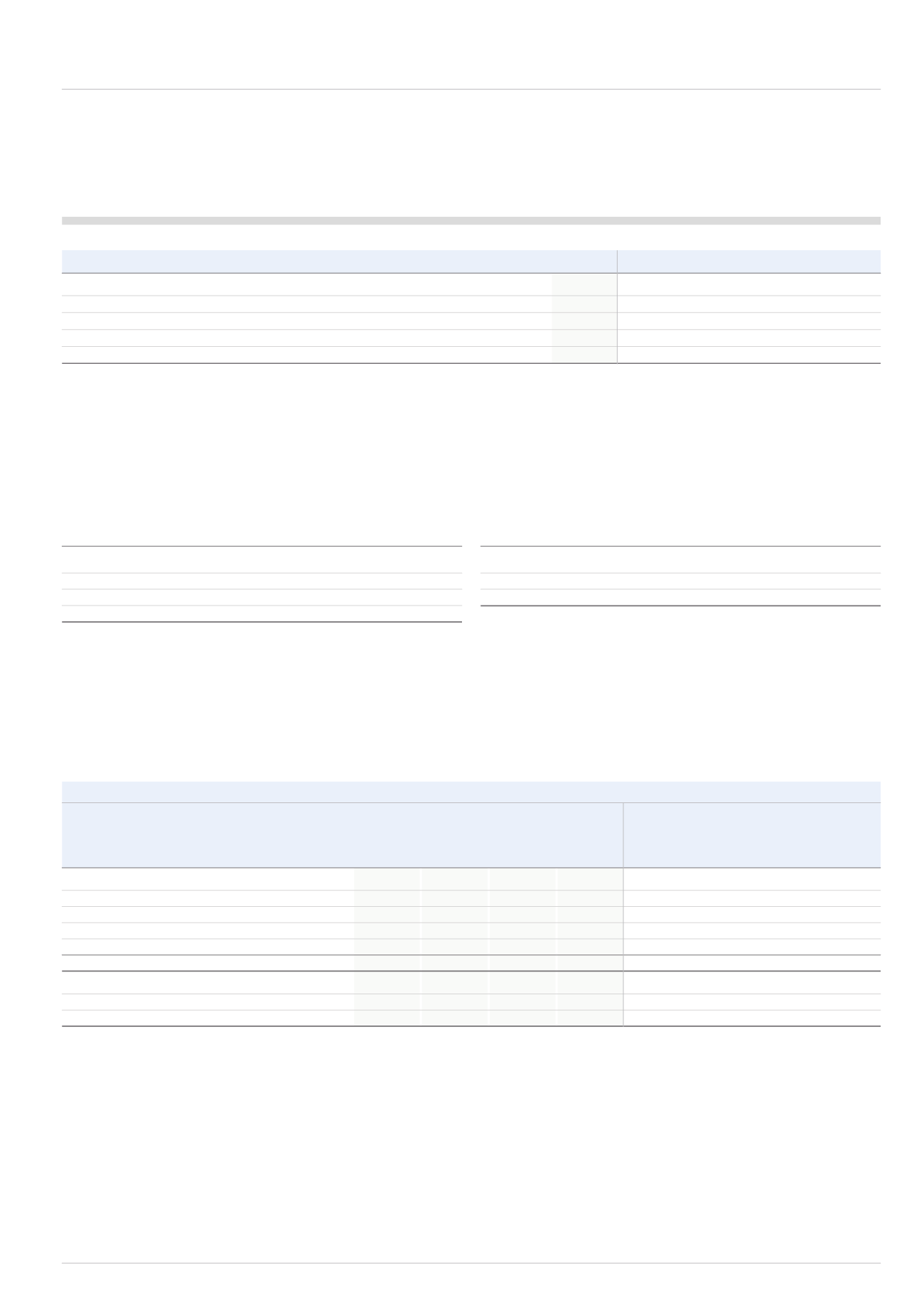

Life expectancy at age 65 (UK Funds only)

Current male pensioners

21.2

21.0

20.9

Current female pensioners

24.0

23.9

23.8

Future male pensioners

23.0

22.8

22.7

Future female pensioners

26.0

25.9

25.8

The mortality assumptions used for the UK Funds above reflect its experience, together with an allowance for improvements over time. The experience was

reviewed as part of the formal triennial actuarial valuation carried out as at 31 March 2014, and the assumptions used as at 31 December 2014 and 2013 reflect

the results of this review. The allowance for future improvements in mortality rates from 2014 is in line with the CMI’s (a research body funded by the actuarial

profession to collect and analyse UK mortality rates) 2013 Core Projection model, with a long-term improvement rate of 1.5% pa.

The table below left illustrates how the UK Funds’ net pension surplus would decrease (excluding the impact of inflation rate and interest rate hedging),

as at 31 December 2014, in the event of the following reasonable changes in the key assumptions above.

The table below right shows how the net pension deficit for IMI’s non-UK plans would increase, in the event of the following reasonable changes in the key

assumptions above.

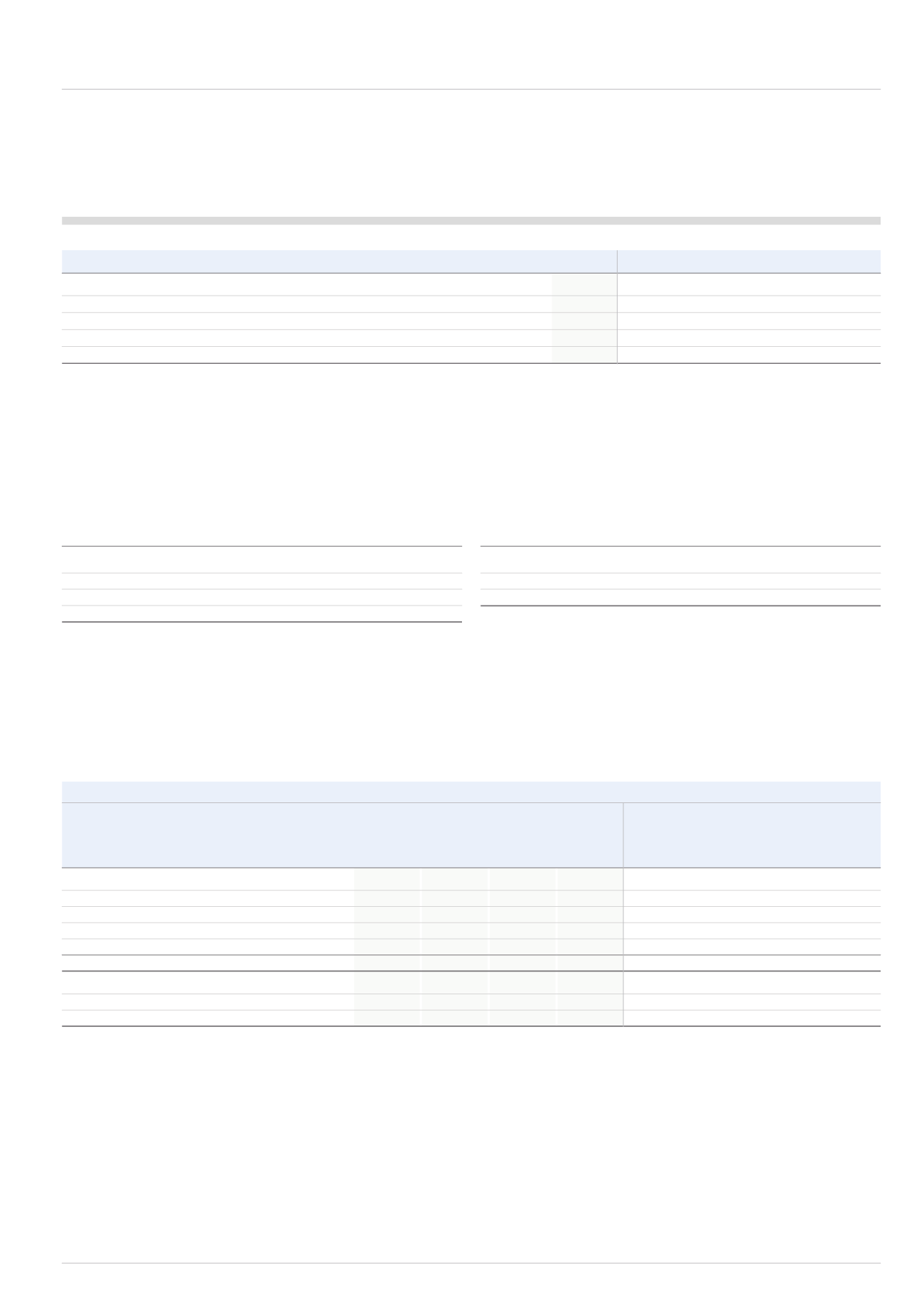

4.5.3.3 Income statement

In accordance with IAS19, pension costs recorded through the income statement primarily represent the increase in the defined benefit obligation based on

employee service during the year and the interest on the net liability or surplus for defined benefit obligations in respect of employee service in previous years.

The table below shows the total cost reported in the income statement in respect of pension obligations and therefore also includes the cost of DC schemes.

2014

2013

Overseas Overseas

Overseas

Overseas

post

non-post

post

non-post

UK employment employment

Total

UK employment employment

Total

£m

£m

£m

£m

£m

£m

£m

£m

Current service cost

-

4.1

0.8

4.9

-

5.4

0.7

6.1

Past service (credit)/cost

-

(0.1)

-

(0.1)

-

0.7

-

0.7

Settlement/curtailment

(3.5)

(4.5)

-

(8.0)

-

(0.1)

-

(0.1)

Recognition of losses

-

-

1.0

1.0

-

-

0.3

0.3

DC employer contributions

3.4

5.4

-

8.8

3.5

5.6

-

9.1

Pension expense - operating costs

(0.1)

4.9

1.8

6.6

3.5

11.6

1.0

16.1

Interest on DBO

52.5

6.7

0.5

59.7

49.0

6.9

0.5

56.4

Interest on Assets

(52.4)

(4.2)

-

(56.6)

(44.7)

(3.4)

-

(48.1)

Interest expense - financing costs

0.1

2.5

0.5

3.1

4.3

3.5

0.5

8.3

The settlement gain in relation to the UK Funds arose following the splitting of the UK fund into two newly formed schemes. The £4.5m overseas settlement gain

relates to the buy-out of our Swedish scheme, a further £1.0m of payroll taxes were incurred as a result of this, resulting in a net settlement gain of £3.5m. Both

settlement gains have been treated as exceptional items in the income statement, see section 2.2.3.

The income statement charges and credits in the above table are presented on a total Group basis (i.e. including both continuing and discontinued operations).

The charges relating to discontinued operations contributed £nil (2013: £0.4m) to the current service cost, £nil (2013: £2.1m) to the DC employer contributions

and £nil (2013: £0.4m) to the net finance expense.

UK

Discount rate 0.1% pa lower

£17m

Inflation-linked pension increases 0.1% pa higher*

£11m

Increase of one year in life expectancy from age 65

£41m

10% fall in non-bond-like assets**

£42m

Overseas

Discount rate 0.1% pa lower

£4m

Salary increases 0.1% higher

£1m

Increase of one year in life expectancy at age 65

£7m

In each case all other assumptions are unchanged.

* This is an in-payment pension increase sensitivity

** Fund assets excluding cash, bonds, insurance policies and the Funds’ interest in the IMI Scottish Limited Partnership.