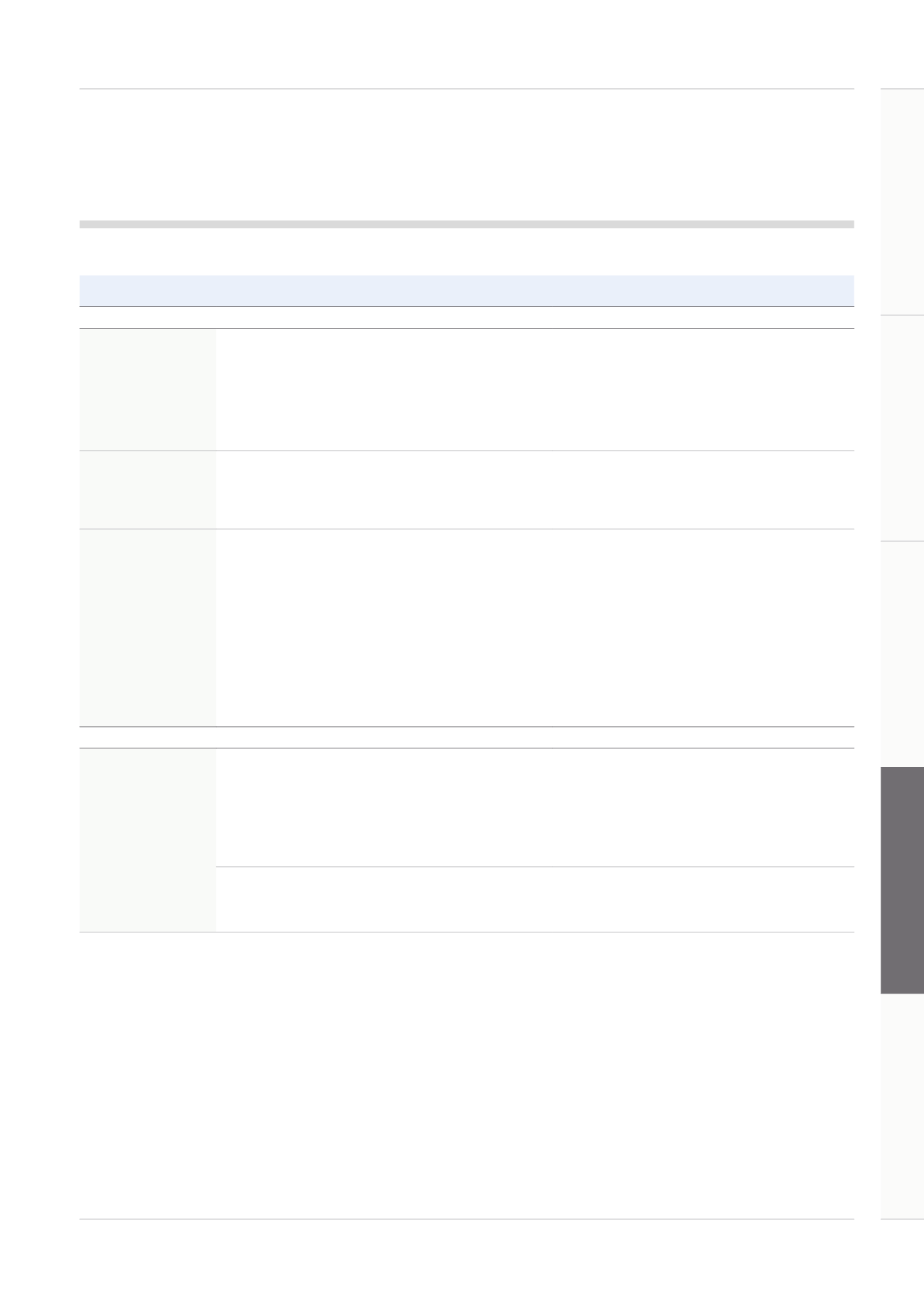

Future policy table – executive directors

Component & purpose Operation

Annual opportunity

Fixed elements of executive remuneration

Salary

Reflects individual

performance and

personal contribution

to delivering the Group

strategy. They are set

in the context of total

pay levels.

Reviewed annually with change normally effective from January.

When setting salary, the Committee takes into account the level

of increase for a reference group of comparable employees in the

leadership group, market data, business performance, external

economic factors, the complexity of the business and the role,

cost, and the incumbent’s experience and performance.

Normally any salary increase for an executive director will

be in line with those of the wider workforce. Increases

beyond this may be awarded in certain circumstances,

such as a change in responsibility after taking into account

the factors noted.

Pension

Provides for retirement

and supports succession

planning.

A cash allowance in lieu of pension is paid monthly. To the extent

required by law, part of this allowance will be paid into a defined

contribution pension arrangement. With the Committee’s approval

the executive directors may redirect all or part of the balance of this

allowance into a defined contribution pension arrangement.

Up to 30% of salary

Legacy obligations of 35% of salary for appointments to the

Board before October 2013 will continue to be honoured.

Benefits

Protects the well-

being of executives

and to provide fair and

reasonable market

competitive benefits.

The policy provides a normal range of benefits to executive

directors. These include but are not limited to:

Non-cash: private healthcare for themselves and their family,

life insurance, and other minor ancillary benefits.

Cash and taxable allowances: car and fuel allowance, personal tax

advice and two annual round trips for the Chief Executive and his

spouse between work and home locations.

Where it is in IMI’s interests to request that executives work in a

different country or region then we will pay relocation and provide

benefits and allowances in line with IMI’s Global Mobility Policy.

Expenses that are incurred by an executive director in undertaking

their role are reimbursed.

The values of benefits vary significantly year-on-year

depending on the age and health of the individual, the cost

of providing them and the geography in which the executive

is based. However, the range of the benefits is not expected

to change from year to year.

Should it be appropriate to relocate an executive director

or to recruit an executive director from overseas, flexibility

is reserved to provide benefits that ensure that the individual

and IMI can both achieve this commercial purpose.

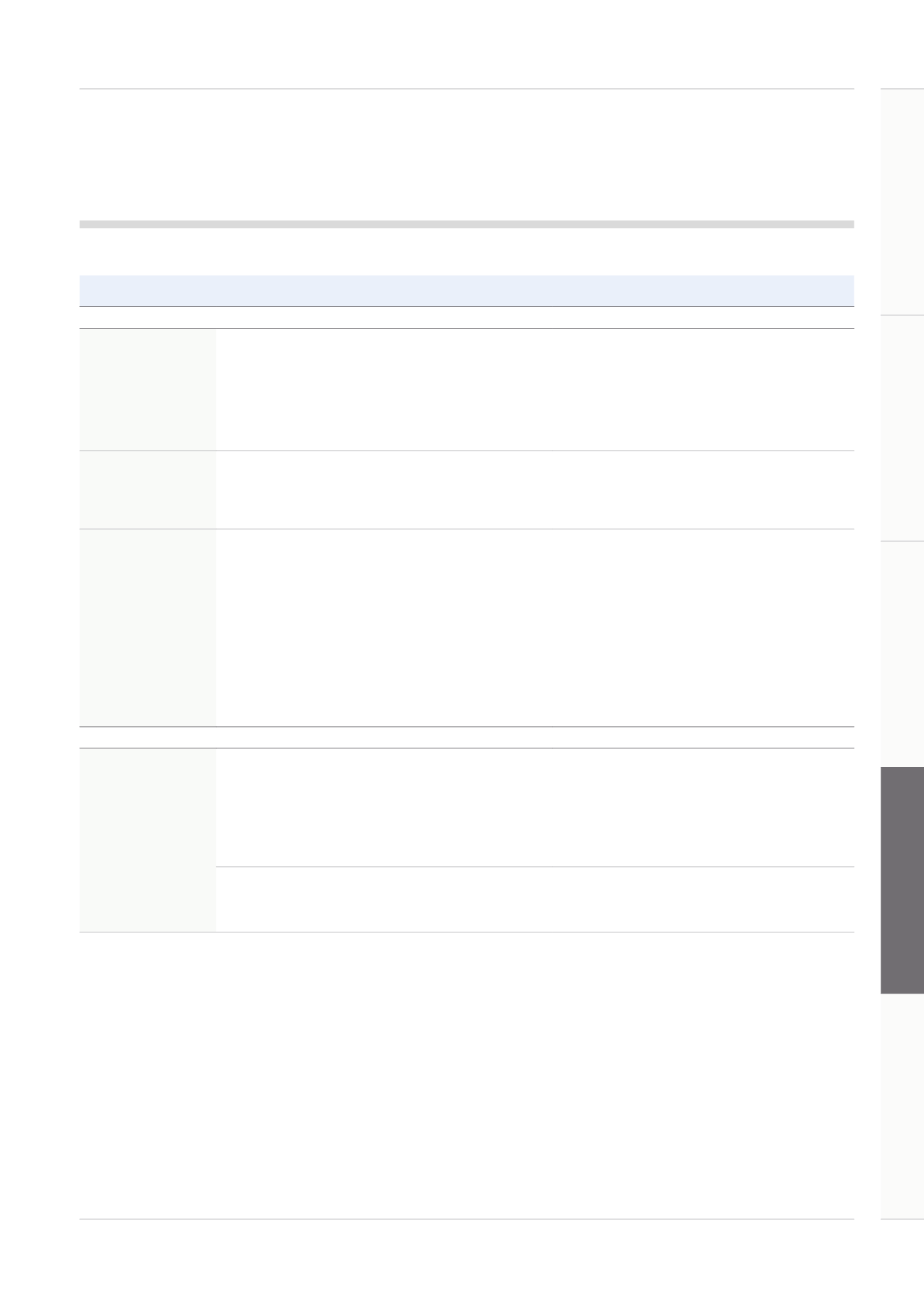

All-employee share plans (all-employee share plans do not have an associated performance framework)

All-Employee

Share Plans

Encourages share

ownership amongst

the broader employee

population and

aligns interests of IMI

employees with those of

shareholders. In addition

provides a tax efficient

investment vehicle for

employees.

UK Plans

UK SAYE: an HMRC approved Savings Related Share Option

Scheme which is open to all of the Group’s UK employees, including

the UK-based executive directors.

Employee Share Ownership Plan: an HMRC approved Share

Incentive Plan which is open to all of the Group’s UK employees,

including the UK-based executive directors.

In line with the statutorily defined limits with respect

to investments, awards and discounts on the price of

share options.

Global Plans:

All-employee share purchase plans operate in

geographies outside the UK. The vehicle and manner of award

varies by geography depending on local market restrictions and

the plan operated in the region.

Eligible employees (including executives) can invest subject

to the plan limits that apply to all participants, which vary by

local market and plan.

61

Strategic Review

Performance Review

Corporate Governance

Financial Statements

Introduction

Annual Report and Accounts 2014