Executive remuneration received in respect of 2014

Base salary

Salaries effective from January 2014 were agreed taking into

account a range of factors, including the performance of the

Group, comparative market data and salary increases for other

employees. The average increase for employees of the Group

was 3.2%, compared to 3.1% for the executive directors. Mark

Selway’s and Martin Lamb’s salaries were not subject to review

in 2014; the salaries for Douglas Hurt and Roy Twite increased

by 3.1% to £430,000.

Pension

Executive directors are entitled to receive a taxable cash

allowance instead of pension benefits. With the Committee’s

approval the executive directors may, at their discretion,

redirect part or all of their allowance into any defined

contribution pension arrangement in the country in which they

are contracted. Mark Selway receives a cash allowance of

30% of salary and the other executive directors were eligible

for a cash allowance of 35% of salary.

Pension benefits for past service

Martin Lamb and Roy Twite were previously active members

of the defined benefit IMI Pension Fund (‘the Fund’). Martin

Lamb opted out with effect from 6 April 2006 and Roy Twite

with effect from 1 February 2007. As a result they retain past

pensionable service up to these dates. With the consent of the

Company, Martin Lamb became a pensioner in the Fund upon

his retirement on 27 September 2014.

The key elements of the benefits in the Fund are

summarised below:

• the normal retirement age under the Fund is 62 for Roy Twite.

Roy Twite may retire from employment with IMI any time after

age 60 without actuarial discount.

• on death after retirement, a dependant’s pension is provided

equal to two-thirds of the member’s pension for Martin Lamb

and 50% of the member’s pension for Roy Twite.

• should Martin Lamb die within the first five years of

retirement, a lump sum is also paid equal to the balance of

five years’ pension payments. For Roy Twite the dependant’s

pension is increased to 100% of the member’s pension for

the remainder of the five year period.

• pensions in payment, in excess of any guaranteed minimum

pension, are increased each year in line with price inflation up

to a maximum of 5% in respect of pension built up before

1 January 2006, and 2.5% in respect of pension built up

after 1 January 2006.

Until Martin Lamb retired on 27 September 2014 his past

pension benefits continued to be linked to final salary inflation

(averaged over the past three years) and equivalent benefits

to those provided for under the Fund rules immediately prior to

closure were preserved in relation to ill-health retirement, death

in service and early retirement at the Company’s instance.

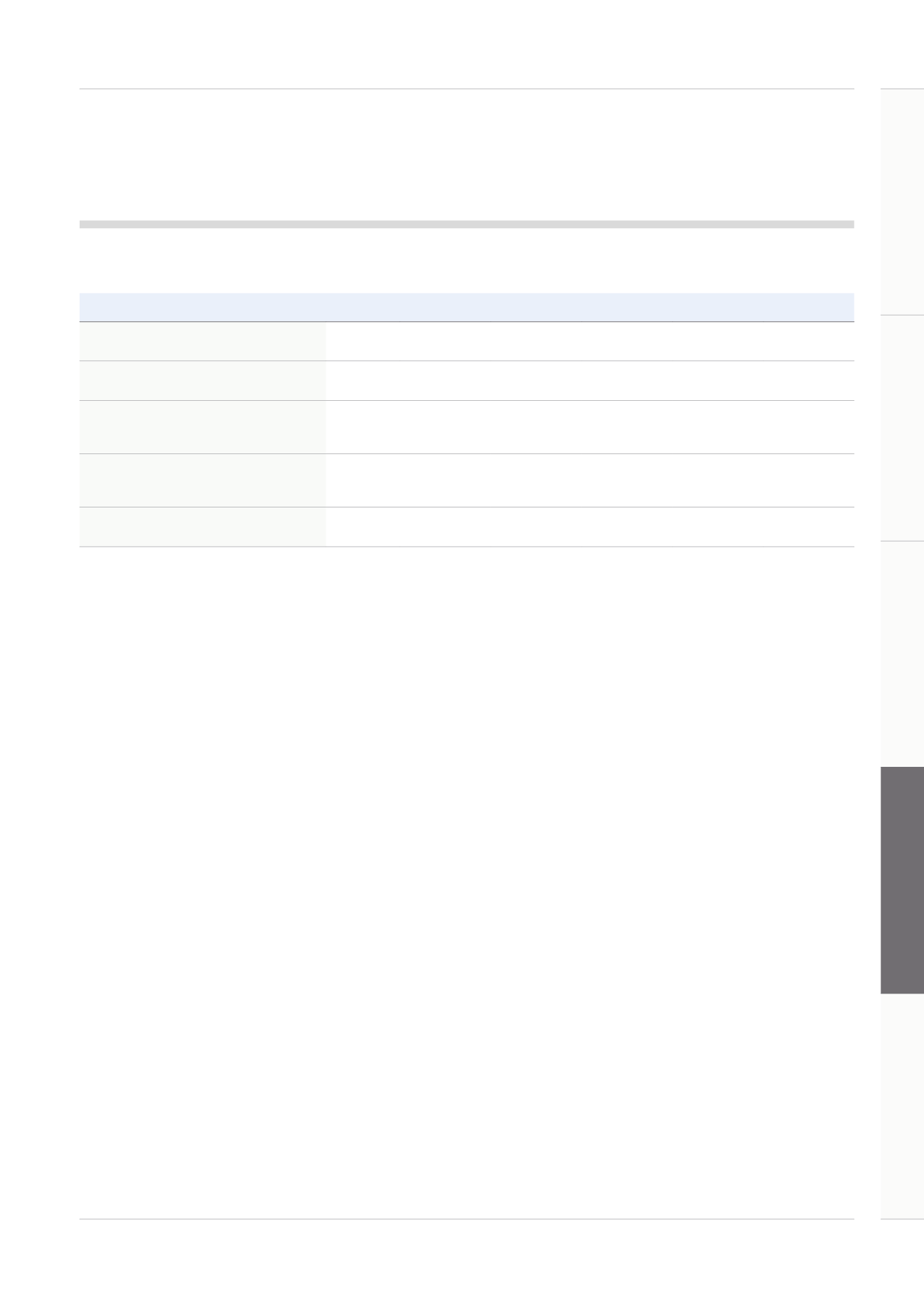

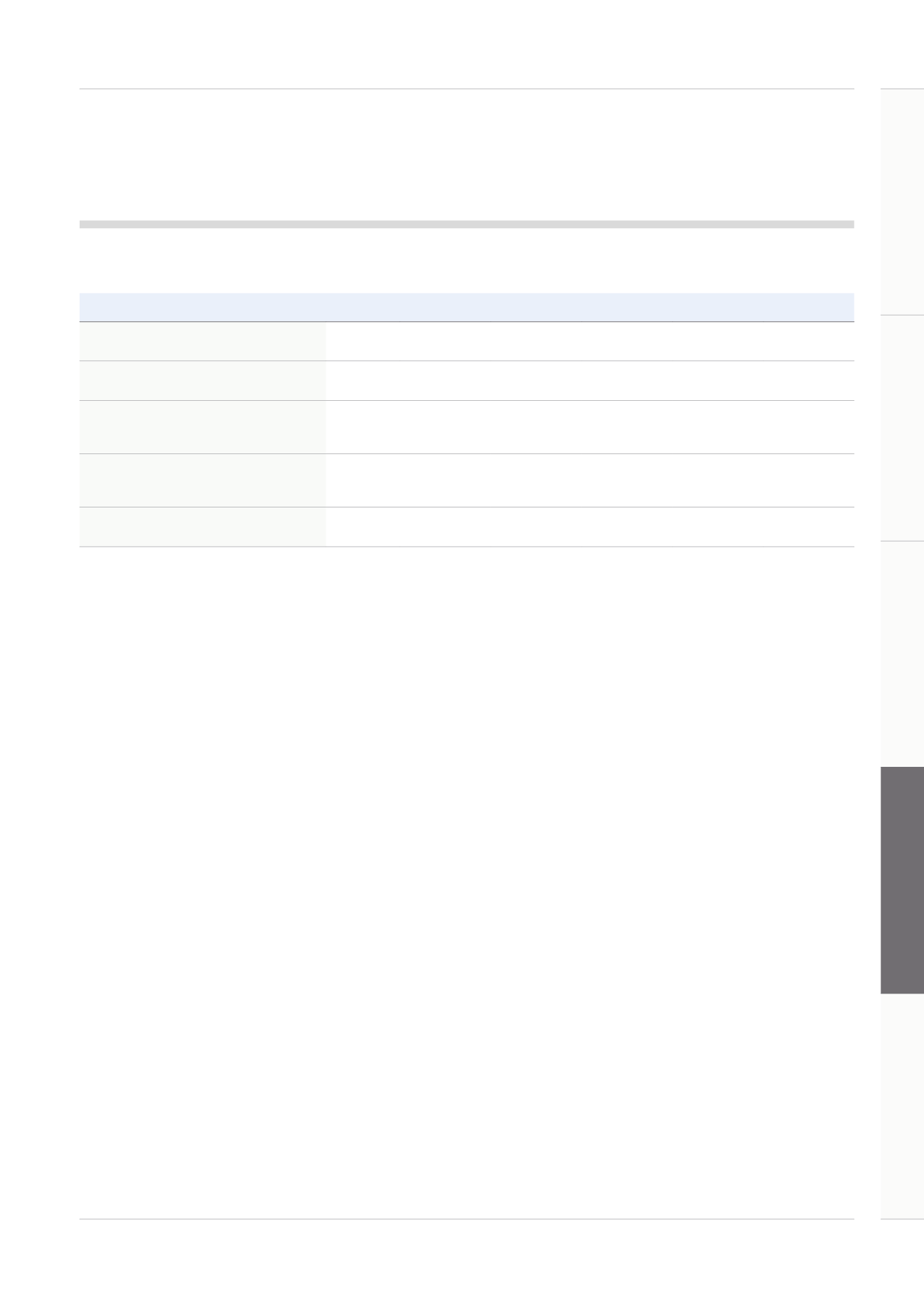

Financial Year ended 31 December

2009

1

2010

1

2011

1

2012

1

2013

1

2014

2

Total remuneration

(single figure, £000)

2,547

4,439

12,289

7,954

6,688

1,567

Annual variable pay

(% of maximum)

91%

95%

85%

47%

62%

36%

Long-term variable pay

(% of maximum) -

Share Matching Plan

64%

97%

95%

100%

100%

-

Long-term variable pay

(% of maximum) -

Performance Share Plan

45%

100%

100%

100%

82.6%

-

Three-year increase in share price (Based on

the relevant date)

2%

140%

180%

112%

61%

68%

The following table summarises the total remuneration for the Chief Executive over the last six years, and

the outcomes of short and long-term incentive plans as a % of maximum.

1

Represents remuneration for Martin Lamb.

2

Represents remuneration for Mark Selway who was appointed Chief Executive on 1 January 2014. No payments under long-term incentive plans will be made until 2016.

71

Strategic Review

Performance Review

Corporate Governance

Financial Statements

Introduction

Annual Report and Accounts 2014