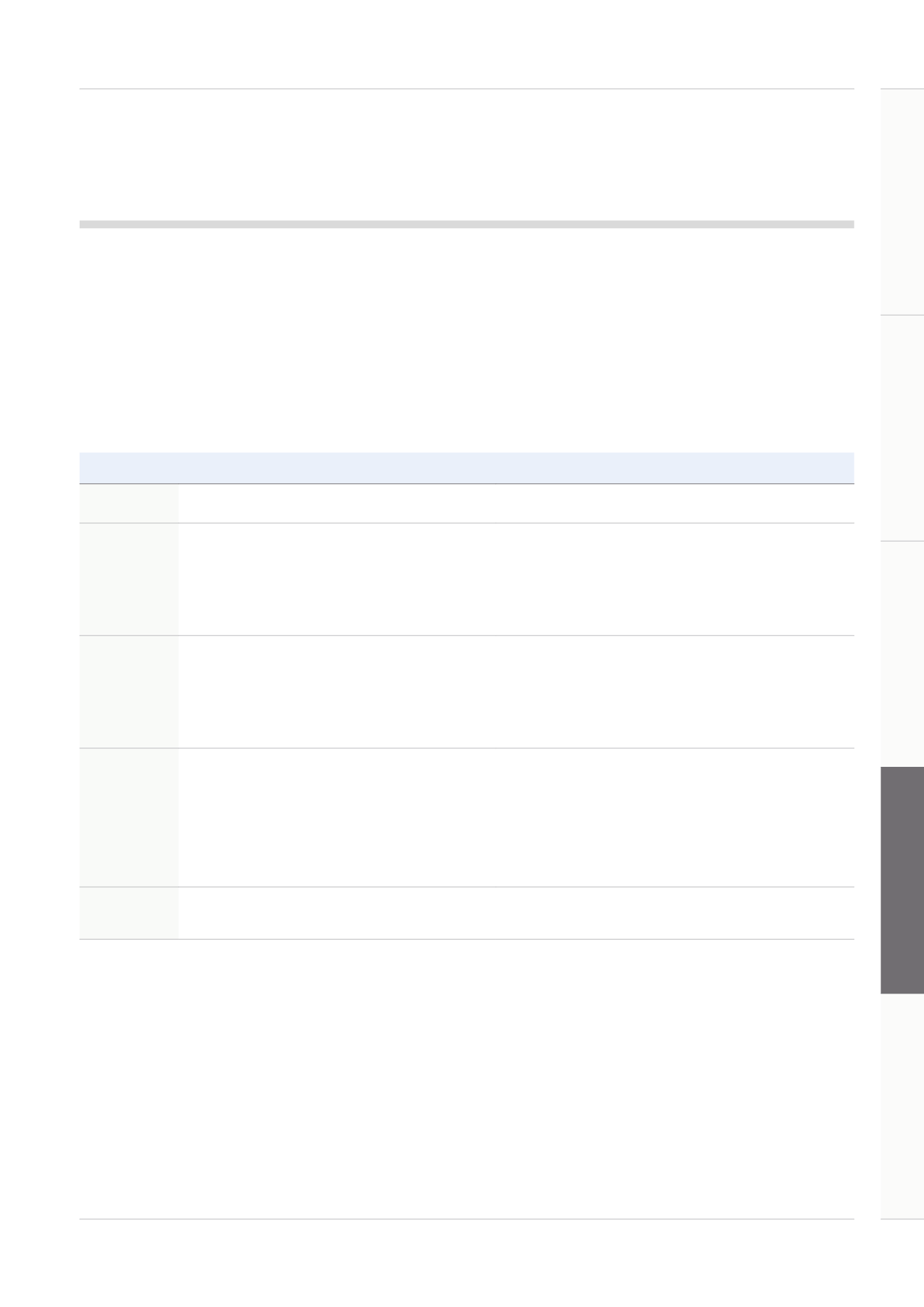

Termination and loss of office

The primary principle underpinning the determination of any payments on loss of office is that payments for failure will not be

made. Service contracts and plan rules have been drafted in such a way that the Committee has the necessary powers to ensure

this. On departure, the Committee will take into account factors including the reason for the executive leaving, performance

during the time served in the year and contractual obligations when approving any payments. When an executive is terminated

for cause there is no entitlement to salary, pension, benefits or an annual bonus and unvested share awards lapse.

The following table provides a summary of the treatment of each component of pay applicable for the current executive directors.

It should be noted that the Committee applies judgement in determining whether an individual is classed as a good leaver or

otherwise under the share plans and is authorised to reach compromise agreements with departing executives. Agreed departure

can include death, ill health, redundancy or retirement.

Payment

Agreed departure

Differences in a change in control situation

Salary, pension

and benefits

The Committee may make payment in lieu of notice.

None.

Annual bonus

Individuals can be considered for a bonus; factors such as time

served during the performance period and performance can be

taken into account.

Deferred bonuses vest.

Performance to the date of the event taking place will be considered in

determining whether any bonus should be payable, subject to the overall

maximum applicable to the relevant individual.

For directors appointed prior to September 2013, there remains a bonus

entitlement if a change in control has taken place within the 24 months

prior to termination. In this scenario, the director is entitled to bonus, or

compensation in lieu of bonus, in respect of the relevant calendar year.

IIP

performance

share awards

and legacy PSP

Performance measured at the end of the performance period,

or at the date of cessation of employment.

Pro-rating for time elapsed at cessation of employment will be

considered by the Committee.

The Committee can reduce or increase the exercise period for

unvested and vested but unexercised awards (legacy PSP only).

Similar to agreed departure.

A reduction in the exercise period for vested but unexercised awards.

Performance and time elapsed will be taken into account, but the

Committee may enable awards to vest in full.

In certain situations (as defined in the plan rules) rollover awards of

a broadly equivalent nature can be offered.

Legacy Share

Matching Plan

(no awards

from 2015)

Invested shares are transferred back on cessation or at the end

of the investment period.

Matching shares:

Performance measured at the end of the

performance period, or at the date of cessation of employment.

Pro-rating for time elapsed at cessation of employment will be

considered by the Committee.

The Committee can reduce or increase the exercise period for

unvested and vested but unexercised awards.

Similar to agreed departure.

A reduction in the exercise period for vested but unexercised awards.

Performance and time elapsed will be taken into account, but the

Committee may enable awards to vest in full.

In certain situations (as defined in the plan rules) rollover awards can

be offered, taking into account performance and time elapsed, although

these can be disapplied by the grantor.

Other

The Committee may approve other limited payments which may

include legal fees connected to the departure, untaken holiday,

out-placement and repatriation.

Similar to agreed departure.

65

Strategic Review

Performance Review

Corporate Governance

Financial Statements

Introduction

Annual Report and Accounts 2014