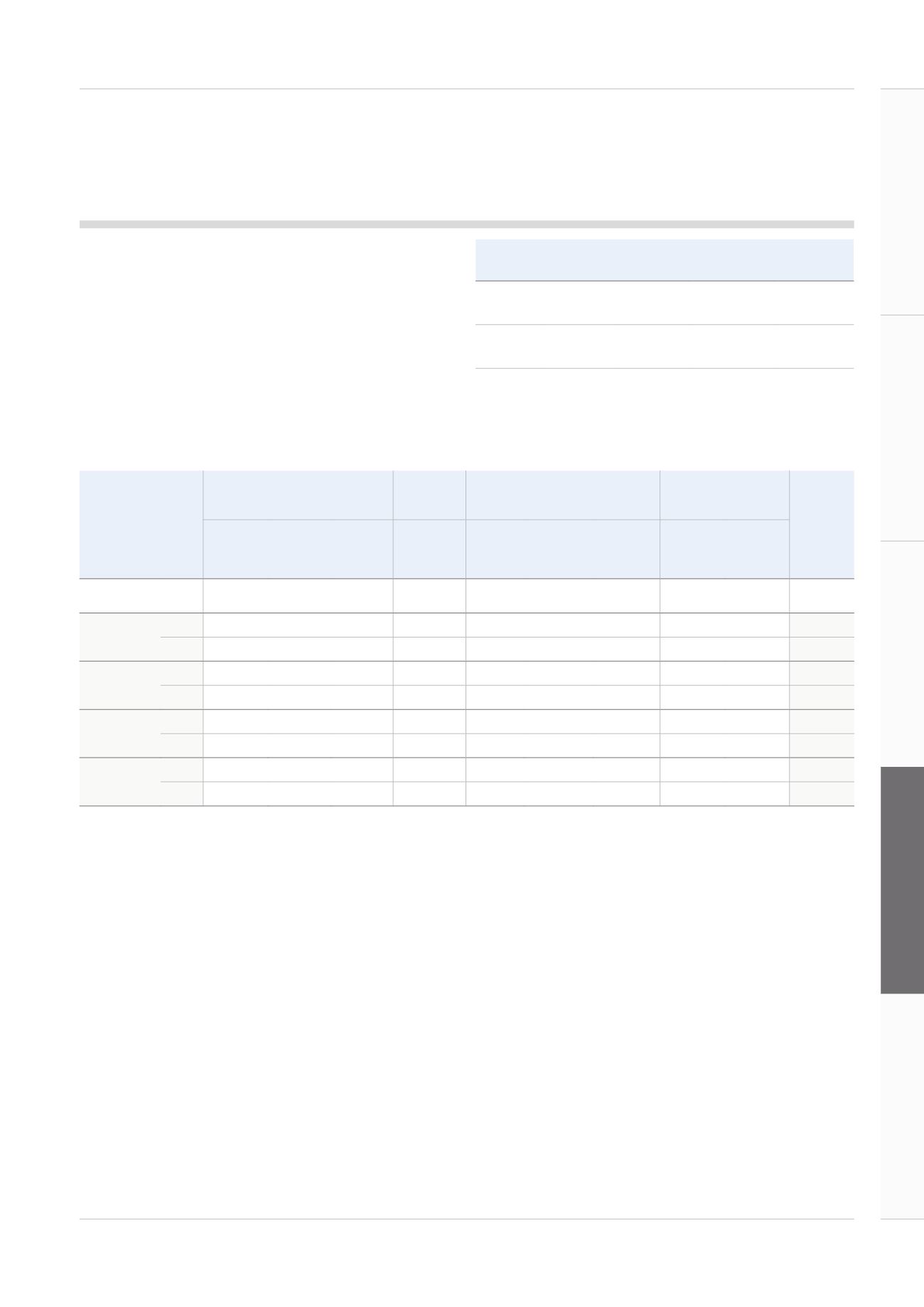

Voting outcome at the 2014 Annual General Meeting

The following table summarises the details of votes cast in

respect of the remuneration resolutions along with the number

of votes cast as a percentage of the Issued Share Capital

(‘ISC’). The Committee was pleased with the level of support

shown by shareholders and will continue to consider the

views of, and feedback from, shareholders when setting

and reporting on remuneration arrangements.

Details of the voting on all resolutions at the 2015 AGM will be announced via the

RNS and made available on the IMI website following the AGM.

Directors’

Remuneration

Report

Votes for

Votes against Total votes cast

Votes withheld

(abstentions)

Directors’

Remuneration

Policy

177,728,610

(95.89%)

7,626,905

185,355,515

(68.30% of ISC)

184,135

Annual

Remuneration

Policy

168,107,992

(98.90%)

1,864,870

169,972,862

(62.63% of ISC)

15,570,312

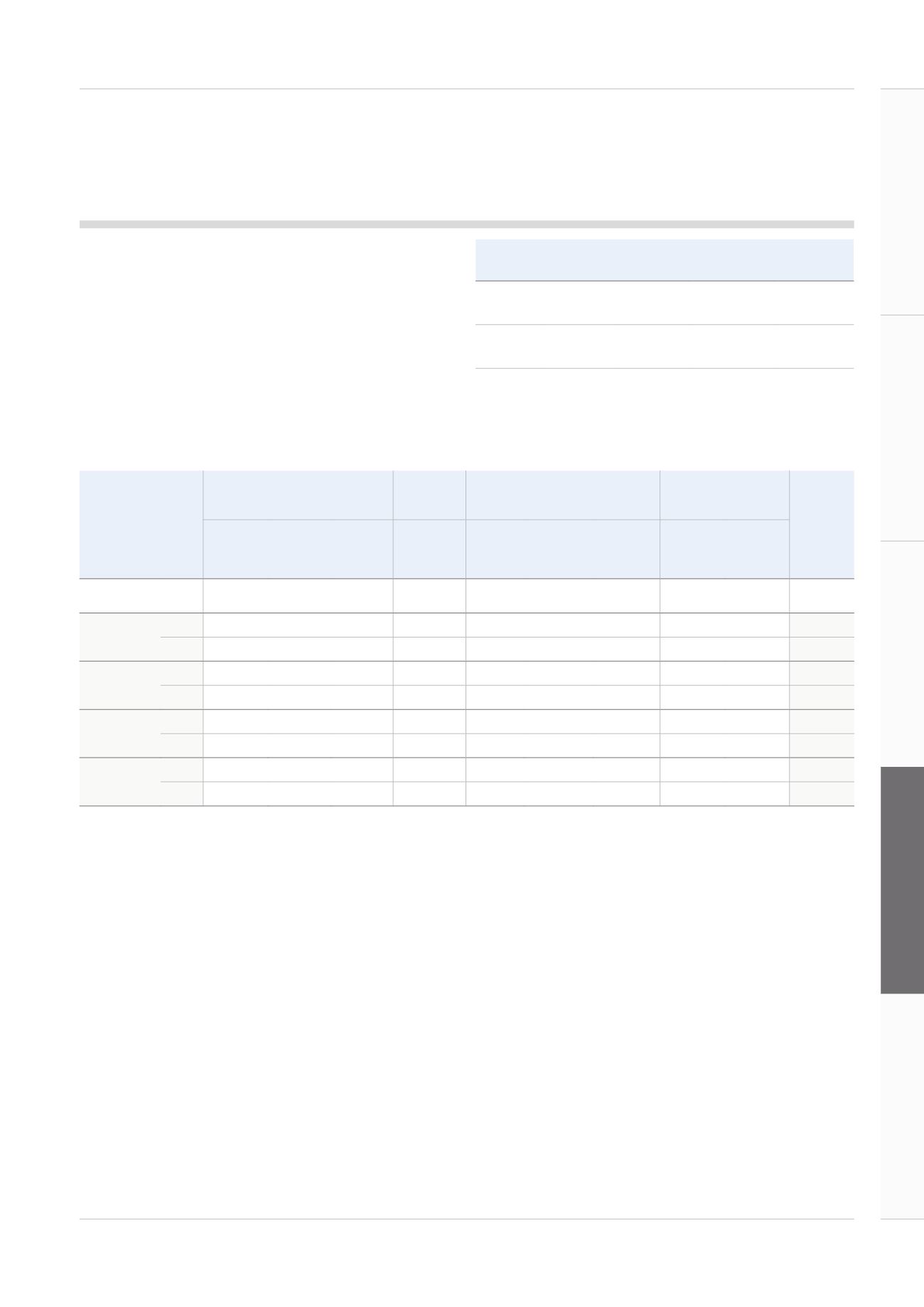

Executive single figure table (audited)

These figures have been calculated as follows:

Base salary:

the actual salary receivable for the year.

Pension:

the cash allowance paid in lieu of pension.

Taxable benefits:

the gross value of all taxable benefits (or benefits that

would be taxable in the UK) received in the year.

Annual incentive bonus:

the value of the annual incentive payable for

performance in respect of the relevant financial year

(half of this is automatically delivered in shares when

the executive does not meet the share ownership

requirement).

Share Matching Plan:

the value on vesting of the matching shares that were

subject to performance over the three-year period

ending on 31 December in the relevant financial year.

(See share price assumptions below).

Performance Share Plan: the value on vesting of shares that were subject to

performance over the three-year period ending on

31 December in the relevant financial year.

(See share price assumptions below).

Share price assumptions: For shares vesting in 2015, that related to

performance in the three years to 31 December

2014, the average share price over the final three

months of 2014 (1,204.86 pence) is used to estimate

the value of shares on vesting. For shares vested in

2014, relating to performance in the three years to

31 December 2013, previously reported figures

3

are

updated to reflect the actual share price on the date of

vesting (1,453.00 pence for the Share Matching Plan

and 1,450.00 pence for the Performance Share Plan).

All-employee share plans: the value of free shares and dividends (SIP) at award

made in the relevant financial year and the intrinsic

value of share options on the date of grant (SAYE) in

the relevant financial year (applying a 10% discount).

Dividend equivalent

payments:

the value of dividend equivalent shares on vested but

unexercised awards under the share plans, valued at

the price on the dividend payment date.

1

Mark Selway was appointed on 1 October 2013 and the table reflects

payments from this date.

2

Martin Lamb retired from the Board on 8 May 2014 and the table reflects

payments to this date.

3

The average share price over the final three months of 2013 (1,487.41 pence)

was used.

D M Hurt and R M Twite served on the Boards of Tate & Lyle PLC and Halma plc respectively during the year. Fees of £62,512.50 and £20,923.08 were received in

respect of these appointments.

Director

Fixed pay

(£000)

Annual variable

pay

(£000)

Long-term variable pay

(£000)

Other items in the nature

of remuneration

(£000)

Total

(£000)

Base salary

Pension

Taxable

benefits

Annual

incentive

bonus

Share

Matching

Plan

(SMP)

Performance

Share

Plan (PSP)

Subtotal

long-term

variable

pay

All-

Employee

Share Plans

Dividend

equivalent

Payments

See Page

Page 71

Pages

71 to 72 Page 72

Pages

72 to 73

Pages

73 to 74

Pages

74 to 75

Page 75

Page 76

M W Selway

1

2014

750

225

45

545

-

-

-

2

-

1,567

2013

188

56

109

237

-

-

-

-

-

590

D M Hurt

2014

430

151

21

191

1,214

-

1,214

4

148

2,159

2013

417

146

20

323

1,543

540

2,083

3

180

3,172

R M Twite

2014

430

151

19

197

1,117

-

1,117

3

46

1,963

2013

417

146

19

299

1,341

510

1,851

3

55

2,790

M J Lamb

2

2014

271

95

11

140

2,656

-

2,656

3

-

3,176

2013

765

386

27

711

3,374

985

4,359

5

329

6,582

69

Strategic Review

Performance Review

Corporate Governance

Financial Statements

Introduction

Annual Report and Accounts 2014